Earlier today, the euro moved little lower against the U.S. dollar after data showed that the GfK German consumer climate index dropped to 8.3 this month, while analysts had expected the index to slip to 8.5. As a result, EU/USD still remains around the April and July 2013 lows. North or south?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: long (stop-loss order: 1.2568; initial price target: 1.3188)

- GBP/USD: none

- USD/JPY: short (stop-loss order: 110.23; initial price target: 105.20)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

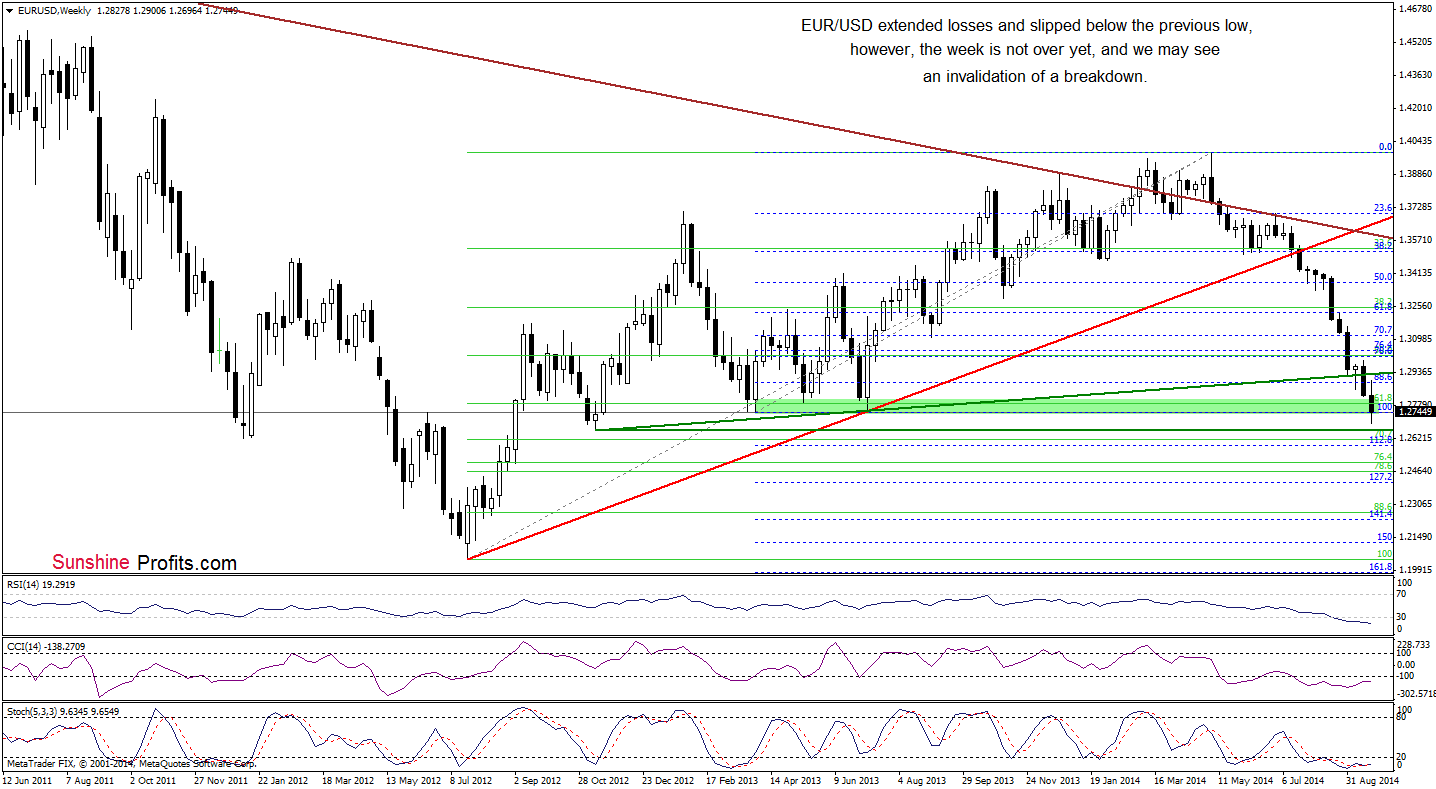

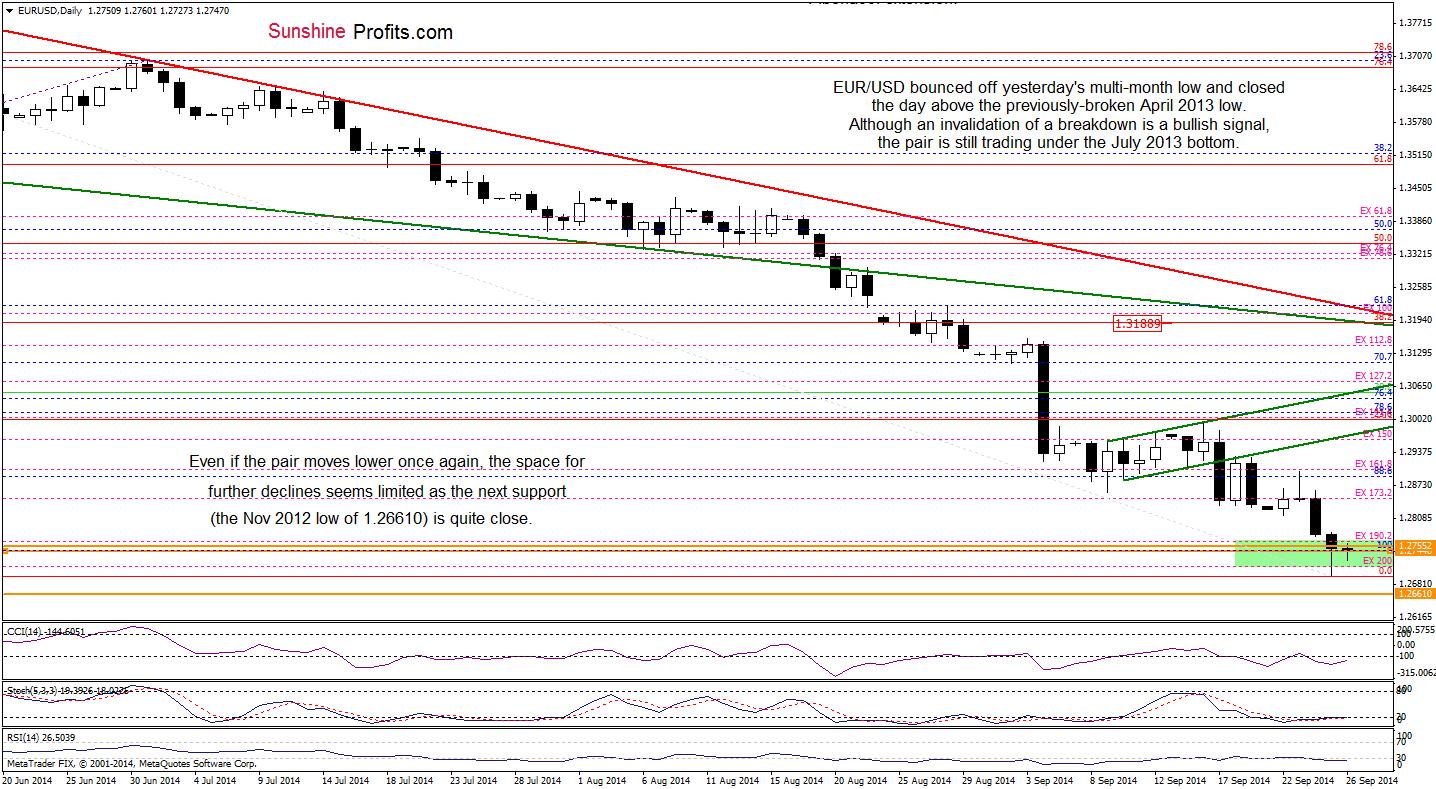

Looking at the above charts, we see that the exchange rate bounced off a multi-month low and the 200% Fibonacci extension and came back to around the previously-broken 2013 lows. Although the size of the move didn’t change much the very short-term situation, the breakdown is still not confirmed and the space for further declines seems limited as the next support level (created by the Nov 2012 low of 1.2661) is quite close. Additionally, all indicators are oversold and there are positive divergences between them and the exchange rate. Taking all the above into account, it seems to us that a bigger upward move is just around the corner.

Very short-term outlook: bullish

Short-term outlook:mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.2568 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

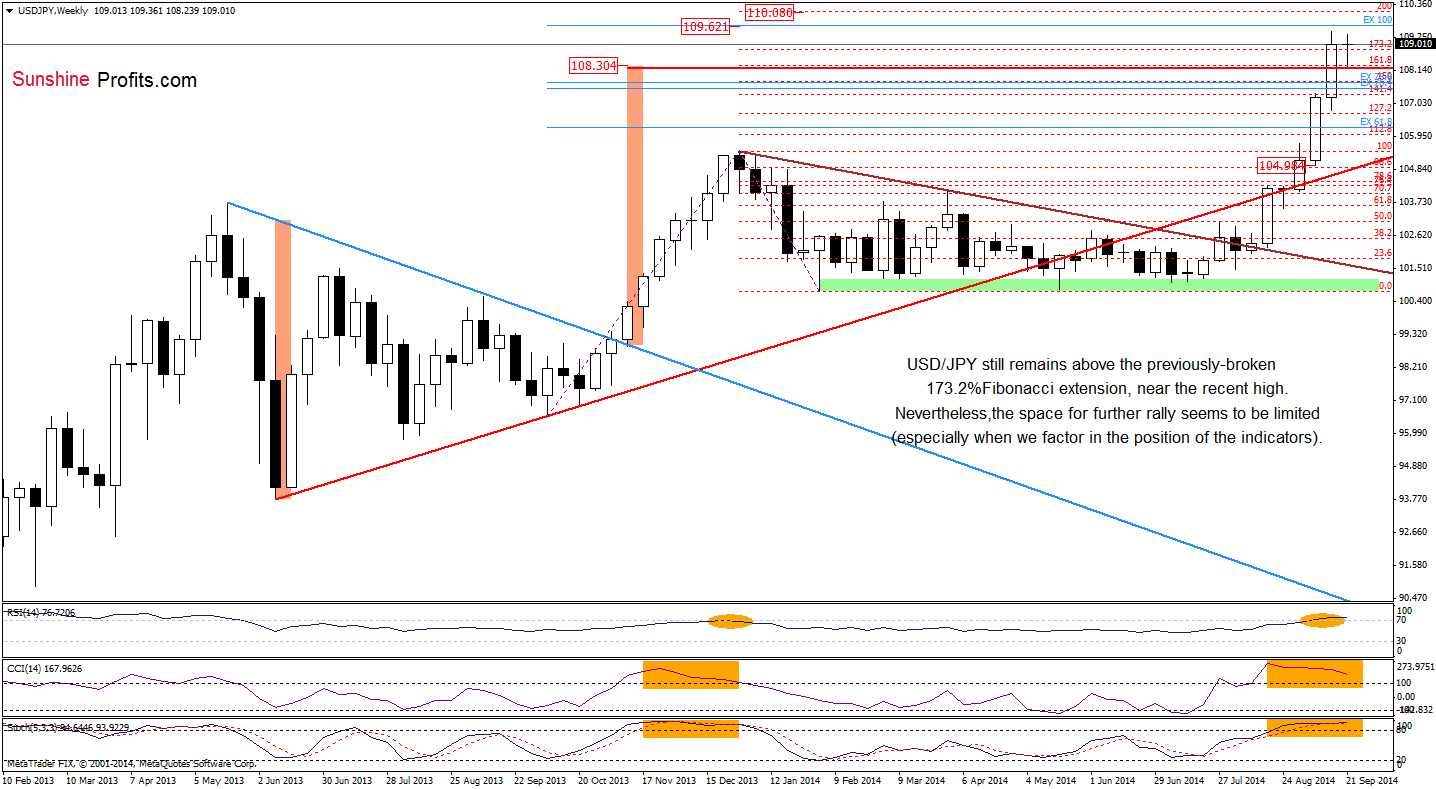

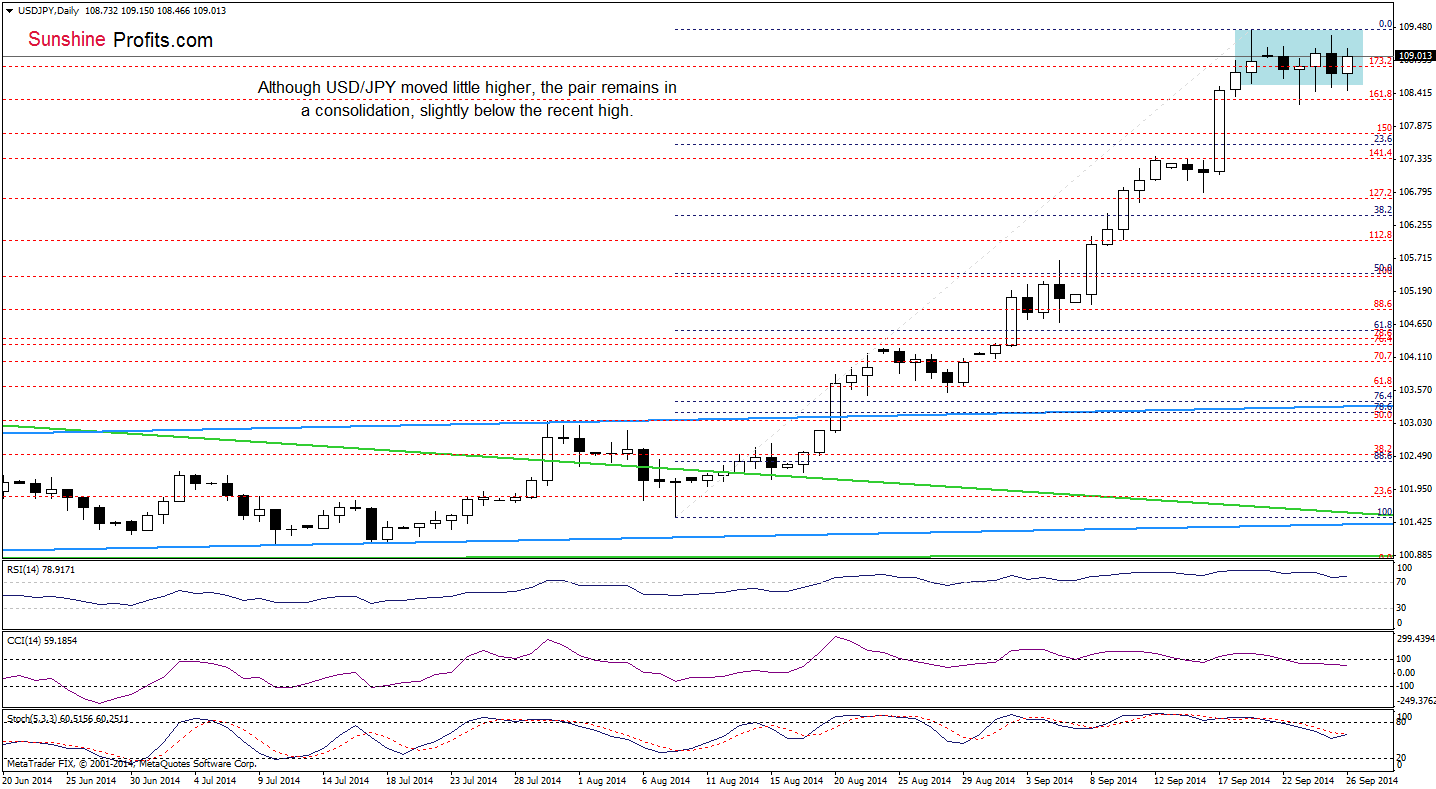

The medium- and short-term situation hasn’t changed much as USD/JPY is still trading slightly below the last week’s high and quite close to the 100% Fibonacci price projection (based on the Oct and Feb lows and Dec high) at 109.62, which serves as the next strong resistance. Therefore our last commentary is up-to-date:

(…) What’s next? Taking into account the current position of the indicators (there are negative divergences between the CCI, Stochastic Oscillator and the exchange rate and they generated sell signals), it seems to us that the next move will be to the downside – especially if the pair breaks below 108.23, where the Tuesday’s low is. If this is the case, initial downside target would be around 107.55, where the 23.6% Fibonacci retracement based on the Aug-Sep rally is.

(…) it’s worth noting that although the USD Index hit a fresh multi-month low earlier today, USD/JPY didn’t climb above the last week’s high, which is a negative signal.

(…) Nevertheless, we should keep in mind that if we don’t see a bigger or at least similar correction to the one that we saw at the beginning of August, another move higher can’t be ruled out. In this case, the next upside target would be around 109.62, where the 100% Fibonacci price projection (based on the Oct and Feb lows and Dec high) is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.23 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

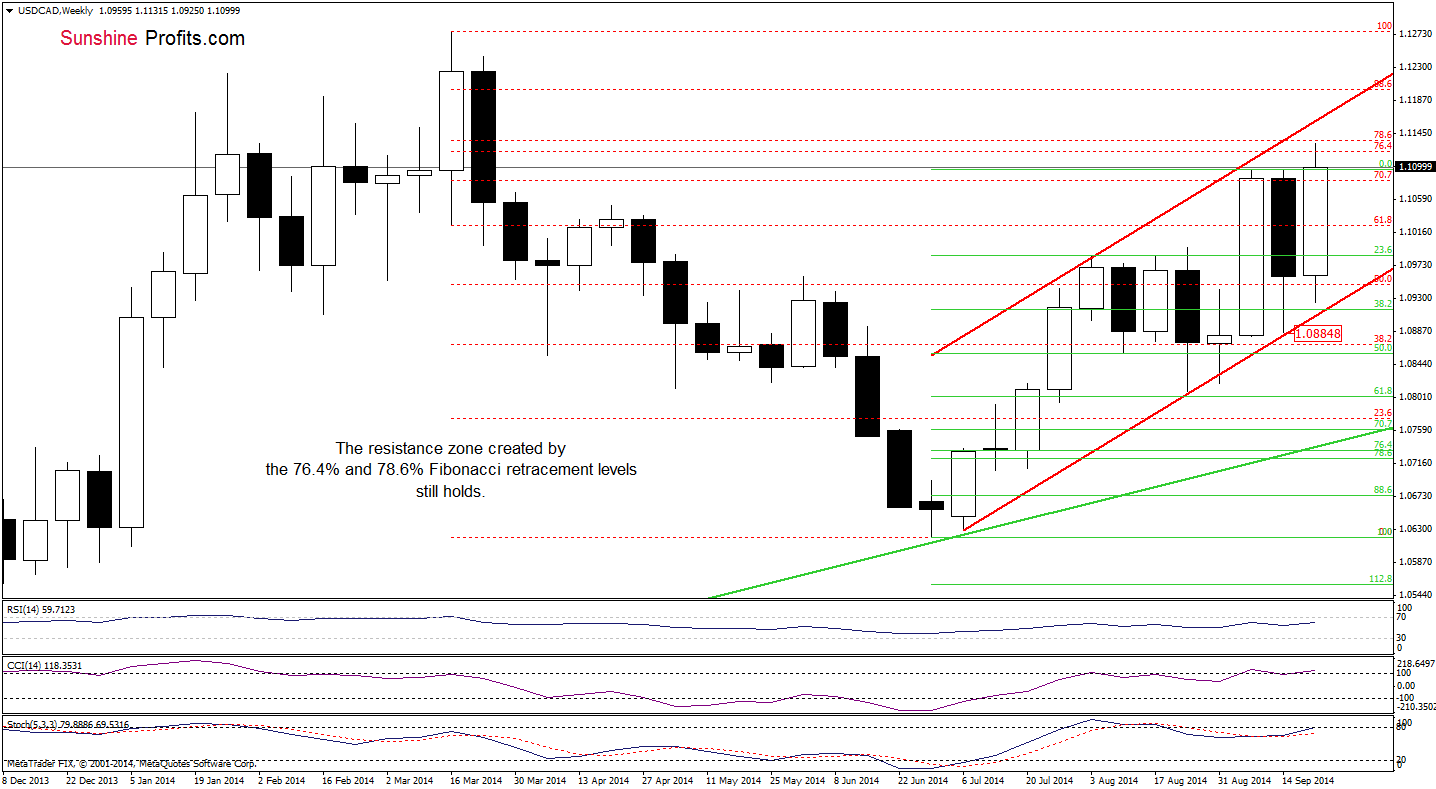

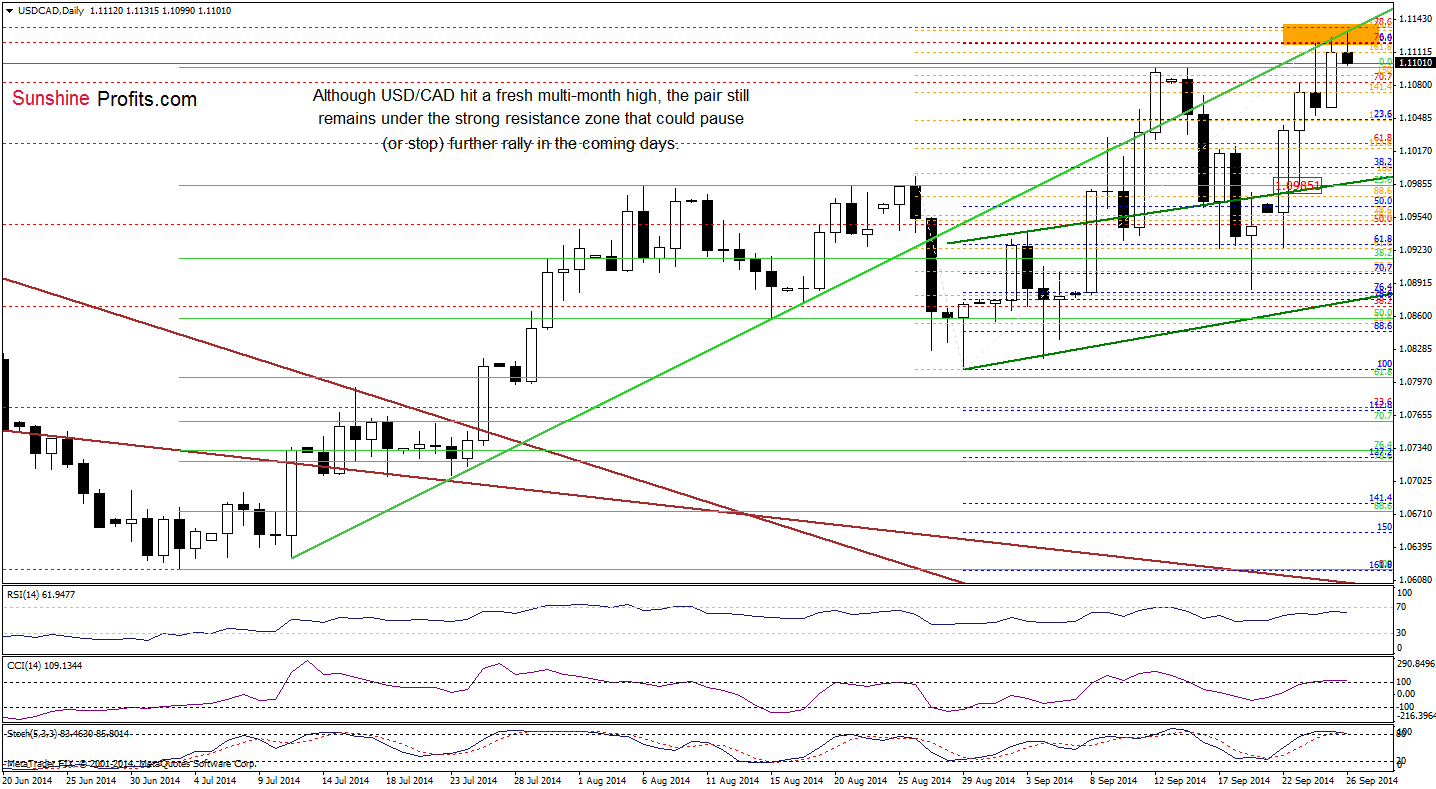

Looking at the above chart, we see that although USD/CAD moved little higher earlier today, the pair still remains below the strong resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels, the 161.8% Fibonacci extension and the key resistance green line. Taking this fact into account, we believe that what we wrote yesterday is still valid:

(…) we think that the next move will be to the downside. In this case, the initial downside target will be around 1.0985, where the 38.2% Fibonacci retracement based on the Aug-Sep rally and the upper line of the rising trend channel are.

(…) If (…) the pair invalidates a breakout, it will be a strong bearish signal, which will likely trigger another downward move to the lower border of the rising trend channel (curently around 1.0907).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts