Gold News Monitor originally sent to subscribers on August 24, 2015, 8:58 AM.

Last week, U.S. inflation expectations plunged to their lowest level since the start of the year. What does it mean for the U.S. economy and the gold market?

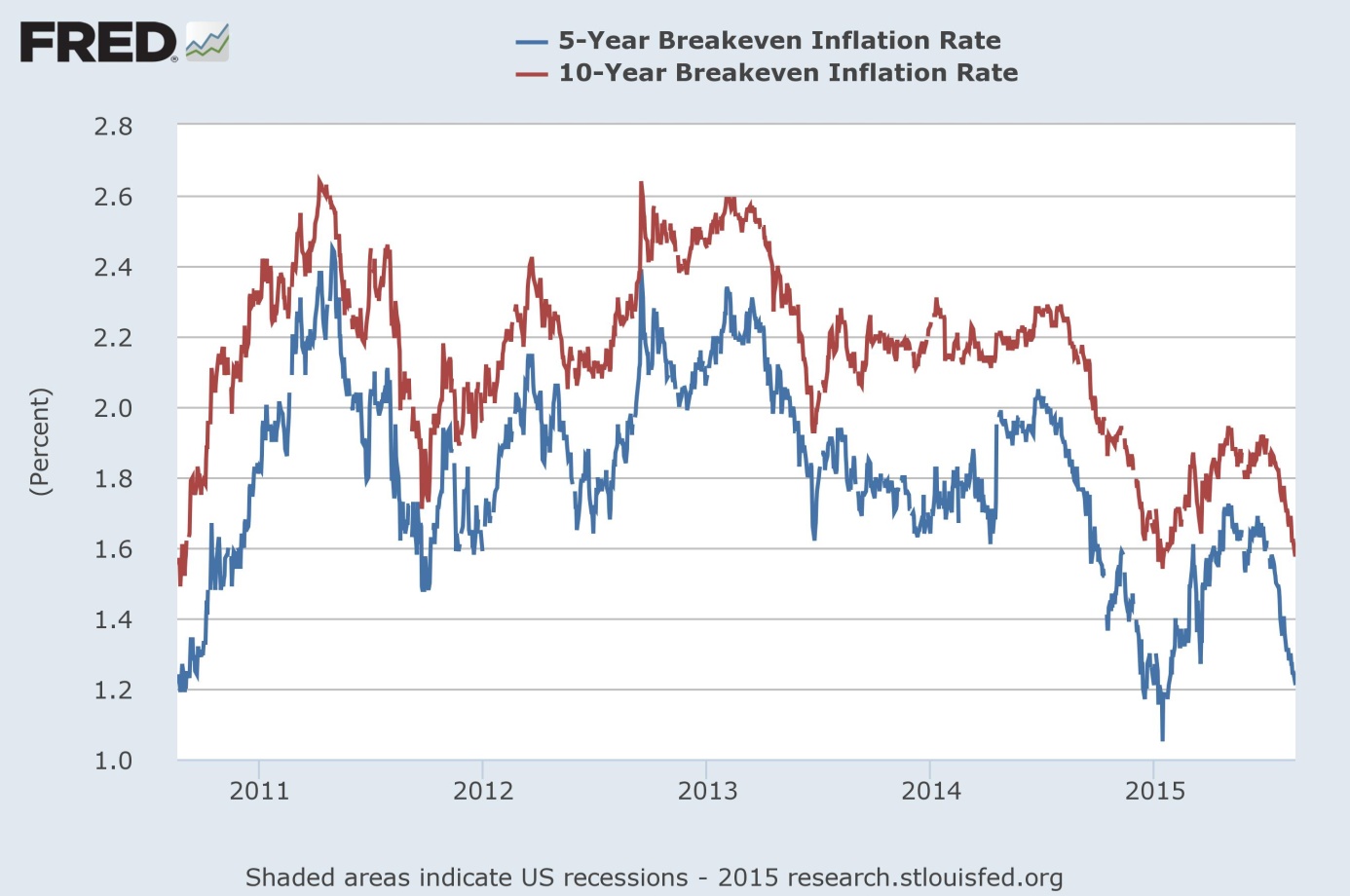

As you can see in the chart below, the measure of inflation expectations in the U.S. (derived as the difference in yields of nominal and inflation-protected bonds) has been falling since July 2014, however, the drop in inflation expectations accelerated last month. The decline followed a sharp fall in commodity prices and concerns about China’s economic slowdown. The devaluation of the yuan added some fears about deflationary forces in the global economy, as the inflationary expectations dropped even further last week. The five-year measure declined from around 1.3 percent to 1.17 percent, while the ten-year measure fell from around 1.7 percent to 1.57 percent. So much for “stable inflation expectations” which the Fed was talking about in the July minutes.

Chart 1: The 5-year (blue line) and 10-year breakeven inflation rates from 2010 to 2015.

What does this decline means for the U.S. economy and the gold market? Well, some analysts argue that it reflects expectations of the Fed’s interest rate hike, as the drop in inflation expectations has accelerated since the Fed’s July meeting, where policy makers appeared intent on raising interest rates before year-end. However, the downward trend started earlier. The fall in inflation expectations signals rather that investors believe that the economic recovery is not that strong and that wage growth and consumer prices will continue to stagnate. Indeed, the last developments seem to confirm this thesis. The CPI rose only 0.1 percent in July, moved by shelter costs, on a monthly basis, and only 0.2 percent year-over-year. In other words, investors do not believe in the Fed’s projections of future inflation and in the temporary character of the current low inflation. The 30-year breakeven rate now stands at around 1.80 percent, which means that investors do not believe that the Fed will reach its inflation target in the foreseeable future.

The key takeaway is that U.S. inflation expectations fell to their lowest level since the beginning of this year. Lower inflation expectations reduce the probability of a September interest rate hike, which is positive news for the shiny metal. This decline reflects the market view that the global economy may experience deflationary growth in the nearest future. This should be a positive environment for gold, as other assets will become less attractive (unless central bankers trigger another asset bubble to spur price inflation at any costs).

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview