U.S. consumer spending rose 0.3 percent in November. What does it mean for the gold market?

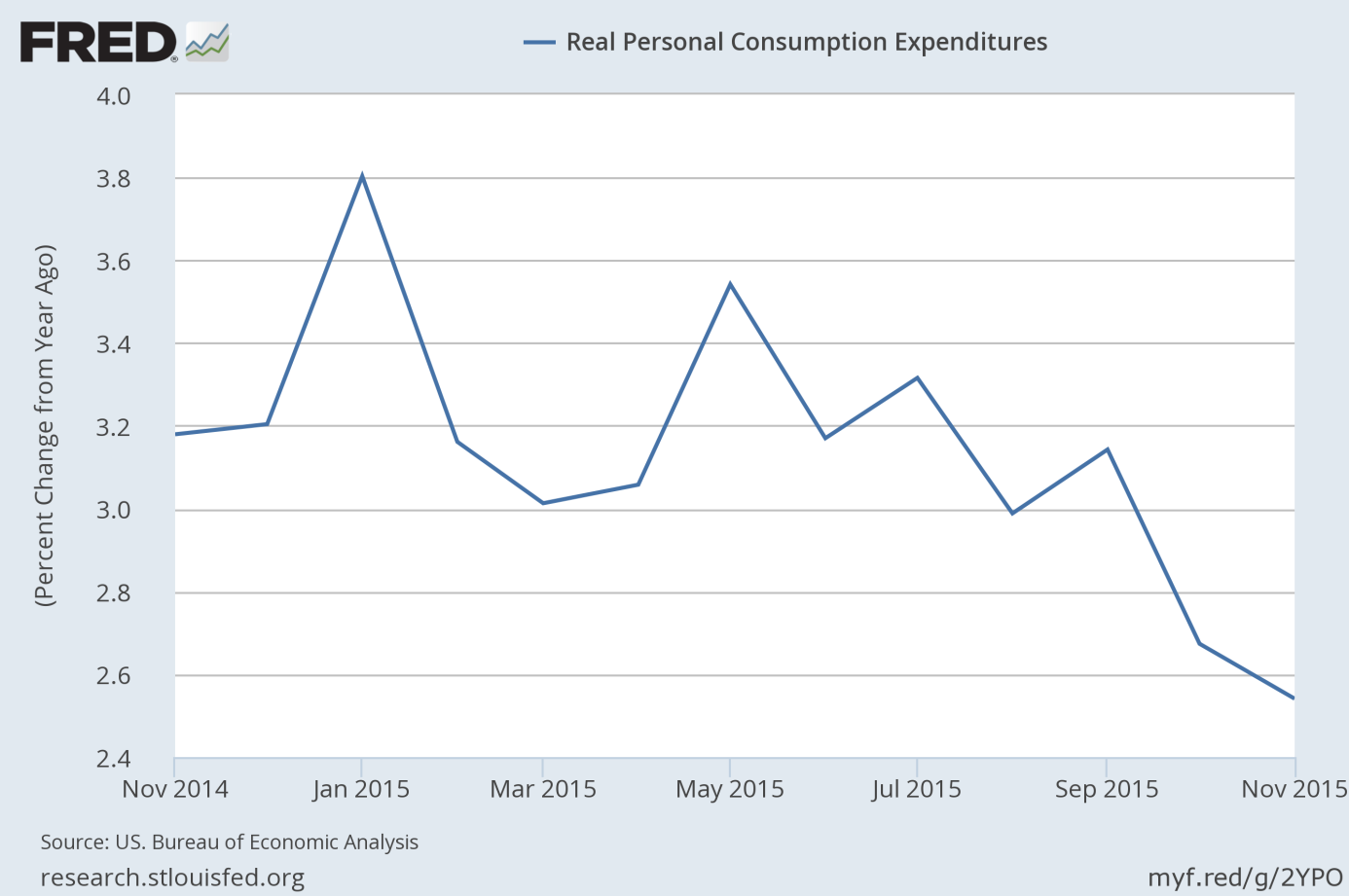

Consumer spending rebounded in November after edging up 0.1 percent in October, in line with expectations. However, the annual pace of growth of personal consumption expenditures has been slowing down in 2015 (see the chart below). The sluggishness of consumer spending is the reason why the GDPNow model forecast for real GDP growth in the fourth quarter of 2015 fell from 1.9 percent to 1.3 percent after the personal income and outlays release.

Chart 1: Real personal consumption expenditure from 2014 to 2015 (as percent change from year ago).

Personal incomes also rose 0.3 percent in November, as expected. The wages and salaries component was strong for a second month and rose 0.5 percent. Annually, spending increased less than incomes due to the savings rate near a three-year high.

Turning to inflation, the PCE price index was flat monthly, but rose 0.4 percent on an annual basis, marking the largest gain since the end of last year. The core PCE price index, which excludes energy and food, edged up 0.1 percent from October, but increased 1.3 percent from November 2014.

The key takeaway is that the November Personal Income and Outlays report shows a slight rebound in U.S. consumer spending on a monthly basis, some upward pressure on inflation and wages. Therefore, it would not prevent the Fed from its established path of interest rate hikes. It is bad news for the gold market. However, the Atlanta Fed’s projections of GDP growth in fourth quarter of 2015 fell from 1.9 percent to 1.3 percent after the personal income and outlays release. It means that the U.S. economic growth is on track to decelerate in the fourth quarter, ensuring a very gradual tightening cycle (assuming further hikes), which should be positive for the gold market.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview