We have seen some nice runs with respect to our open positions. Trade management is about patience and careful analysis of the most recent action. It results in an informed decision to either stay the course or adjust the current position. What kind of action do the odds favor right now?

- EUR/USD:short (a stop-loss order at 1.1416; the initial downside target at 1.1305)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (with a stop-loss order at our entry level at 0.7228 and the next downside target at 0.7041)

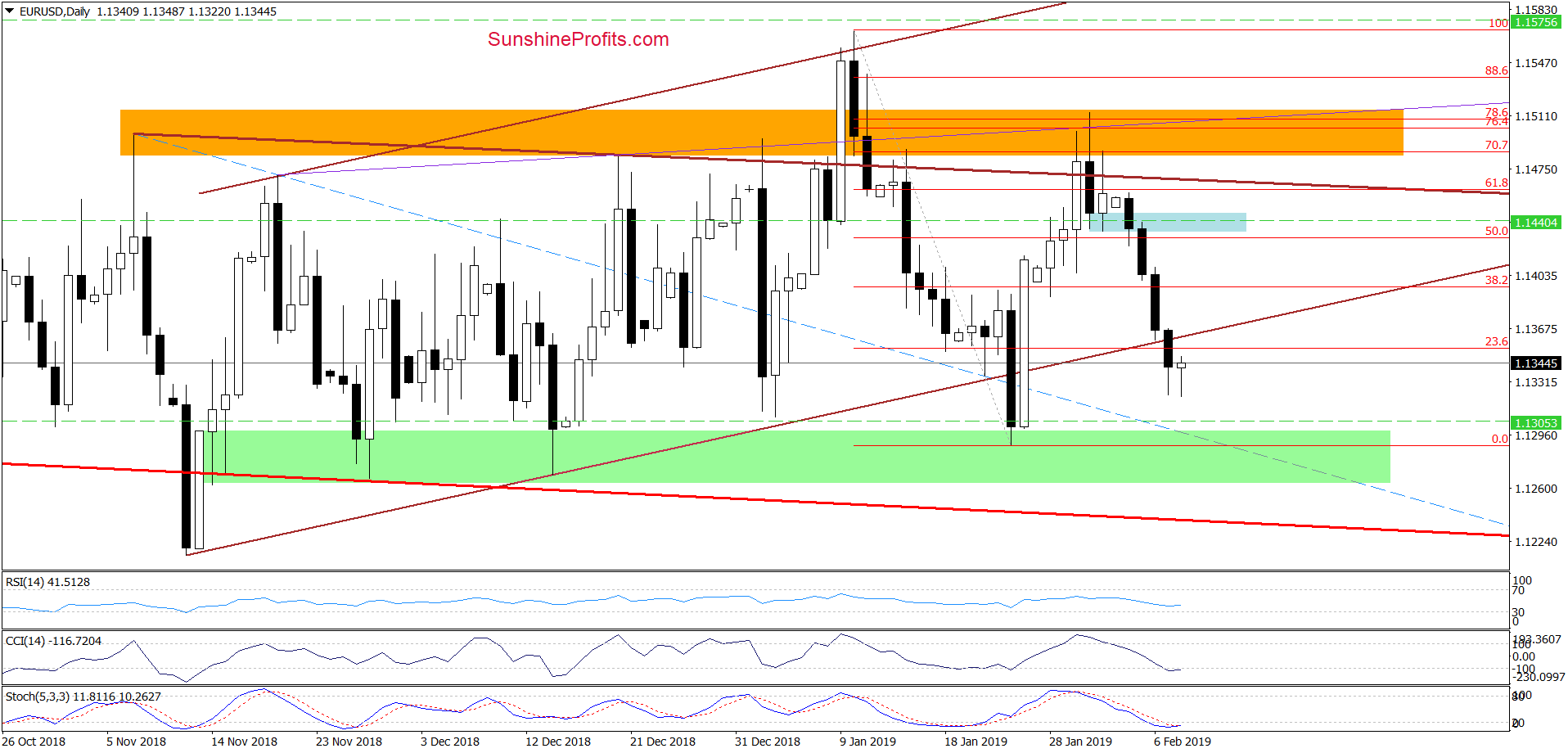

EUR/USD

On the daily chart, we see that although EUR/USD bounced off the session lows yesterday, the pair still closed the day below the lower border of the brown rising trend channel. Earlier today, there was an attempt to move both lower and higher. As long as there is no invalidation of the breakdown below the lower border of the brown rising trend channel, any upswing would probably be nothing more than a verification of the earlier breakdown.

Taking these into account, we believe that our last commentary on this currency pair remains up-to-date:

(…) The indicators are still positioned in a supportive way for such an outcome.

(…) we continue to believe that we’ll see a realization of our pro-bearish scenario:

(…) EUR/USD will likely turn south and re-test the lower border of the brown triangle or even the green support area, which stopped the sellers several times in recent weeks.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at 1.1416 and the initial downside target at 1.1305 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

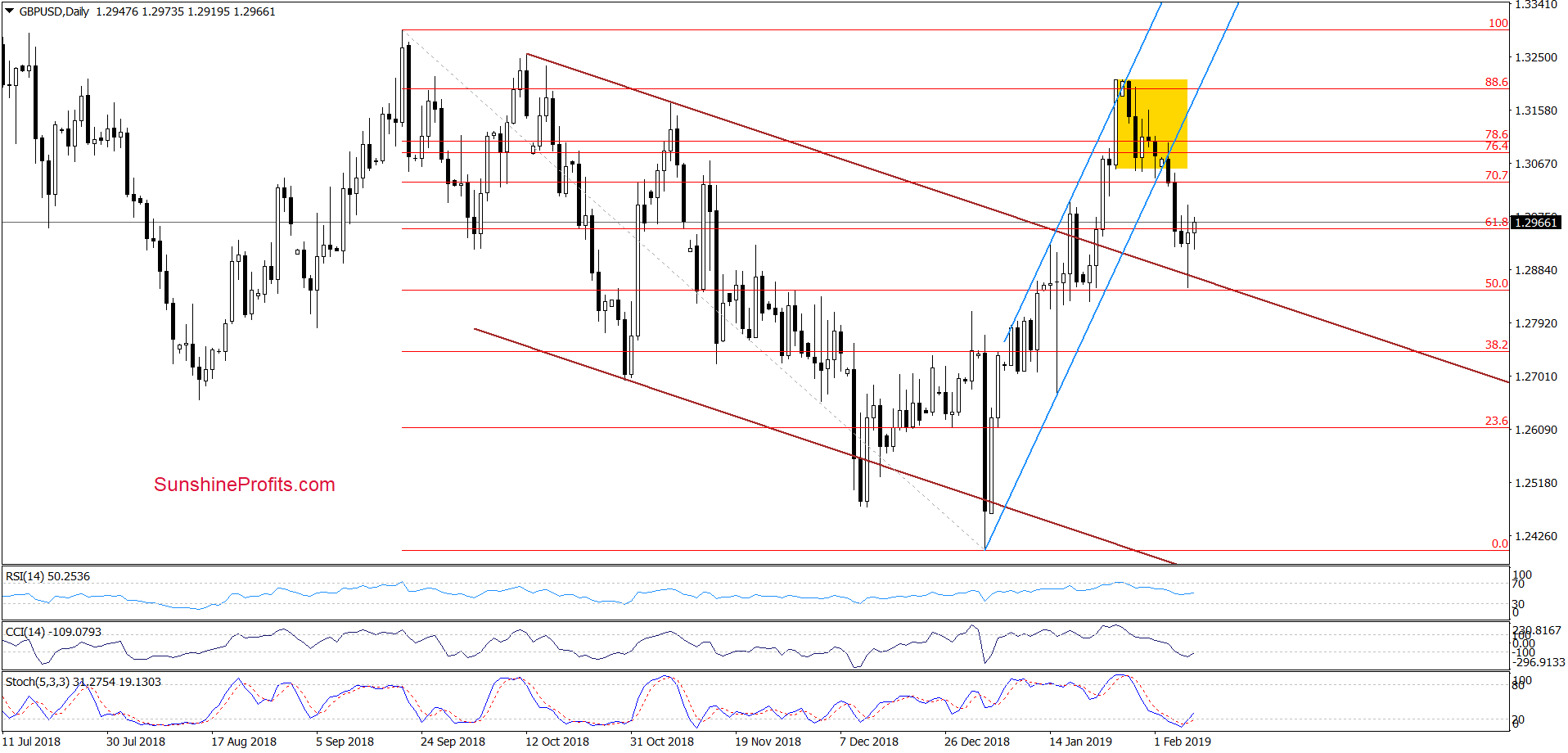

GBP/USD

Looking at the daily chart, we see that the breakdown below the lower border of the yellow consolidation and the lower line of the rising blue trend channel triggered a downward move. GBP/USD dived to the previously-broken upper border of the declining brown trend channel and recovered slightly since, as evidenced by the long lower knot.

Earlier today, there was one more attempt to move higher. The buy signals generated by the Stochastics and CCI increase the possibility of further improvement in the coming day(s).

If this is the case and GBP/USD moves higher from current levels, we could see it retest the previously-broken lower border of the yellow consolidation. However, this scenario will become more likely only once the pair breaks above yesterday’s high.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

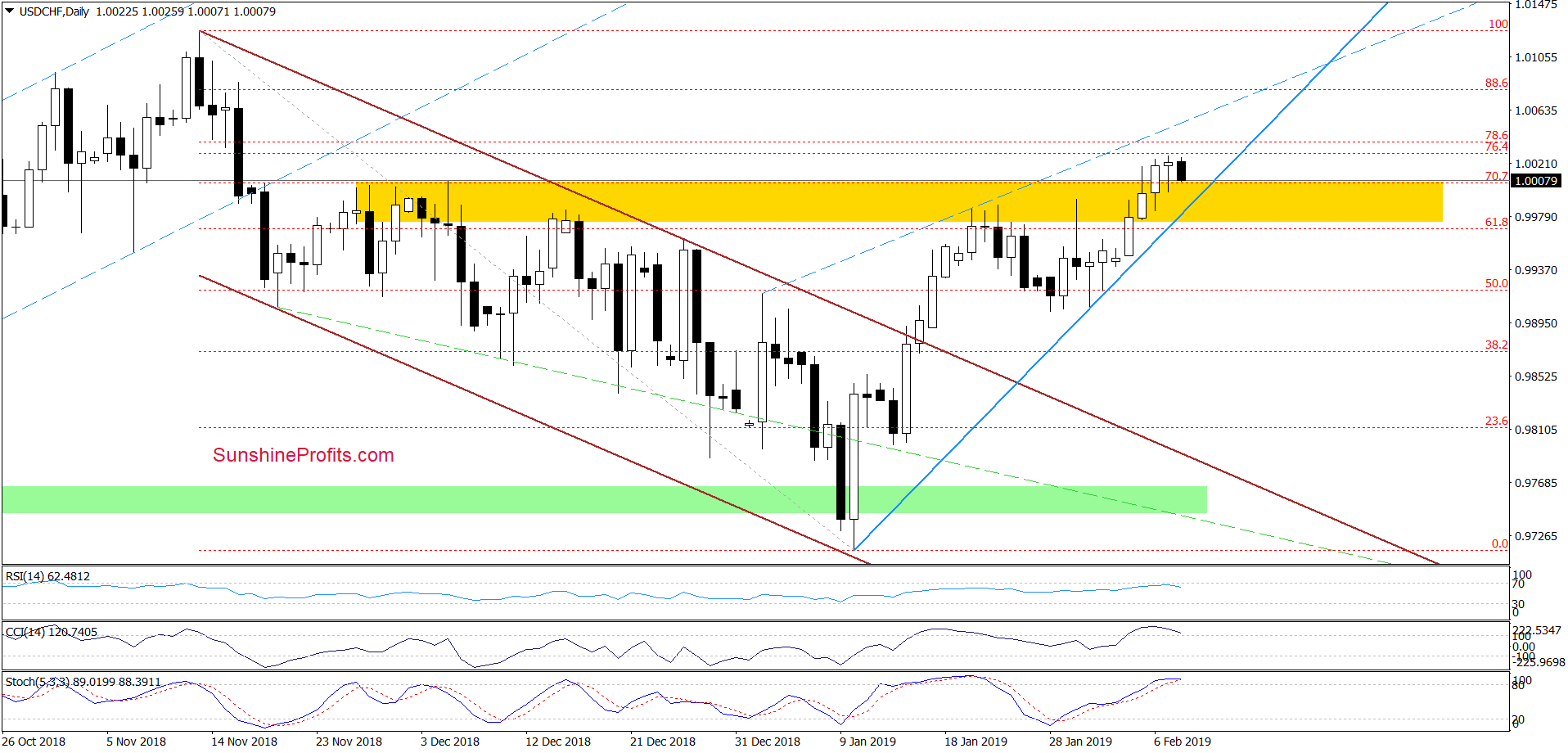

USD/CHF

Quoting our last commentary on this currency pair:

(…) as long as there are no sell signals generated by the daily indicators, one more attempt to move higher can’t be ruled out. It could test the 76.4% or 78.6% Fibonacci retracements and even reach the blue dashed line (that would be the upper border of the potential blue rising wedge).

Looking at the daily chart, we see that the situation developed in tune with the above expectation. The currency bulls almost touched our first upside target of 76.4% Fibonacci retracement in recent days.

Despite the breakout above the yellow resistance zone however, the bulls didn’t manage to take the price any higher. Today’s trading is marked with a pullback, currently sitting at the upper border of the yellow (previously resistance) zone.

However, as long as there is no invalidation of the breakout above the upper border of the yellow zone and daily indicators remain overbought (in other words, there are no sell signals generated), one more attempt to go north can’t be ruled out. If the bulls close their ranks and push the price up, we can see a retest of the 76.4% Fibonacci retracement or even a move to the blue dashed line in the near future.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist