On Monday, AUD/USD broke above an important resistance zone and verified this breakout yesterday. What does it mean for the exchange rate? Will we see a further rally?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

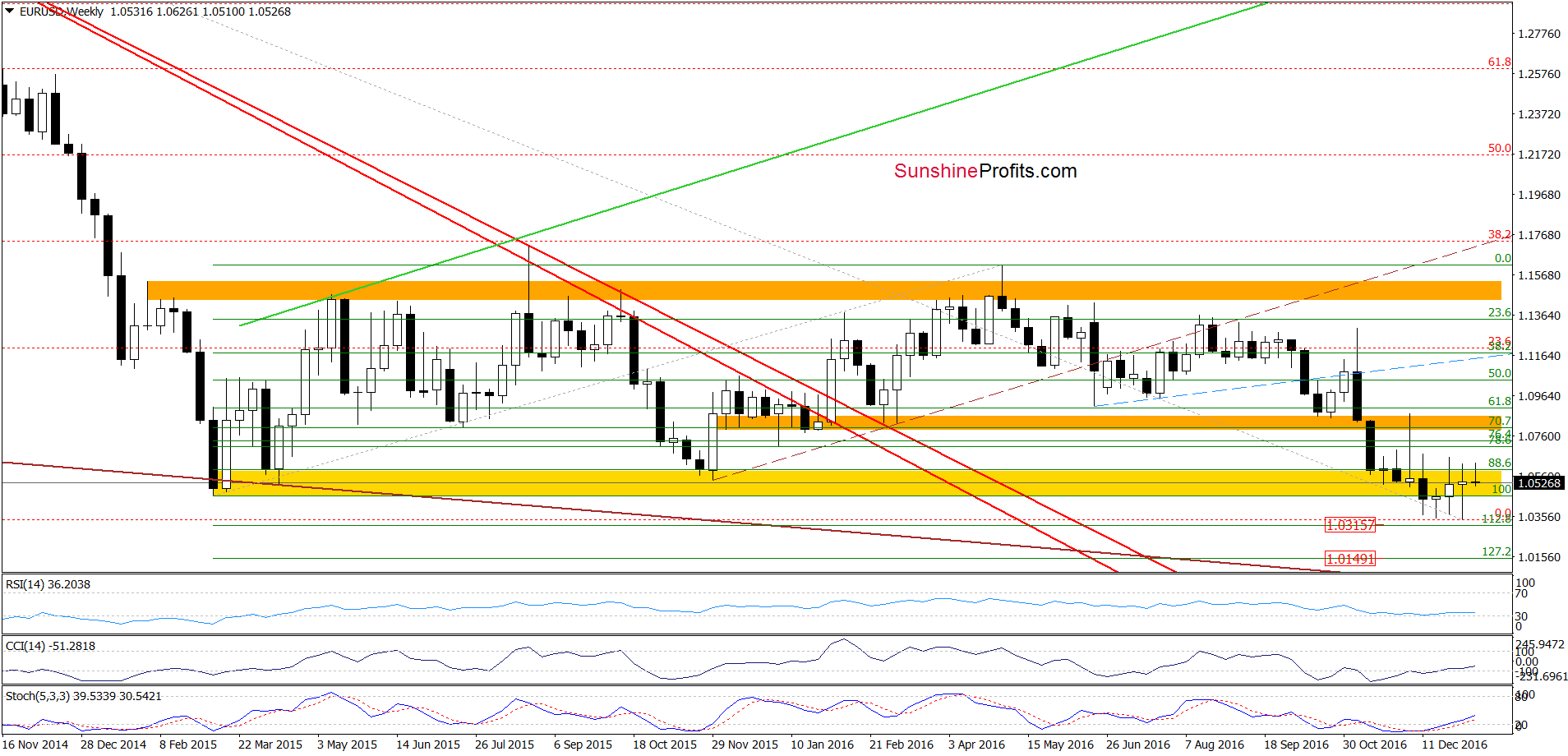

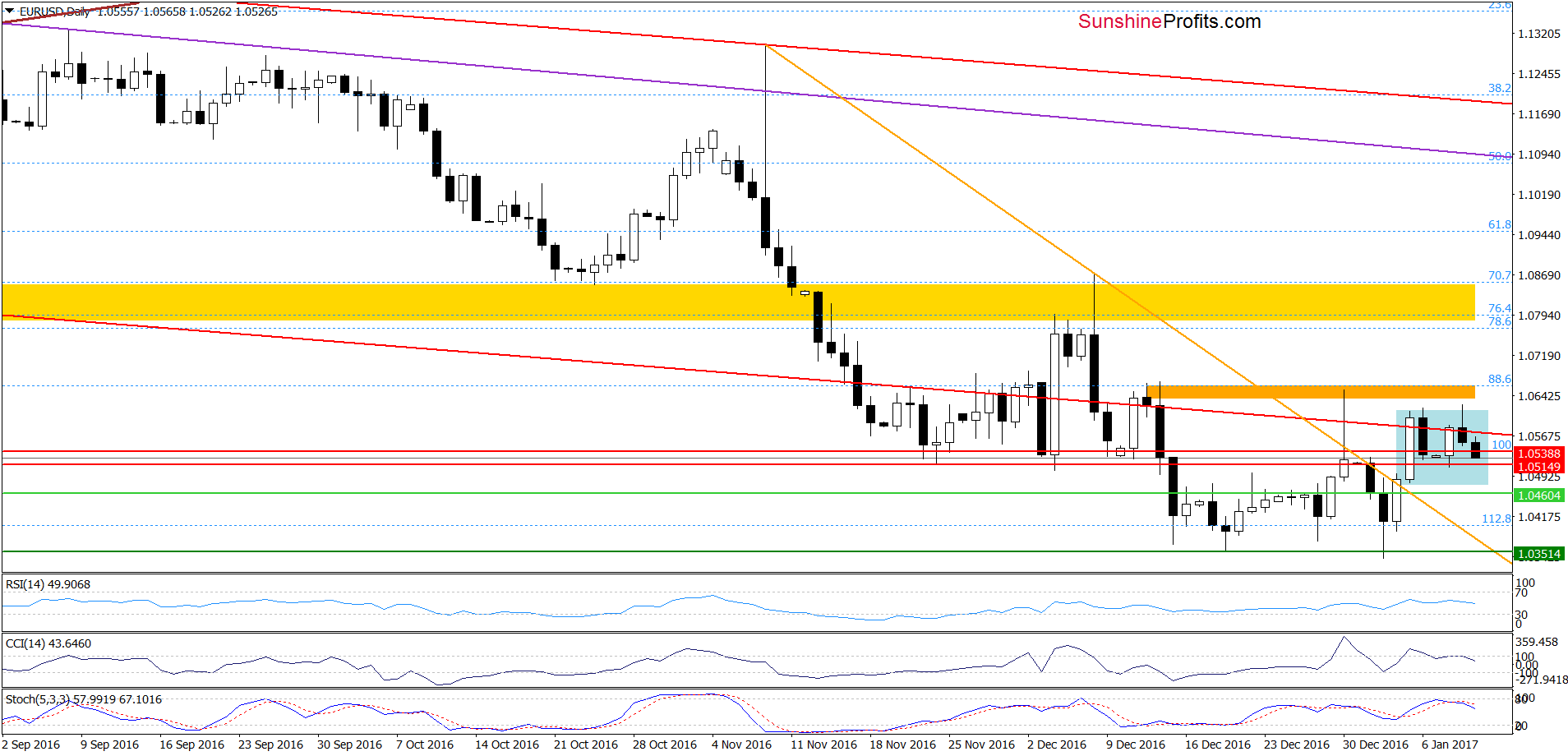

Looking at the charts, we see that the overall situation in the medium- and short term hasn’t changed much as EUR/USD is still trading in a narrow range in the yellow resistance zone (marked on the weekly chart) and inside the blue consolidation seen on the daily chart. Therefore what we wrote yesterday remains up-to-date:

(…) EUR/USD slipped under the previously-broken lower border of the red declining trend channel, (…) but as long as the pair remains in the blue consolidation another bigger move to the upside/downside is not likely to be seen and waiting at the sidelines for another profitable opportunity is justified from the risk/reward perspective.

(…) it is worth noting that the orange resistance zone stopped the earlier rally at the end of December, which suggests that the way to higher levels will be open only if EUR/USD breaks above it. Until this time, another attempt to move lower should not surprise us. [Please note that the CCI and Stochastic Oscillator generated sell signals, increasing the probability of further declines in the coming days].

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

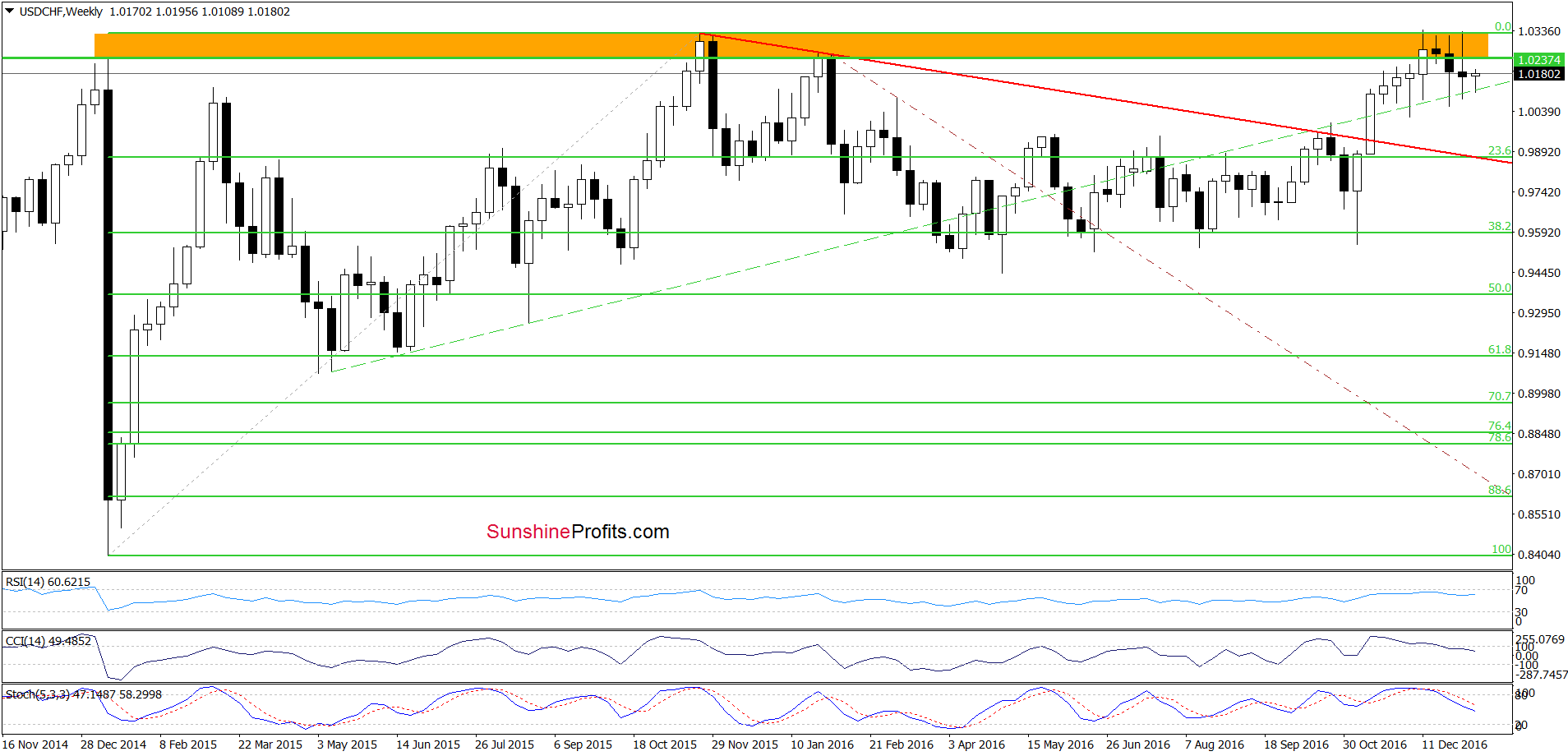

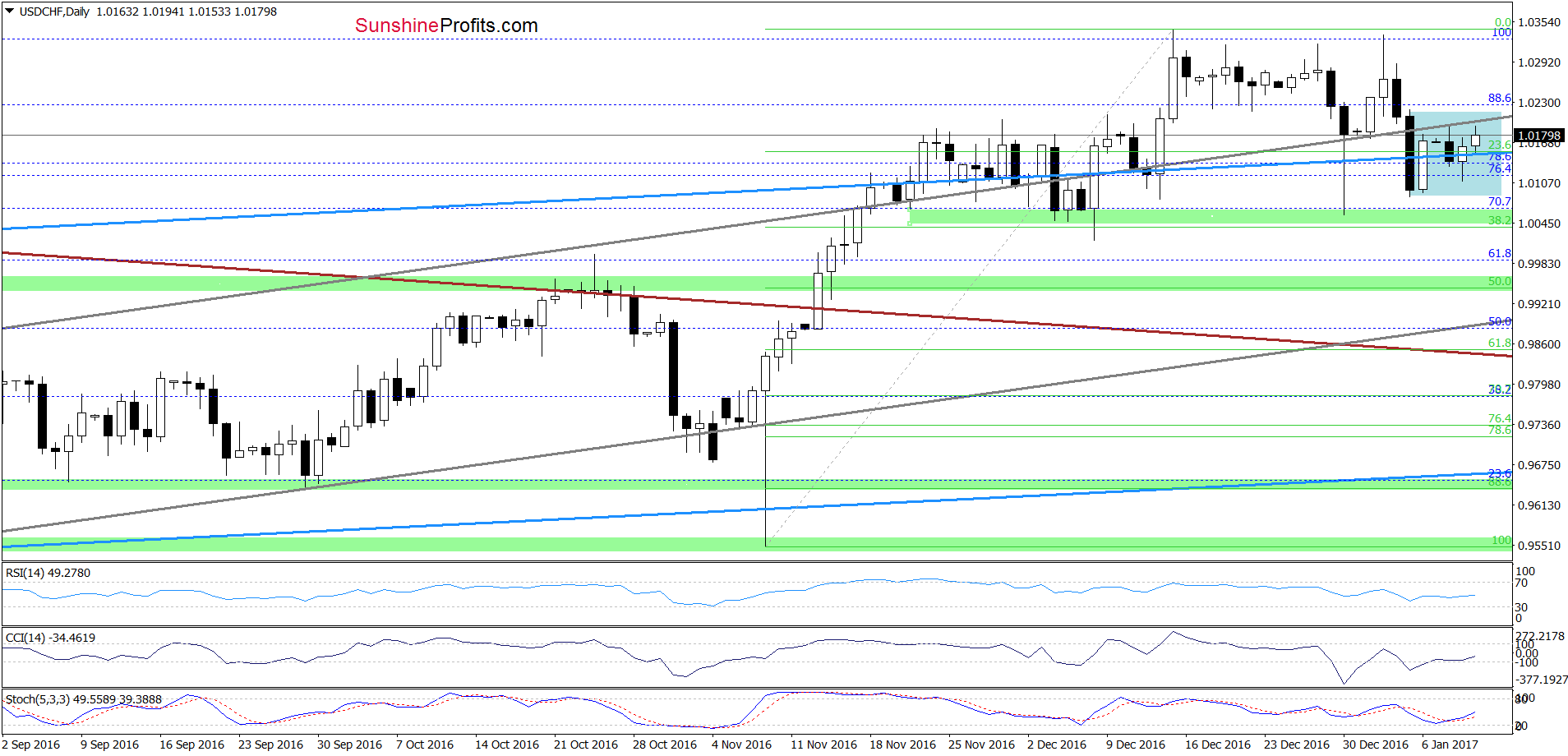

From today’s point of view we see that that the situation hasn’t changed much since Monday and USD/CHF is still trading in the blue consolidation, which means that our last commentary on this currency pair is still valid:

(…) the CCI and Stochastic Oscillator generated buy signals, which increases the probability of further improvement in the coming week. However, in our opinion, such action would be more likely if the exchange rate also invalidated the breakdown below the grey support/resistance line. In this case, USD/CHF would likely re-test the recent highs.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

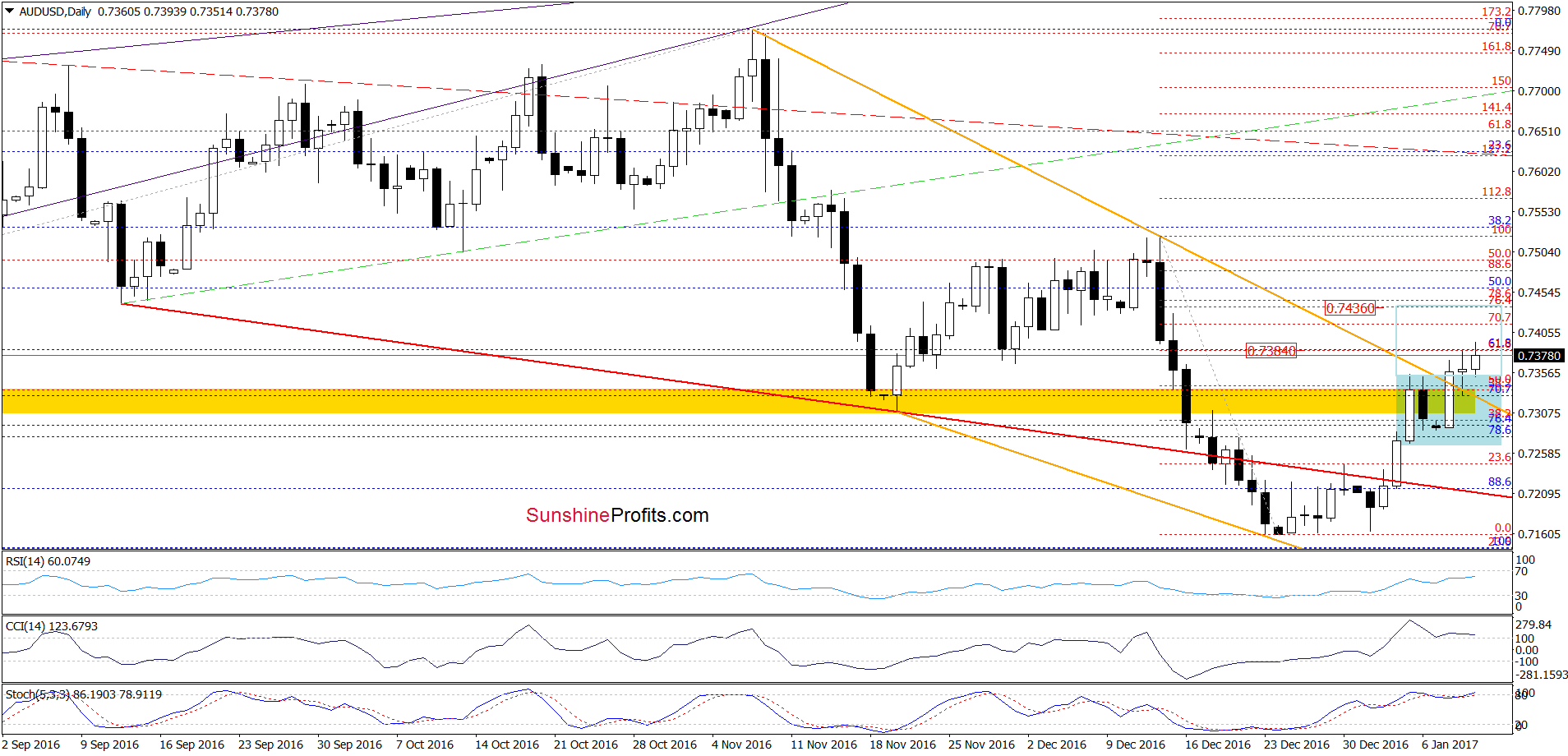

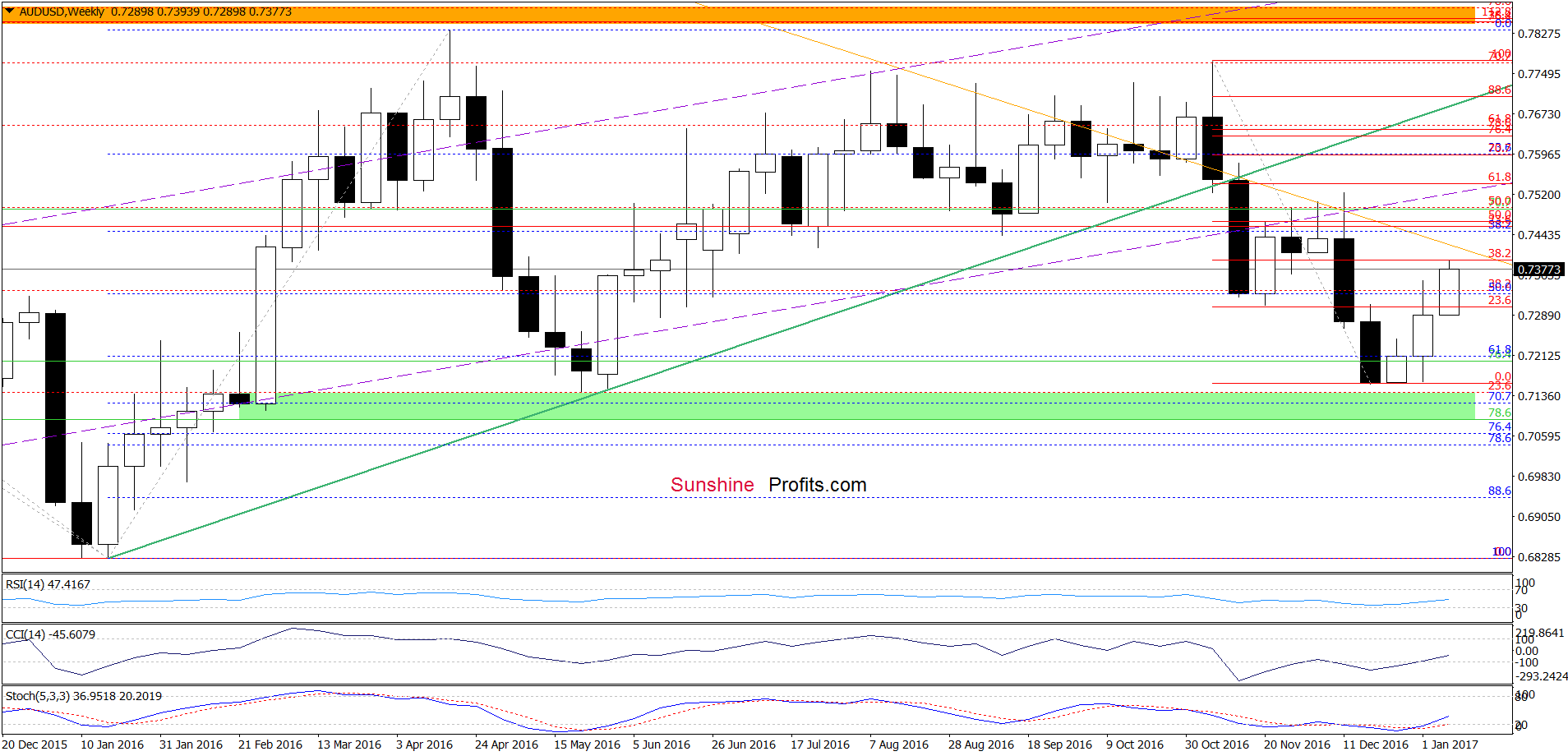

On the daily chart, we see that the situation in the very short term has improved after AUD/USD broke above the upper border of the blue consolidation, the yellow resistance zone and the orange declining resistance line based on the November and December highs. This positive event triggered another upswing earlier today, which suggests that we may see a rally to around 0.7436, where the size of the upward move will correspond to the height of the consolidation. Nevertheless, in our opinion, such price action will be more likely if AUD/USD breaks above the 61.8% Fibonacci retracement based on the December declines and the 38.2% retracement based on the entire November-December downward move (marked on the chart below).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts