Black gold's decline goes on, and today's congested trading doesn't change that. The medium-term factors tend to win over the short-term obstacles simply. But still, can today's situation be an exception to the rule?

Meanwhile, the USD Index has reversed yesterday after attempting a breakout above the rising resistance line, vindicating our cautious approach. But the dollar is on an upswing today. With the jobs data provide a convenient catalyst for the upcoming breakout, or a bit more patience is warranted?

As you've read in the previous Oil Trading Alerts and Forex Trading Alerts, Nadia Simmons, who is the author of these reports has not been feeling well. This remains to be the case, and as it's been several days since you received crude oil or forex analysis from us, I (PR here) would like to help.

Consequently, I will be writing analyses of both: crude oil and the forex market and I will publish them combined, so that those, who normally enjoy access to only one of these reports, will get something extra. That's not much of a positive surprise for those, who already have access to both Alerts (for instance through the All-Inclusive Package), so if you have access through this package or you subscribed to both products individually, I will provide you with something extra. I will analyze any company of your choice with regard to its individual technical situation, and I will send you this on-demand analysis over e-mail. If this applies to you, please contact us with the name of the company that you're interested in.

Having said that, let's take a look at the crude oil market.

Crude Oil Analysis

Today's crude oil analysis is going to be brief, because practically everything that we wrote yesterday remains up-to-date, and crude oil is moving in tune with our forecast. The profits on the short position are growing as well. Consequently, we will quote yesterday's analysis, while updating the charts:

Crude oil just rallied this month and then reversed its course. As of yesterday's closing price, it was up by $0.81 in September. However, today's overnight decline took crude oil over 50 cents lower, which means that the small monthly gain has been almost entirely erased. Moreover, this creates a bearish reversal, which suggests lower crude oil values in the following months.

Let's not forget what caused crude oil to rally recently - it was an attack on the Saudi oil field. In other words, it was a geopolitical event, and such events usually have only temporary effect on prices.

As crude oil declined after we posted the above (and made our new short position immediately profitable), the earlier small monthly gain instantly turned into an almost 2% monthly decline. The reversal became even more apparent, and thus important.

Black gold moved a bit higher earlier today, but it's a perfectly natural course of action. Crude oil just broke below two important support levels - the rising support line based on the August and September lows and below the 61.8 % Fibonacci retracement level.

Breakdowns and breakouts tend to be followed by verifications. It's a situation, in which the price moves back to the broken line or level to "check" if this move was just accidental. In practice, this means that some traders are betting on breakouts or (in this case) breakdown's invalidation as the latter tend to be immediately followed by strong moves in the opposite direction.

Now, until crude oil overcomes again the above-mentioned combination of resistance levels, the outlook will remain bearish. The monthly reversal strongly suggests that the breakdown will be confirmed and thereupon continued. In other words, our yesterday's comments on crude oil remain up-to-date.

In our view, the following short position remains justified from the risk-reward point of view.

Trading position (short-term; our opinion): short position with a stop-loss order at $58.27 and the binding exit target at $53.05 is justified from the risk/reward perspective.

Forex Analysis

As far as the currency market is concerned, Nadia usually covers the individual currency pairs. However, that's not what I specialize in, so instead of the usual format of these analyses, I will maximize their usefulness and likely profitability. This means that instead of focusing on individual currency pairs, I will cover the USD Index, as that's what I've been following on a regular basis for years.

It's also tradable, as there are futures on it (DX symbol) as well as ETFs, for instance the UUP and the UDN. The key development that might distort the price movements will take place on Friday, so the market is likely to move according to its trend until that time. Friday's price movement might be a bit more chaotic, though.

And which way is the current trend pointing?

In the same direction as yesterday.

Up.

Our previous comments on the long-term chart remain up-to-date:

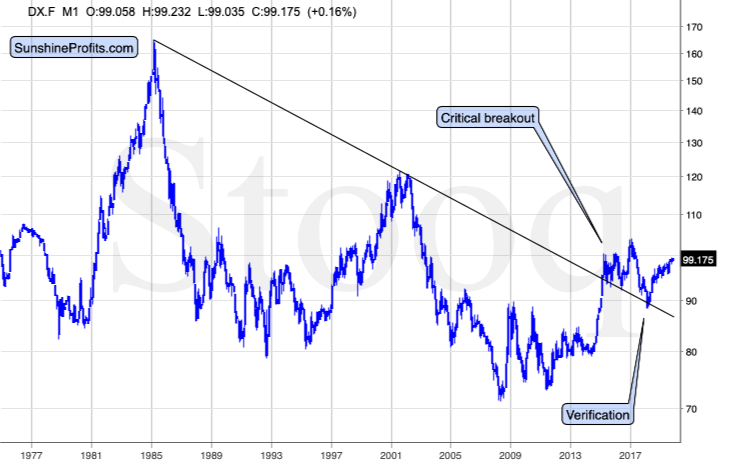

The long-term trend is up as even the dovish U-turn by the Fed, rate cuts, and myriads of calls from President Trump for lower U.S. dollar and much lower (even negative) interest rates, were not able to trigger any serious decline.

What we saw instead was a running correction that's the most bullish kind of corrections. It's the one in which the price continues to rally, only at significantly smaller pace.

On the short-term chart we see something new. In the previous Alerts, we wrote that the lack of breakout above the rising green resistance line was a reason for caution and against opening a new speculative trading position. Yesterday's reversal and daily decline show that it was a good decision to stay out of the market.

Once the green line is broken, the USD Index is likely to soar to about 102 level or even beyond before it takes a bigger breather. The jobs report and Powell's speech are on Friday, which means that there might be no decisive price action until that time. There is already a bullish hint, though.

You see, each time a new yearly high was made, and the USD Index declined, the next daily session was also a daily decline. This time is different - so far. The USD Index is up by 0.24% so far today, which might be a small indication that this time will really be different and the USDX will break higher shortly.

Still, until that happens, the jury is out and we're on the sidelines. So is our capital in case of the currency market. Based on the USD's very long-term chart is seems that we will enjoy many days of higher USD values, but from the trading point of view it appears best to enter the market only after the breakout materializes.

The USD Index is after a major breakout and this breakout was already verified a few times. The most recent rally is just the very early part of the post-breakout rally. Much higher USD Index values are likely to follow in the upcoming months.

Trading position (short-term; our opinion): No position in the USD is justified from the risk/reward perspective at the moment of writing these words.

As always, we will keep you - our subscribers - informed.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager