How Do the Geopolitical Risks Affect the Gold Market?

In 2013 gold lost 30% of its value. In 2014 the yellow metal has made an impressive comeback and rebounded 13% in March, beating many other assets. Now its price is approximately $1,300, which still means 6% recovery this year.

What lies behind this rise? Apart from the Fed’s actions, which were widely analyzed in earlier Market Overviews, geopolitical concerns were one of the most important factors that affected the price of gold in 2014. This confirms that the gold price depends on many different factors, not solely on the Fed’s actions. The biggest geopolitical concern in Europe is military conflict in Ukraine and the resulting tensions between the USA and Russia, not to mention Middle East turmoil (Iraq, Libya, Palestine, Syria). The list of geopolitical risks continues with China flexing muscles in the South China Sea, the first re-arming of Japan since WWII, the Ebola virus in Africa, default in Argentina, and the old-new problems in the Eurozone (recession in Italy and Portuguese economic hardships).

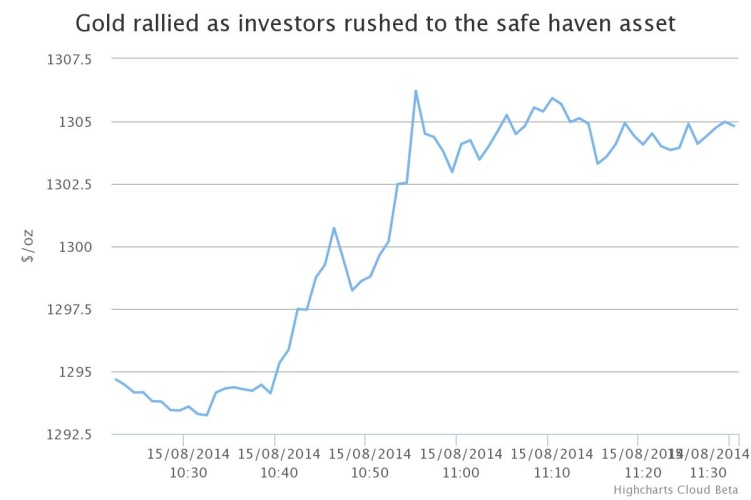

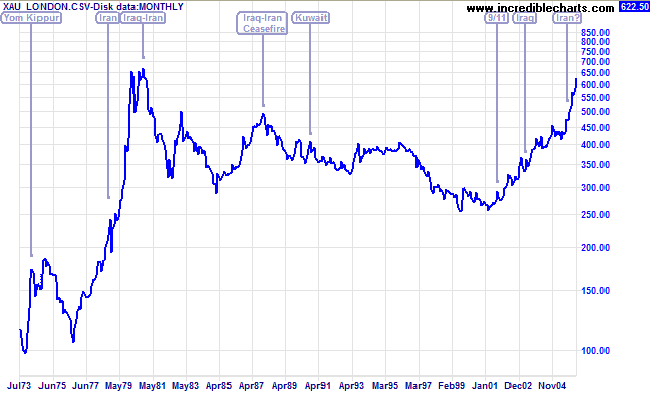

How do the geopolitical risks affect the gold market? Generally, gold prices are positively correlated with the rising tensions. There are many examples: 1979 and American diplomats taken as hostages in Tehran, as well as the Soviet invasion of Afghanistan when gold skyrocketed from $380 to $850 per ounce. After 9/11 the gold price in the London market rose from $216 to $287 in one day. More recently, after escalating tensions in Iraq (i.e. President Obama’s decision to send 300 military advisors), on 19 June, 2014 gold reached its highest point in two months. Similarly, gold surged 7 points after the Ukrainian attack on a Russian convoy in August 2014 (Graph no. 1).

Graph no. 1: Rise in gold price due to escalating tensions (attack on Russian convoy) between Russia and Ukraine on August 15, 2014

Source: telegraph.co.uk

Why does such a correlation exist? The reason is quite obvious. As Jim Rogers said, “[It] is not good for anything except for real assets because people need real assets during the time of war – whether they are involved in the war or just protecting themselves.” In times of high uncertainty, investors abandon investments that might be affected and turn to real value. Precious metals may then be a smart option since they do not entail counterparty risk. This is why gold is considered as a safe-haven investment – it is the ultimate means of payment in hand when all other means of payment fail.

“Flight to gold” refers not only to retail investors, but also to central banks. Since local currencies usually suffer during war, central banks may be eager to increase their gold reserves. Iraq in Q1 2014 bought 60 tonnes to support the Iraqi dinar. And according to the World Gold Council, in Q2 2014 central banks continued to be strong buyers and purchased 118 tonnes, i.e. 28% more than the year before. Keep in mind that the Middle East was responsible for 6% of consumer demand and also for a significant share of the central banks’ holdings last year.

There are also three other reasons why geopolitical factors can support the gold market. First, political turmoil often increases government spending and creates inflationary pressures because wars are generally paid for by excessive money printing. Needless to say, gold is considered by the investors, rightly or not, as an inflation hedge.

Second, military actions, especially in the Middle East, but also the potential escalation of the conflict between Ukraine and Russia, may disrupt the supply of gas and oil, which means higher gold mining costs and even more turmoil in Europe due to lack of energy supplies. As such risks increase, the price of gold should also rise thanks to its “insurance” function.

Third, geopolitical tensions can lead to a slower pace of economic growth, either due to higher uncertainty and less investment, or due to imposition of economic sanctions which curb the gains from international trade. Gold, as a defensive asset, gains relatively in the slow economic growth environment. Recent data from Germany suggest that the situation in Ukraine can slow down global recovery: the index of German economic sentiment dropped from 27.1 in July to the weakest in 20 months – 8.6 in August – meaning significantly below expectations.

Ukraine, War and Gold

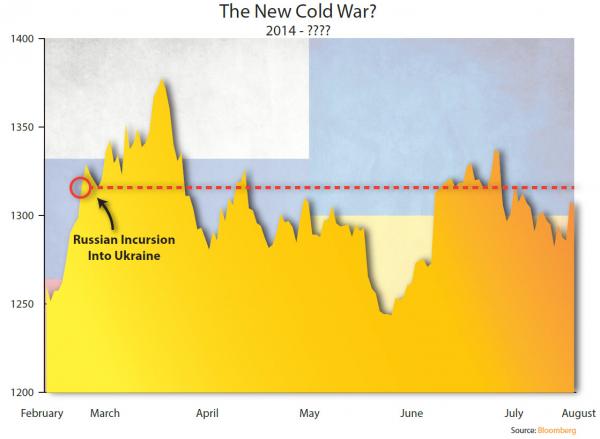

How has the situation in Ukraine affected and how will it affect the gold market? The rise in gold prices in February and March, up to $1,385, is commonly attributed to the Ukrainian crisis in the main. However, the gold price started rising before the conflict due to ongoing demand for physical gold (or based on technical factors – there’s rarely certainty as to what really caused a given move), which probably had nothing to do with the geopolitical concerns.

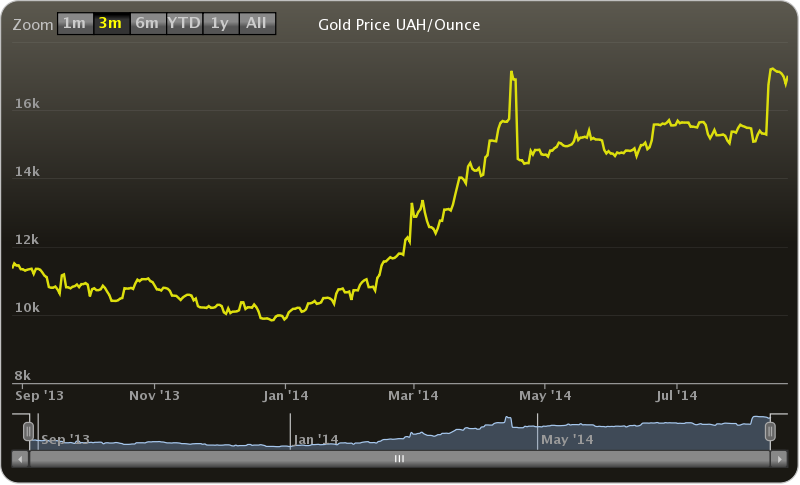

The yellow metal gained especially on the Ukrainian Hryvnia, which collapsed by almost 70% against gold in the first four months of 2014 (Graph 1), even though the country is not (yet?) officially at war. It means that even though the price of gold in dollars did not skyrocket, gold definitely was a safe haven for people and companies in Ukraine and protected them from the currency collapse.

The situation in Ukraine may affect the gold price for some time; investors, however, should remember that historically the gold price often returned to prewar levels.

On the other hand, with rumors of war between Ukraine and Russia or even of a new Cold War, it would not be a short-term risk, but rather a long-term challenge, having more material impact on gold price. According to the popular view, such geopolitical concerns strengthen the gold price. However, the relationship between military conflicts and gold is much more complex: gold does not always gains due to crises. There are several reasons for that.

First, it is said that gold “smells” war - its price rises in anticipation of a conflict, e.g. rumors about possible American intervention in Syria in 2013 had a significant impact on prices of gold. However, when rumors turn into action the price of gold is often unaffected or even decreases, as this is when the profit-taking begins. The Iraq War may be an example. The gold price was generally rising from October 2002, when the new inspection of weapons production facilities began, until the end of January 2003, when the State of the Union was delivered by President George W. Bush, outlining justification for the war. After the start of the invasion of Iraq on March 20, 2003, gold went up only about $1 to 338.75, but it actually meant a $50 lower level than in the previous month, as it can be seen in the Graph 2. The bottom line is that gold is not immune to the phenomena that affect other markets – that’s why experienced traders often say to buy the rumor but sell the news.

Graph no. 2: Gold Price UAH/Ounce during the last year

Source: www.goldpriceticker.com

Second, some military actions rather reduce risks. This was the case with Operation Desert Storm during the Gulf War in 1991 – the presence of the US army in Kuwait meant a significant reduction of political risks in the Middle East. Therefore, after an initial spike, the gold price dropped as the campaign turned out to be successful.

Investors should not forget that gold can be used for liquidity purposes to finance war or bailout. After the Lehman Brothers’ collapse, the gold price actually dropped, because it was used for liquidity purposes by the banks. The same happened in 2010, when investors thought that Greece was going to sell its gold to finance the bailout.

Different crises are of different importance for the global economy and gold market. The Falklands War was not so significant as the Iraq War or even riots in the Republic of South Africa – an important producer of the yellow metal.

Some conflicts strengthen the dollar which reduces their potentially positive impact on gold prices (precious metals are generally traded in US dollars). For example, the Gulf War was accompanied by the appreciation of the dollar. This is because in a crisis investors always flee to the dollar, which remains attractive compared to other currencies, even if it loses in terms of gold ounces.

Graph no. 3: Gold price (London fixing) from January 1, 2003 to December 31, 2003 (before and after US invasion of Iraq)

Source: kitco.com

These observations lead to important conclusions: 1) geopolitical risks are, indeed, correlated with the price of gold, but the impact on gold depends on the type of crisis. Even if gold gains, it does so rather before conflicts heat up, so investors should not be late to the party.

Sanctions, Multi-currency Reserve System and Gold

Generally sanctions, protectionism and trade barriers lead to war. As the saying goes: “If goods don’t cross borders, armies will”. And war is rather good for gold. Sanctions have already led to the Russian countermeasures, which may result in the next round of trade barriers, currency wars, curbed economic growth and eventually military conflicts. In the week after the recent increase in the US economic sanctions on Russia the main US stock indices declined, but the gold exchange attracted $106m.

It seems however that new sanctions on Russia have very little impact on its economy, because they apply to “sale, supply, transfer or export” of certain technologies “suited to the oil industry for use in deep water exploration and production, Arctic oil exploration and production, or shale oil projects” (Article 3 paragraphs 1 and 3 of the UE Council Regulation 833/2014 concerning restrictive measures in view of Russia's actions destabilizing the situation in Ukraine). Therefore, in the short run American and European sanctions on Russia do not affect the commodity significantly because (1) they are targeted at future projects (the current Russia production is practically unaffected by the sanctions – this is why the Brent crude benchmark changed little as these sanctions were announced) and (2) do not concern gas production.

Nevertheless, sanctions and resulting tensions can induce Russia to take countermeasures and speed up the process of de-dollarization, cooperating more closely with the rest of BRICS countries. For example, Bank Rossiya will be the first Russian bank to use exclusively the Russian ruble. Some analysts also write about the possibility of disruptive sales of US Treasury bonds worth $138 billion dollars. Moreover, Russia, China and South Africa are responsible for 40% of world gold production – and potentially gold-backed currencies will further challenge the dollar and strengthen the gold price. This is because (1) backing currency with gold would increase the demand for the yellow metal, and (2) gold is a kind of a bet against the dollar.

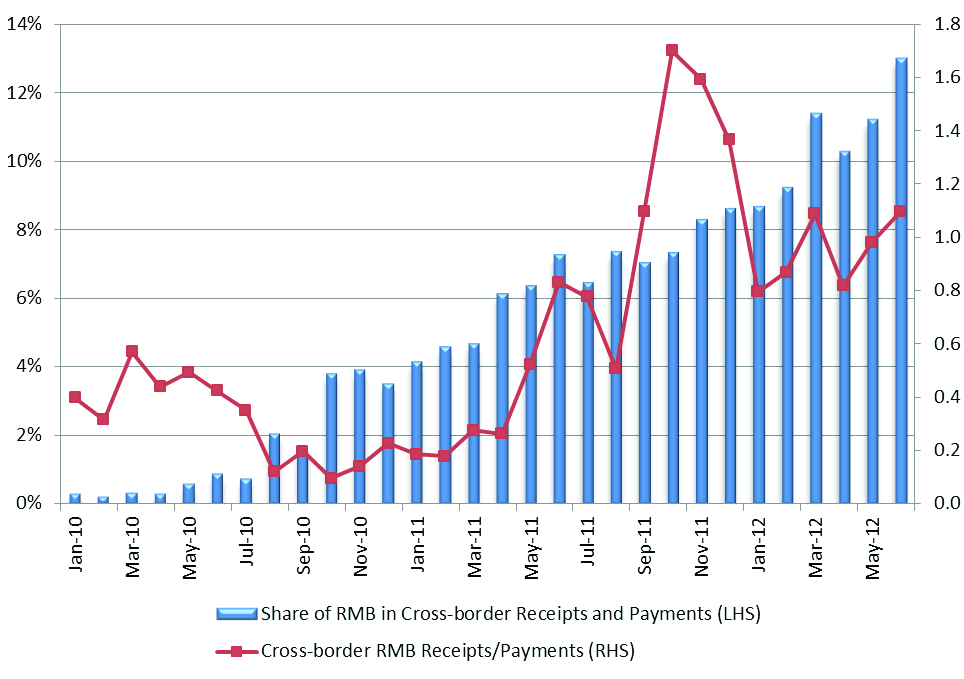

Analyzing the relationship between geopolitics and gold, investors should not ignore the current changes in the international monetary system. We have already seen the rise of share of the East in the global economy (the world’s biggest physical gold exchange is now located in Shanghai) and growing use of Yuan in global transactions. Russia is turning towards China now. These two countries recently agreed on a draft currency swap agreement which will allow them to increase trade in domestic currencies in bilateral payment instead of using US dollars.

Graph no. 4: Share of renminbi in cross-border receipts and payments

Source: gold.org

How could these changes affect the gold market? As just said, gold can be regarded as a bet against the dollar and therefore declines in the dollar’s role means higher gold prices. According to the OMFIF report, “Demand for gold is likely to rise as the world heads towards a multi-currency reserve system under the impact of uncertainty about the stability of the dollar and the euro, the main official assets held by central banks and sovereign funds.”

Lastly, it should be noted that gold not only responds to geopolitical concerns, but is a geopolitical metal. For instance (this time it will be a rather distant example) the Roman Empire invaded Dacia to take control of its rich gold mines in the 2nd century B.C – which is something that affected the gold market substantially. In short, what counts for the investors is the impact of military actions on the price of gold, whatever the motives behind them are.

Summary

This year clearly showed that the yellow metal’s price depends not only on central bank’s policies, but also on geopolitical factors. Traditionally, geopolitical problems are positively correlated with the price of gold. Gold has been safe haven during any kind of turmoil for five thousand years. But there are some caveats to be aware of.

Many historical examples suggest that the price of gold rises before military actions rather than during them. Gold gains due to threat of war or the rise in global uncertainty. But not all military actions increase uncertainty; some of them clearly decrease it. For example, Operation Desert Storm during the Gulf War in 1991 reduced political risks in the Middle East. Similarly, not all crises affect the gold market. For example, gold would probably respond to the potential conflict between Pakistan and India (strongly gold-oriented countries) or to turmoil in South Africa (one of the main gold’s producers), but it did not significantly respond to the Falklands War (where the heck are Falklands?!).

Graph no. 5: Gold price during some military conflicts

Source: incrediblecharts.com

Second, it seems that this traditional correlation between geopolitical risk and rising prices of gold is weaker than in the past. Taking into account the number and potential economic importance of current geopolitical risks gold should have sky rocketed. However, it did not. Instead, it is traded horizontally in the 8% range corridor since April.

Why is that? One part of the story is that gold has probably gotten ahead of itself during the previous 10 years of rallying and had to correct these gains in the following years. Another explanation could be even simpler: greater geopolitical risk is the new norm. Gaza has faced geopolitical problems for 40 years now. It does not mean that investors do not pay attention to them, but rather that they already take them into account. Investors are also more capable of gathering relevant information, assessing the risks and protecting themselves accordingly. Gold can be regarded as the insurance policy, but it is not the only player in town.

Additionally, investors consider many geopolitical incidents as short-term risks. This can explain why the price of gold often spikes at the beginning of a new crisis, but after a while falls again, sometimes to the pre-crisis level.

However, we should not lose sight of central banks’ actions. The accommodative monetary policies and the record low interest rates increase the risk taking and cap price of gold. Investors are more prone to take or accept higher risks if they expect to be protected by the central banks or governments always being ready to develop bailouts.

The bottom line is that the only generalization is that there is no generalization. It means that gold does not necessarily gains during crises, because its behavior depends on many factors including the economic context of the particular situation. For example, the need for cash can be greater than the demand for a safe haven, as it was probably in the case of the Libyan civil war and the Japanese earthquake in 2011. Therefore, although we consider gold as long-term insurance against future political tensions (among many other things), we do not advise automatically buying gold because of the rise of the geopolitical risks. These issues are very complex and it is extremely difficult to correctly predict the future courses of action and their impact on the gold market. Investors should be aware that not all conflicts affect the price of gold (positively) and even when they do, crises often do not escalate further, so investors risk purchasing gold at unfortunate times, after the momentum has passed. In many historical cases after the initial spike, the price of gold quickly returned to the pre-crisis level (Graphs 1 and 2).

Long-term investors should not make a decision based only on geopolitical events, which often strengthen gold support only in the short-term, but always look at the fundamentals. The latest report of World Gold Council for Q2 2014 shows that demand (even demand for physical bullion) for gold actually decreased (about 125 tonnes compared to Q1 2014 and 16 tonnes compared to Q2 2013), despite the geopolitical concerns.

Hence, the importance of the geopolitical concerns (a.k.a. current events) is often overstated. Unless investors believe that the world is on the edge of the next Cold War, or even the Third World War, or live in the region affected by the conflict, they should be guided by the fundamentals and not by the geopolitical concerns that are popular in the media at a given point in time. Crises should be regarded rather as possible bonus or premium factors contributing to the rise in the price of gold.

Graph no. 6: Gold price since Russian incursion into Ukraine

Source: zerohedge.com

Long-term trends are shaped by fundamentals while shorter-term trends can be attributed to investors’ and traders’ emotions – the impact of geopolitical concerns can trigger some moves, but their impact seems to average out over the long run.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor