Earlier today, official data showed that German manufacturing PMI increased to 54.4 in Jun, beating analysts’ expectations. As a result, the euro moved higher against the greenback, which approached EUR/USD to recent highs. But did this move change anything?

In our opinion the following forex trading positions are justified - summary:

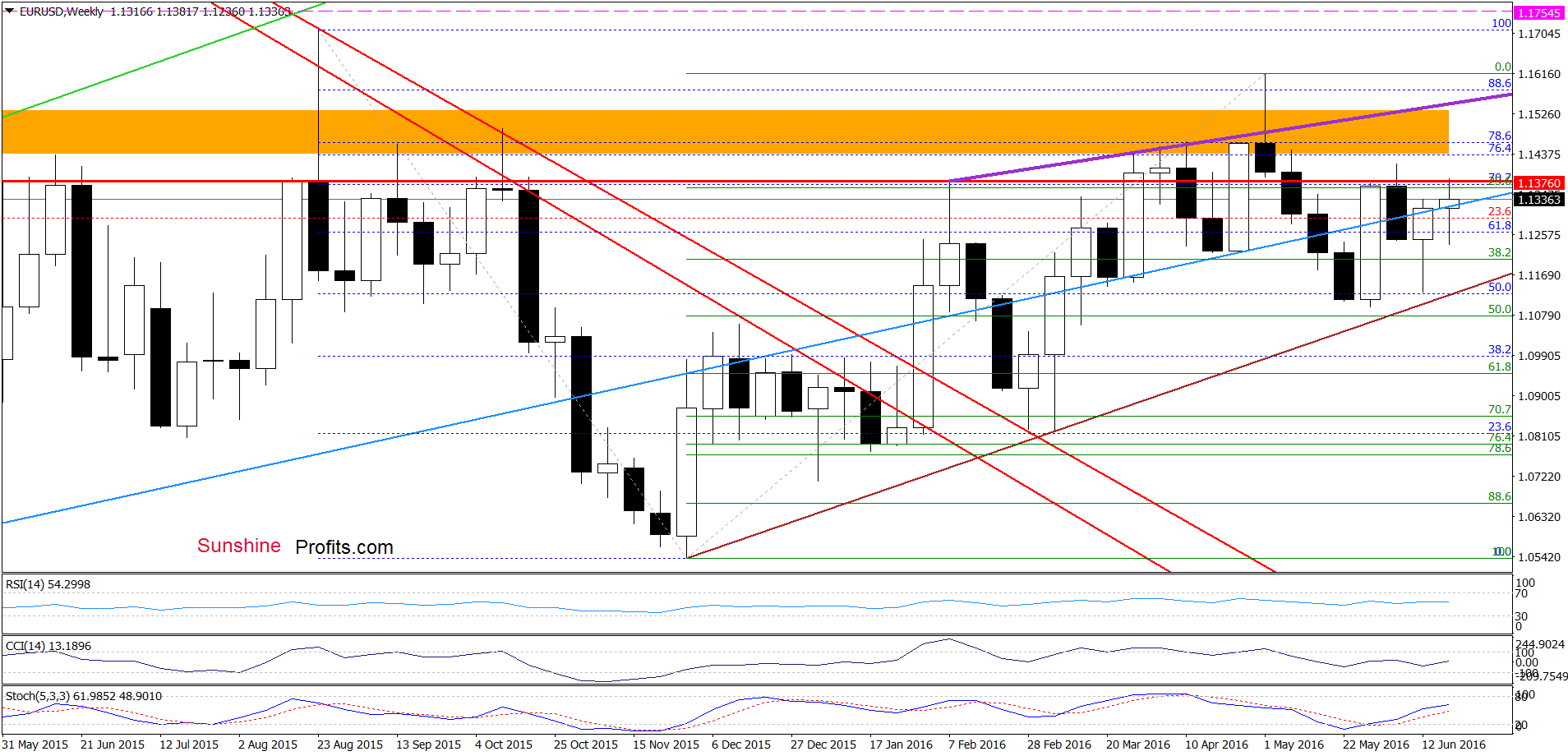

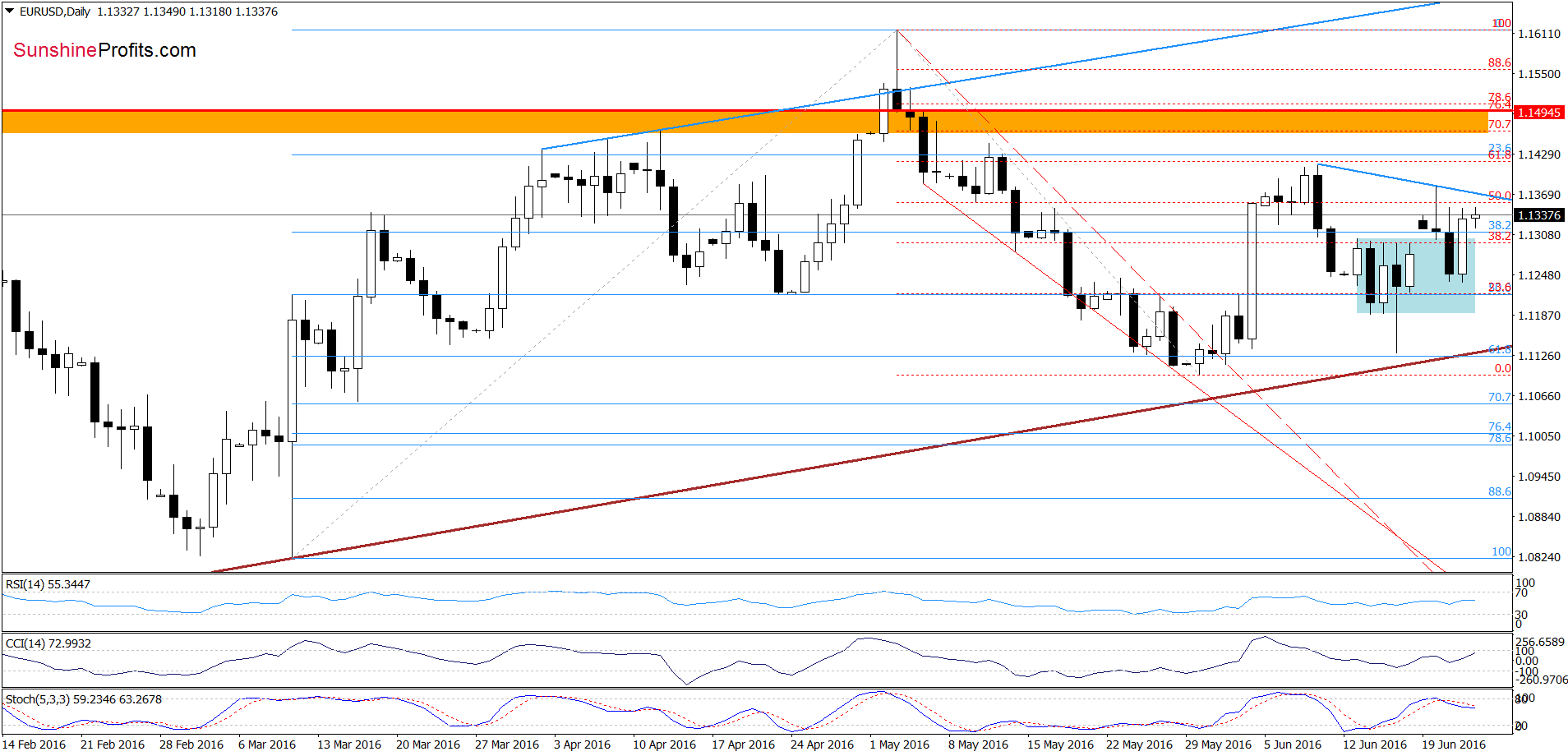

EUR/USD

Although EUR/USD declined sharply and invalidated the breakout above the upper border of the consolidation, currency bulls didn’t give up and pushed the pair higher yesterday. With this move, the exchange rate came back above the upper line of the consolidation, which suggests a test of the blue resistance line based on the previous highs or even a climb to the Jun 9 peak and the 61.8% Fibonacci retracement in the coming day. Nevertheless, a sell signal generated by the Stochastic Oscillator is still in play, which suggests that the space for gains may be limited and reversal is jus around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

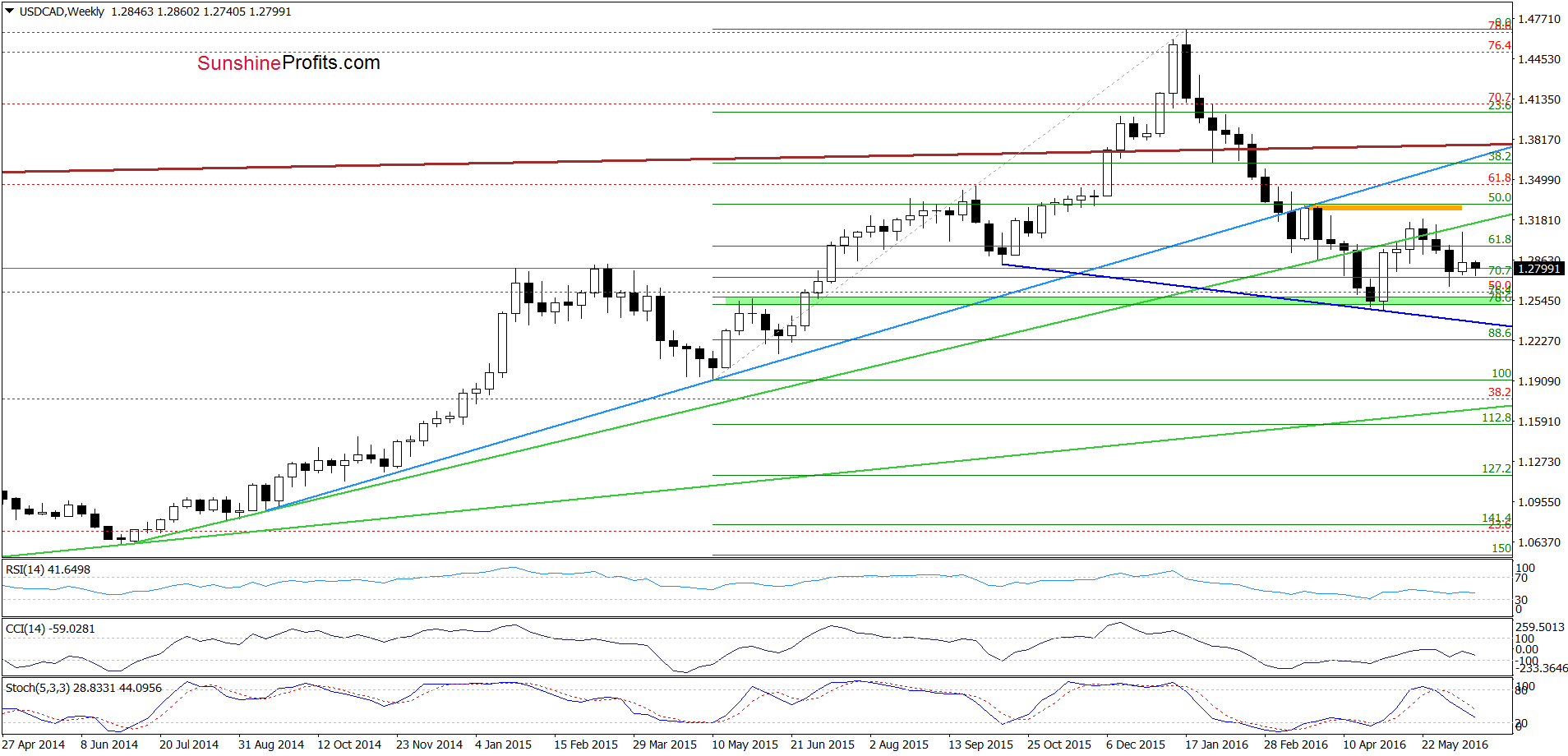

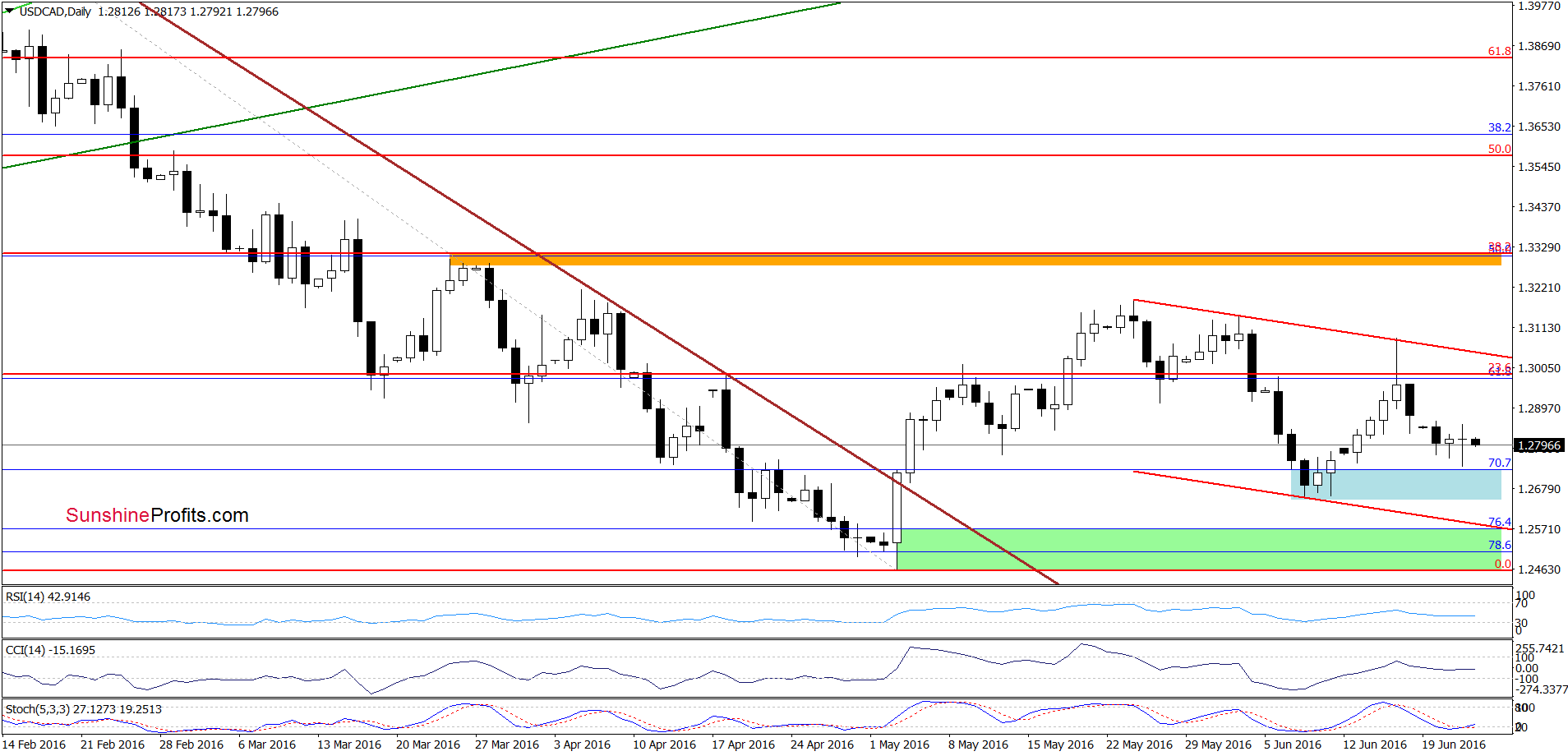

USD/CAD

On the above charts, we see that the overall situation hasn’t changed much since our last commentary, which means that what we wrote on Tuesday is still valid:

(…) the pair invalidated earlier breakout above the barrier of 1.3000, which suggests further deterioration and a test of the 70.7% Fibonacci retracement and the recent lows and in the coming days.

Nevertheless, please note that the Stochastic Oscillator generated a buy signal, which suggests that the space for declines may be limited and reversal is likely in near future.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

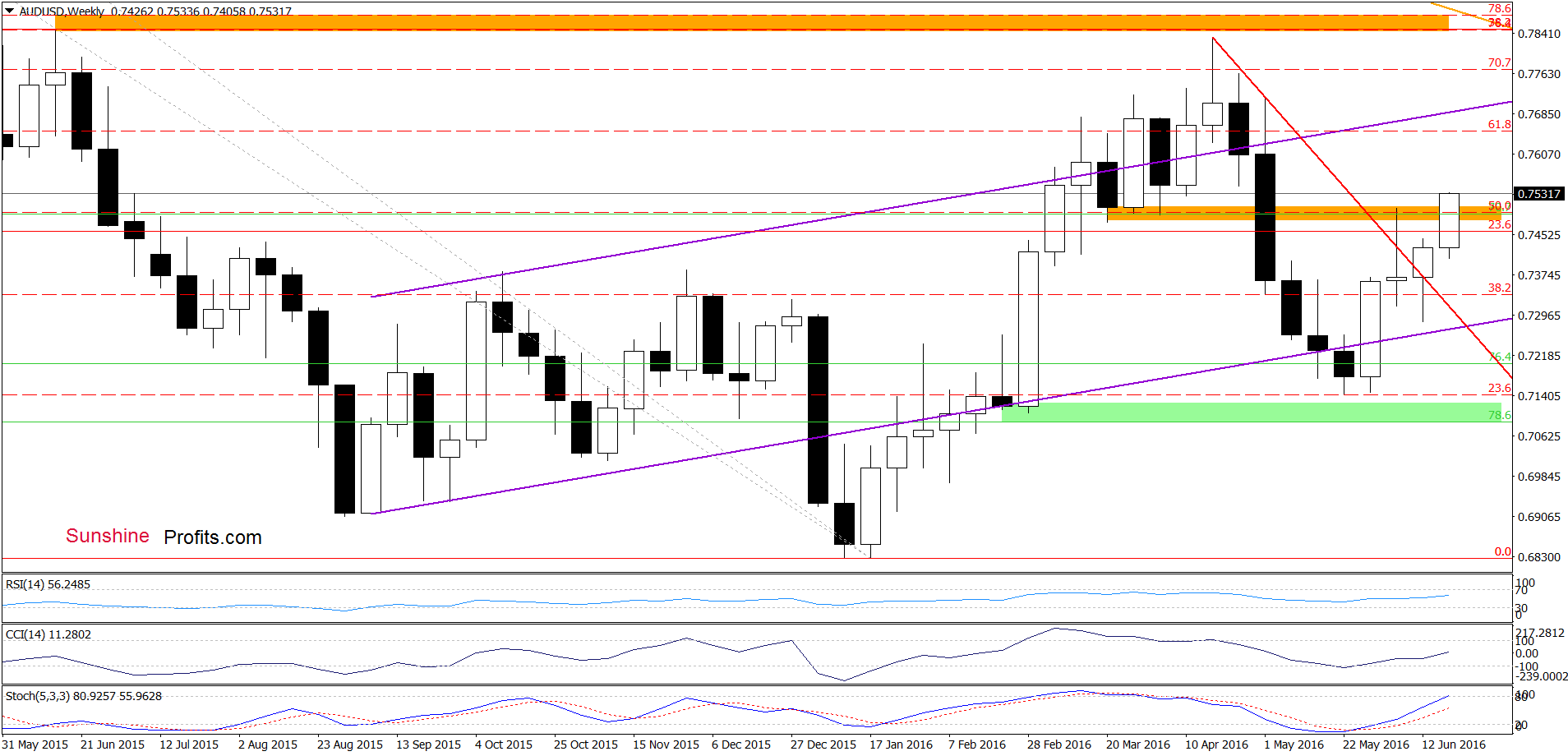

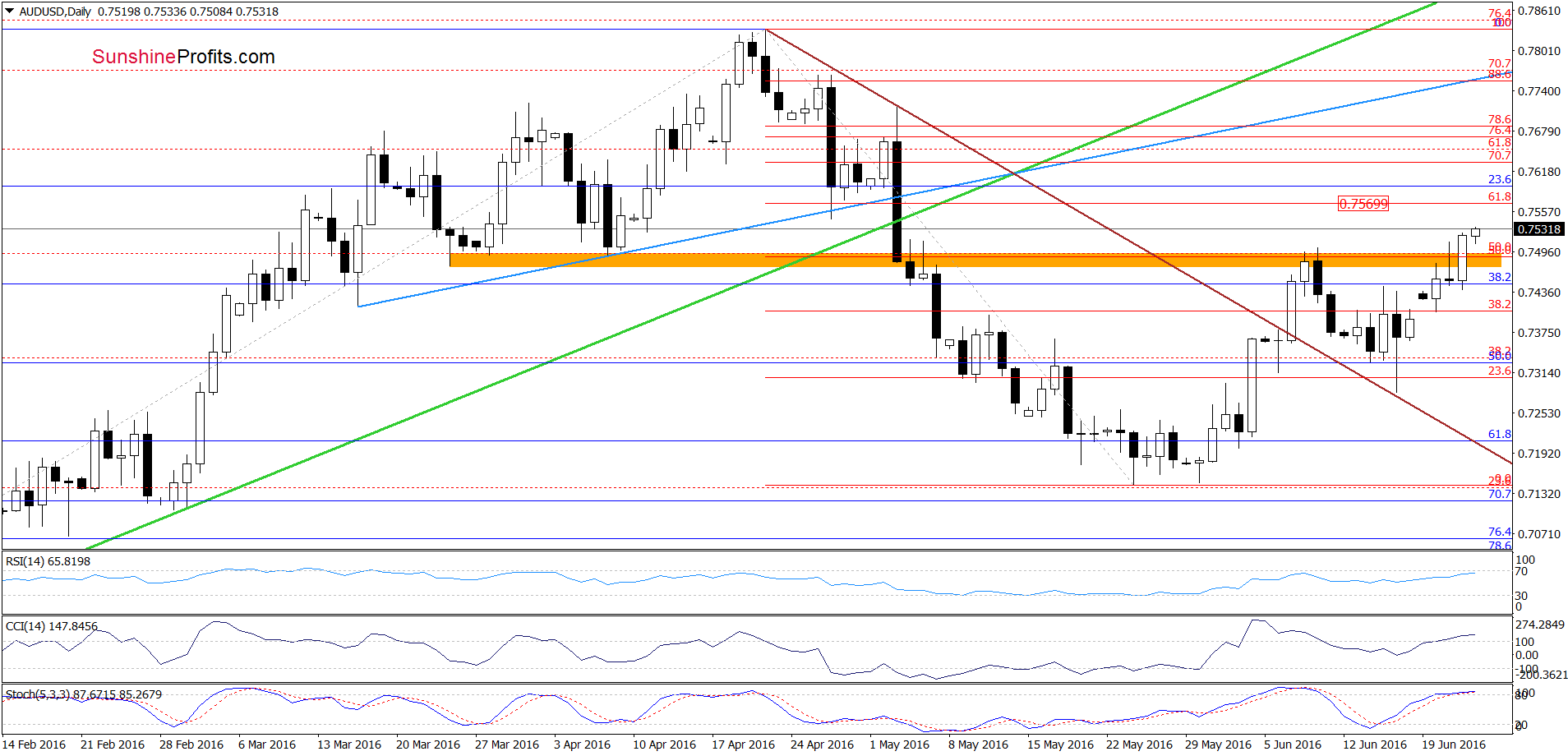

AUD/USD

From today’s point of view, we see that AUD/USD extended gains above the orange resistance zone, which means that we wrote on Monday is up-to-date also today:

(…) the next upside target would be around 0.7570, where the 61.8% Fibonacci retracement based on the entire recent downward move currently is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts