Attempting to build on yesterday’s gains, the euro headed higher earlier today just to reverse sharply lower. Are the bulls done and out? Is our reward on the horizon? Nothing beats the satisfaction of performing a great analysis and seeing that it’s bringing results to you. Let’s dive in together to explore the opportunities we see now.

- EUR/USD: short (a stop-loss order at 1.1410; the initial downside target at 1.1258)

- GBP/USD: short (a stop-loss order at 1.3310 – we have decided to move it a bit higher; the initial downside target at 1.2820)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: half of short positions (a stop-loss at 0.7228; the exit target at 0.7042)

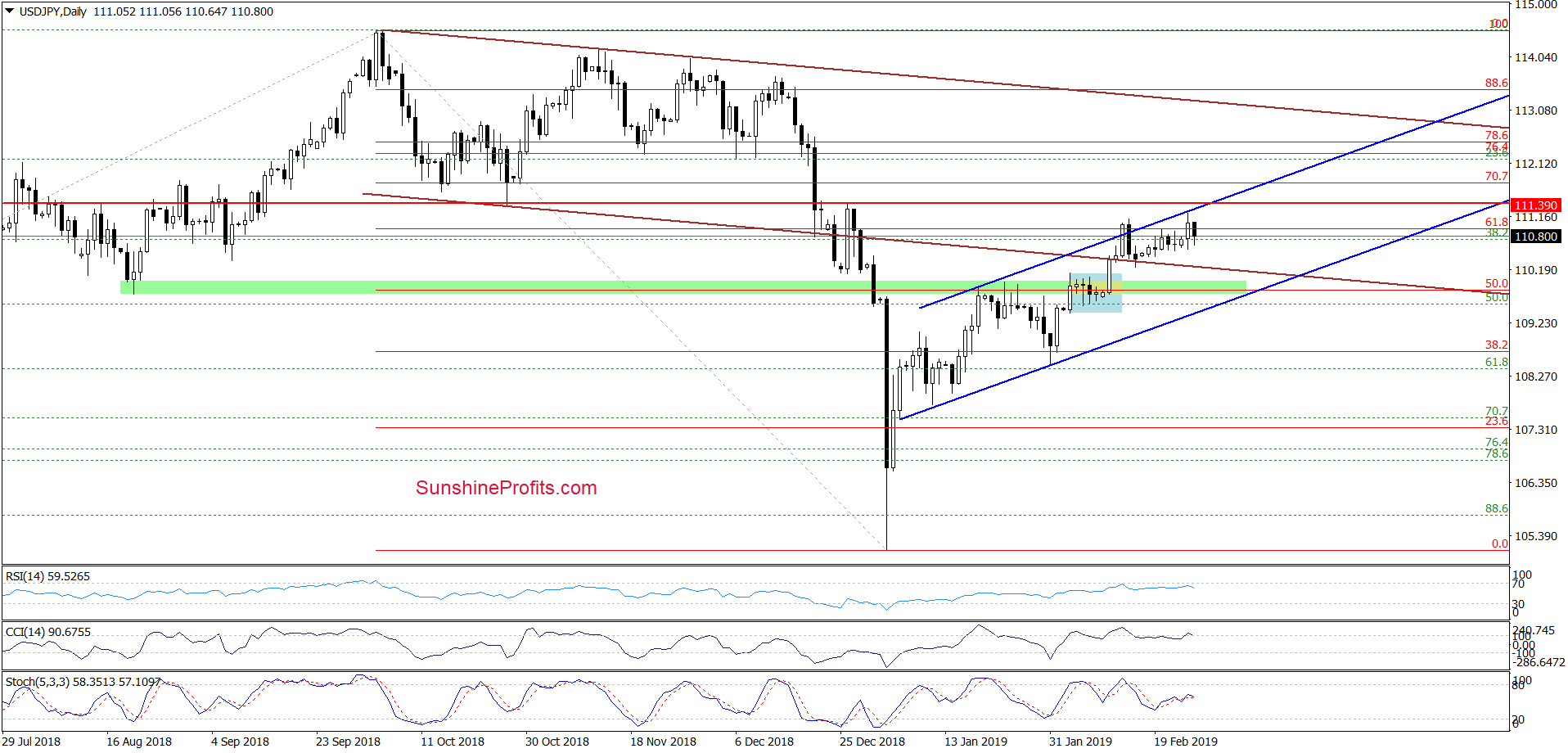

EUR/USD

Earlier today, EUR/USD extended yesterday’s move to the upside, but the combination of the upper border of the blue consolidation and the 50% Fibonacci retracement stopped the buyers. The exchange rate reversed lower and invalidated the earlier tiny breakout above the consolidation. Combined with the current position of the daily indicators, it suggests that another decline is just around the corner.

Our last commentary on this currency pair remains up-to-date also today:

(…) we’ll likely see another move to the downside and a retest of the major supports (the lower border of the red declining trend channel and the long-term red support line based on the October 2017 and August 2018 lows) and recent lows around 1.1250 in the following days.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1410 and the initial downside target at 1.1258 are justified from the risk/reward perspective.

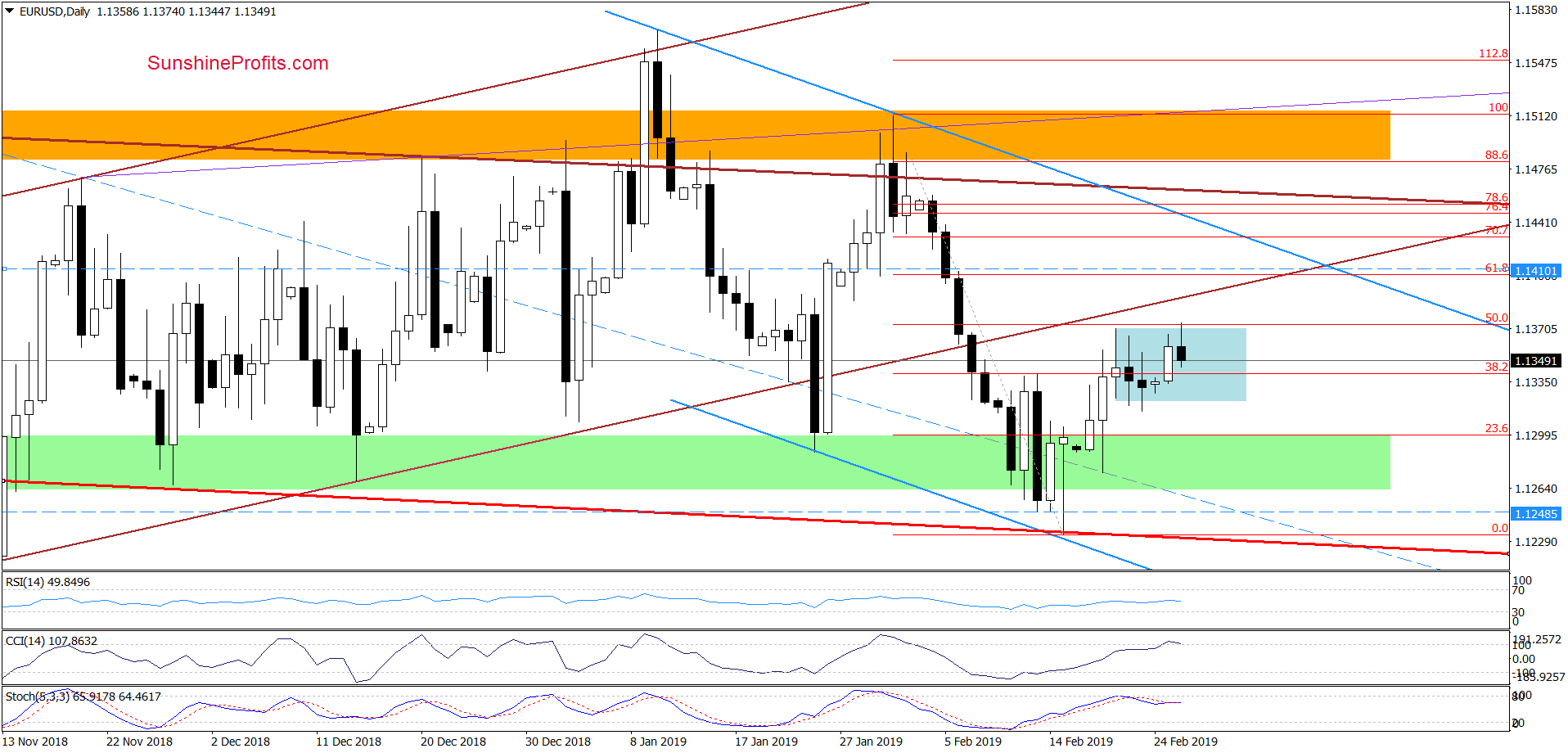

USD/JPY

On Wednesday, we wrote:

(…) Although currency bears tried to take USD/JPY below the lower border of the brown declining trend channel, they failed. This translated into an invalidation of the tiny breakdown below that brown line.

This positive price action triggered further improvement in the following days. It increases the likelihood that we’ll see a retest of the strength of the upper line of the blue rising trend channel in the very near future.

The situation developed in tune with our expectations and USD/JPY moved to our upside target during yesterday’s session. Despite Monday’s improvement, the bulls didn’t manage to take the pair any higher, which translated into a pullback earlier today.

Combining this with the bearish slant of the daily indicators, we stick to our Wednesday’s opinion that if the bulls:

(…) show weakness again, the probability of a bigger move to the south (targeting at least a test of the lower line of the blue trend channel) will increase and we’ll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but decision to open short positions is just around the corner. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist