The euro reversed sharply lower and the pressure is building within other monitored pairs, too. Being nimble means to thoroughly evaluate the developments and take measured action when the odds favor doing so. It can also mean opening a new trade. Take a look at how what we are talking about translates into action exactly.

- EUR/USD:short (a stop-loss order at 1.1375; the initial downside target at 1.1242)

- GBP/USD: short (a stop-loss order at 1.2979; the initial downside target at 1.2712)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (a stop-loss order at our entry level at 0.7228 and the next downside target at 0.7041)

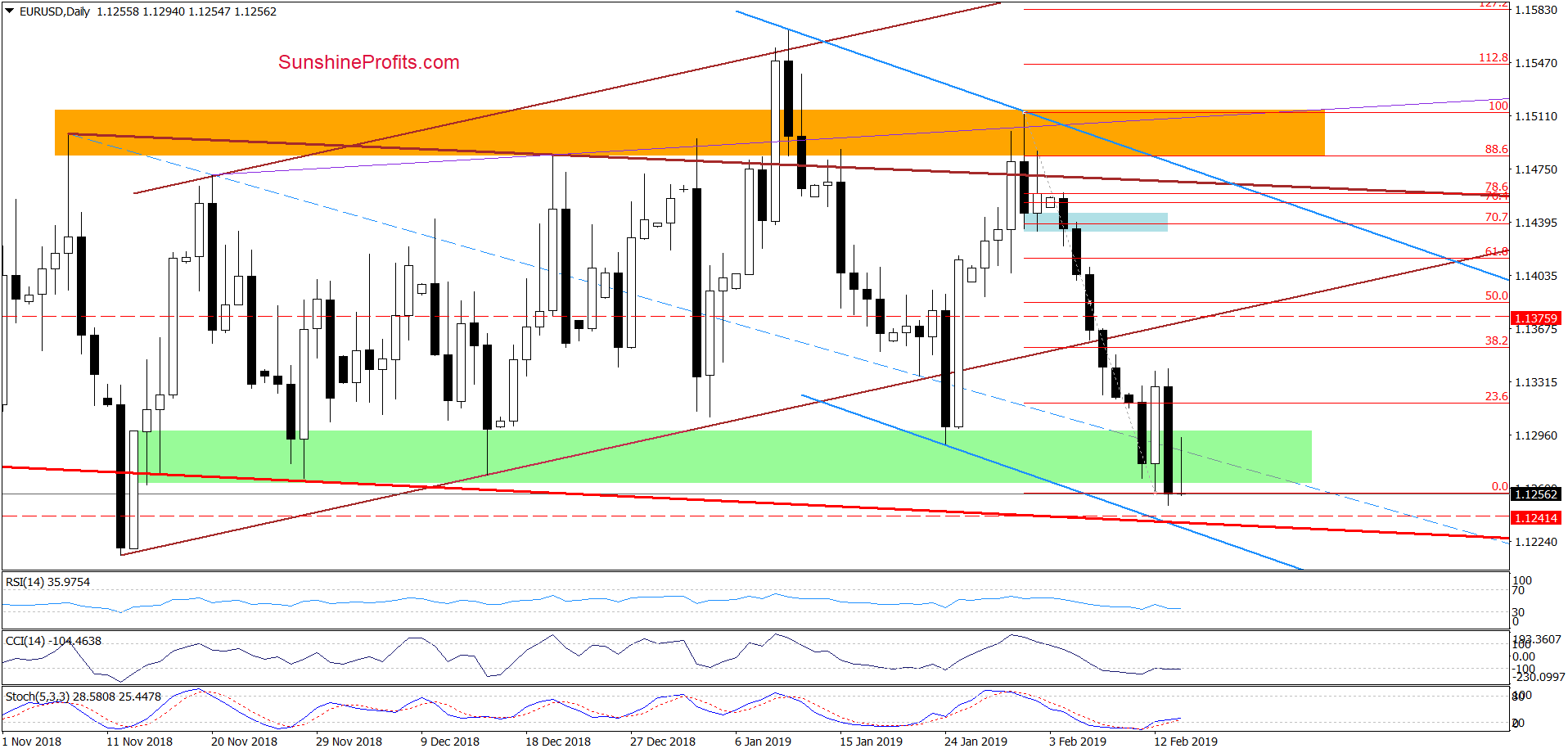

EUR/USD

Yesterday, we wrote the following:

(…) currency bulls didn’t even manage to reach the 38.2% Fibonacci retracement. Earlier today, there was another unsuccessful attempt at it, which encouraged the sellers to take the pair down to trade at around 1.1310 currently.

The euro turned south, which in combination with the above-mentioned unsuccessful attempts to go higher suggests further deterioration in the coming days. (…). If the bearish scenario is indeed the case and the pair declines from here, we’ll likely see (at least) a test of the lower border of the red declining trend channel.

Taking all the above into account, we think that re-opening short positions is justified from the risk/reward perspective. (…)

Our outlook was validated by the market, and we saw the euro move sharply lower yesterday, making our short positions profitable. Earlier today, the bulls timidly tried to move the price higher, but were rejected as evidenced by the long upper knot.

The price trades currently close to the lower border of the green support zone. It has broken slightly below that yesterday and we haven’t seen any vigorous attempt to reverse higher. On the other hand, yesterday’s price action strongly reminds of a bearish engulfing pattern, similar to what we have just seen in crude oil on Monday Feb, 11th. For those of you not trading oil with us yet, the bearish engulfing pattern:

(…) suggests further deterioration in the coming week(s). This candlestick pattern consists of a relatively small white candle that is followed by a large red candle that engulfs the previous white candle. It indicates a trend change – here, from up to down.

Notwithstanding Tuesday’s not-so-small white candle, the point here is the forceful reversal lower cutting through the previous lows like a hot knife through butter. Taking all these into account, we believe that further deterioration is just around the corner. We are likely to see a test of the lower border of the declining red support line and our profit target hit in the very near future.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.1375 and the initial downside target at 1.1242 are justified from the risk/reward perspective.

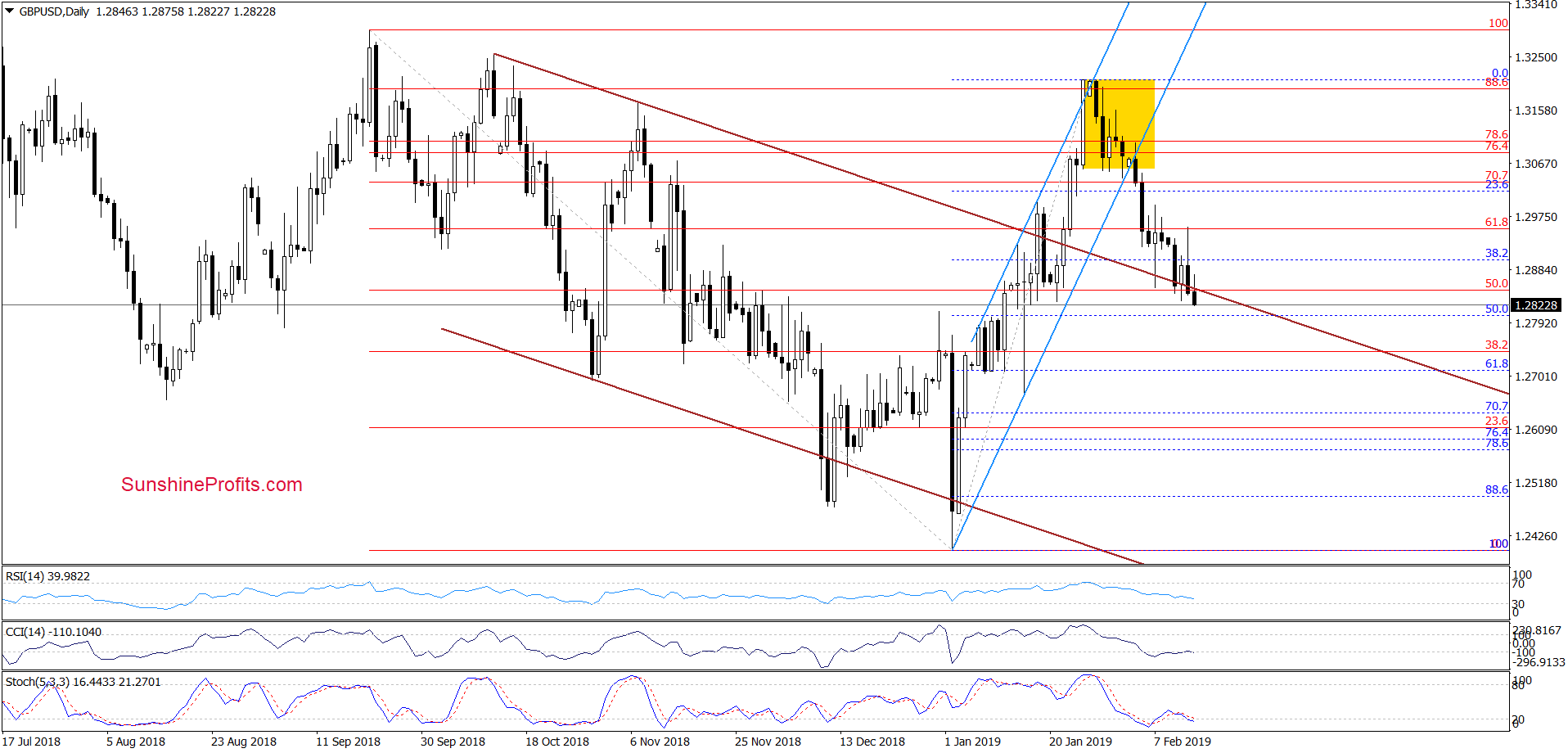

GBP/USD

Let’s take a look at the daily chart. Although GBP/USD bounced off the previously-broken upper border of the declining brown trend channel during Tuesday’s session, the bulls didn’t achieve a lasting improvement. Yesterday, they attempted to go still higher but were rebutted and the price reversed sharply to close the day below the upper border of the declining brown trend channel.

Such a close doesn’t bode well for higher values of the exchange rate. Today’s yet another feeble attempt to go higher has been also rejected and the pair trades at around 1.2830 at the moment of writing these words.

These signs suggest that GBP/USD could decline even to around 1.2711, where the 61.8% Fibonacci retracement is. The bearish scenario is also reinforced by the sell signal generated by the Stochastic Oscillator.

Taking all the above into account, we think that opening short positions is justified from the risk/reward perspective.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.2979 and the initial downside target at 1.2712 are justified from the risk/reward perspective.

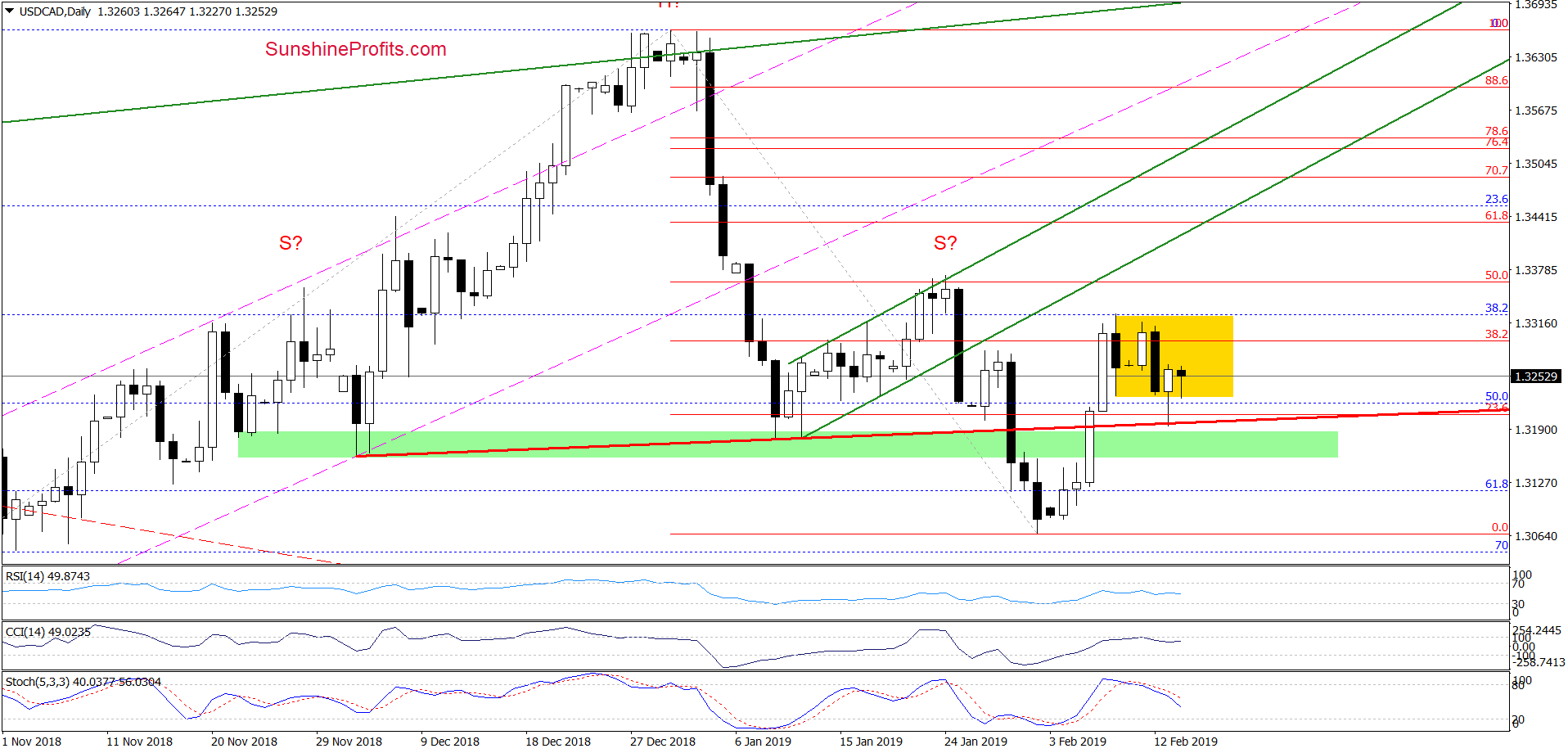

USD/CAD

The overall situation hasn’t changed much as USD/CAD is still trading inside the yellow consolidation. Yesterday, currency bears tried to go south, but the previously broken red support line stopped them. The bulls triggered a rebound that took the pair back into the consolidation.

The earlier breakdown was invalidated which suggests that further improvement can’t be ruled out. If the bulls show strength and trigger an upswing, we could see a test of the upper border of the yellow consolidation, possibly followed by the 50% Fibonacci retracement and the January peaks tests.

Nevertheless, if the bulls show weakness in the coming day(s) and we see a daily close below the rising red support line, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist