Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

10 Economic Trends That Will Shape the U.S. and Gold Market in 2020

January 17, 2020, 4:08 AM

Will 2020 turn out better than 2019 for the yellow metal? Gold prices don't move in a vacuum - the macroeconomic situation definitely plays a key fundamental role. In today's article, we'll present the macroeconomic outlook for 2020 and you'll learn whether the fundamentals are likely to become more or less friendly toward gold in 2020.

-

Gold Daily News: Thursday, January 16

January 16, 2020, 6:54 AM

Gold futures gained 0.6% on Wednesday, January 15 as it continued to rebound off Tuesday's local low of $1,536.40. The price has got closer to the recent highs. Overall, it has been trading within a week-long $1,540-1,560 consolidation following January 8 run-up above $1,600 mark that ended with a sharp downturn.

-

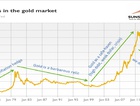

The Gold Market in 2019

January 10, 2020, 7:30 AM

How good was 2019 for the precious metals market? It definitely brought quite some excitement to the arena. In today's article, you'll learn more about the most important gold price drivers in 2019. This analysis will help you better understand the gold market, and draw the right investment conclusions for 2020.

-

Market News Report: December 16 - December 20, 2019

December 16, 2019, 8:17 AM

The markets were pretty quiet early last week ahead of Wednesday's FOMC Rate Decision announcement. But it didn't move them that much. All changed on Thursday following Donald Trump's tweet about the coming trade deal. It set the risk-on mode. What about this week's potentially market-moving news releases? Let's take a look at the details.

-

Market News Report: December 9 - December 13, 2019

December 9, 2019, 9:59 AM

Last week's economic data releases brought volatility to the financial markets. Stocks sold off following worse-than-expected PMI readings, then they got back up after Friday's huge Nonfarm payrolls beat. The price of gold rallied and then sold off. In the coming week we may see even more trading action. Especially on Wednesday. Let's take a look at the details.

-

Preparing for THE Bottom in Gold: Part 7 - Buy-and-Hold on Steroids

December 6, 2019, 3:22 PM -

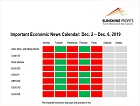

Important Economic News Calendar: December 2 - December 6, 2019

December 2, 2019, 8:30 AM

Last week's economic data releases were mixed but investors went risk-on ahead of the Thanksgiving holiday long weekend. Stocks hovered along new record highs while the price of gold remained close to its recent local lows of around $1,450. In the coming week we will surely see more action in the global financial markets! Let's take a look at the details.

-

Manufacturing Recession and Gold

December 1, 2019, 11:52 PM -

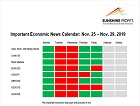

Important Economic News Calendar: November 25 - November 29, 2019

November 25, 2019, 8:55 AM

The global financial markets barely moved last week as economic data releases didn't bring any meaningful surprises. So will the Thanksgiving holiday week bring volatility to the financial markets? Actually, we may see some market movements in the first half of this week. Let's take a look at the details.

-

Power of Narratives and Gold

November 22, 2019, 12:25 AM

Let's face it, we live in a world of radical uncertainty. Yet we're supposed to make perfectly rational decisions - so, how do we cope with the unknown? We tell narratives, and form our decisions around them! Let's explore the narratives in the financial markets for it reveals their importance to the gold market.

-

Important Economic News Calendar: November 18 - November 22, 2019

November 18, 2019, 6:35 AM

The Fed's Powell testimony on the economy before Congress pushed stock prices higher last week. And it was worth paying attention to that news. But will the next set of economic data confirm the bullish outlook? Investors will have to focus on Wednesday's and Friday's releases. Let's take a look at the details.

-

What ECB’s Tiering Means for Gold

November 15, 2019, 12:42 AM -

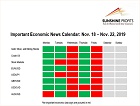

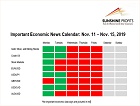

Important Economic News Calendar: November 11 - November 15, 2019

November 11, 2019, 8:50 AM

Last week the markets took some breather following the late October - early November huge economic data announcements. The ISM Non-Manufacturing PMI led to some volatility but despite the sell-off in gold it was a relatively quiet week on the financial markets. What about the coming week? Let's take a look at the details.

-

Will Repogeddon Make Gold Rally?

November 8, 2019, 12:35 AM

One of the most important recent developments in the world of finance was the September liquidity crisis in the U.S. repo market. As a reminder, the repo market is where borrowers borrow cash from lenders against collateral in the form of safe securities such as government bonds. As we wrote in the Gold News Monitor, the U.S. overnight repo rate, which is the rate demanded to get cash in exchange for Treasuries for 24 hours, shot up from slightly above 2 percent to as high as 10 percent.

-

Strong October Jobs Data Stun Gold. For How Long?

November 5, 2019, 9:02 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts