Yesterday in the alert’s title, we have asked this same old song question. Some of the pairs seem to be bidding our patience. However, this is not just about the euro. Anyway, we have cashed in profits there on the day of the ECB surprise. Let’s stay focused on our other open positions – the loonie is humming along nicely while the yen needs more time. You might think reading these, what a nice summary. Don’t be fooled, we have much more to tell you. Or you forgot about our recent candidate for opening long positions?

- EUR/USD: half of earlier existing short positions (a stop-loss order at 1.1330; the next downside target at 1.1180)

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 112.32; the initial downside target at 109.82)

- USD/CAD:long (a stop-loss order at 1.3247; the initial upside target at 1.3530)

- USD/CHF: none

- AUD/USD: none

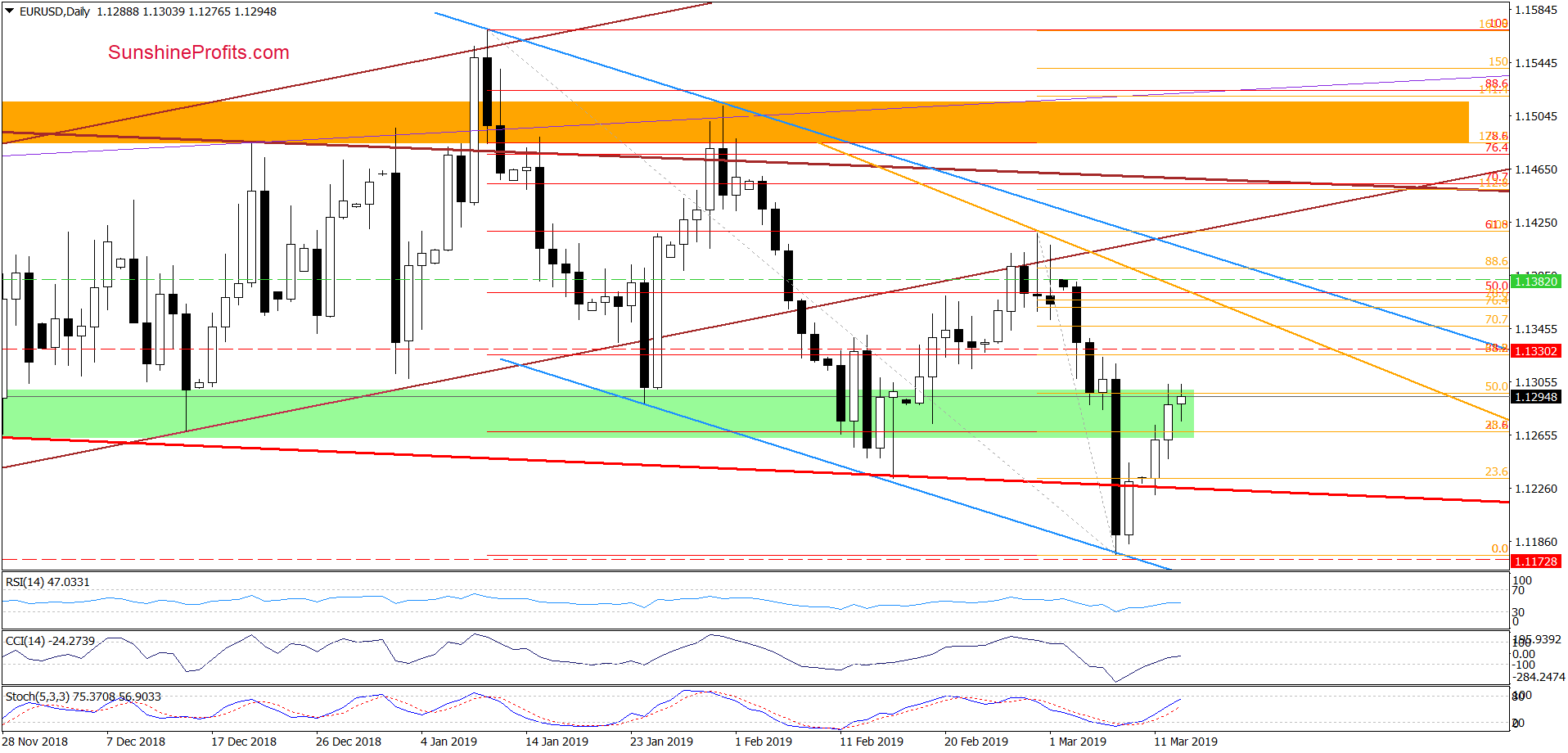

EUR/USD

EUR/USD bulls made yesterday another day of their gains. The exchange rate climbed to the 50% Fibonacci retracement based on the late-February-early March downward move. It even managed to break above it slightly, however the bulls didn’t manage to hold their gains and the rate pulled back to close the day below the above mentioned retracement, well inside the previously broken green support zone.

Earlier today, the bulls made another push higher but again faced hurdles at the above mentioned retracement. Additionally, the pair is still trading inside Thursday’s candlestick. This means interim indecision and in its implications suggests that as long as there is no breakout above Thursday’s peak, another attempt to move lower may still be ahead of us.

If that’s indeed the case, we’ll likely see at least a test of the last week’s lows or even the lower border of the blue declining trend channel in the following days.

Trading position (short-term; our opinion): profitable half of earlier existing short positions with a stop-loss order at 1.1330 and the next downside target at 1.1180 are justified from the risk/reward perspective.

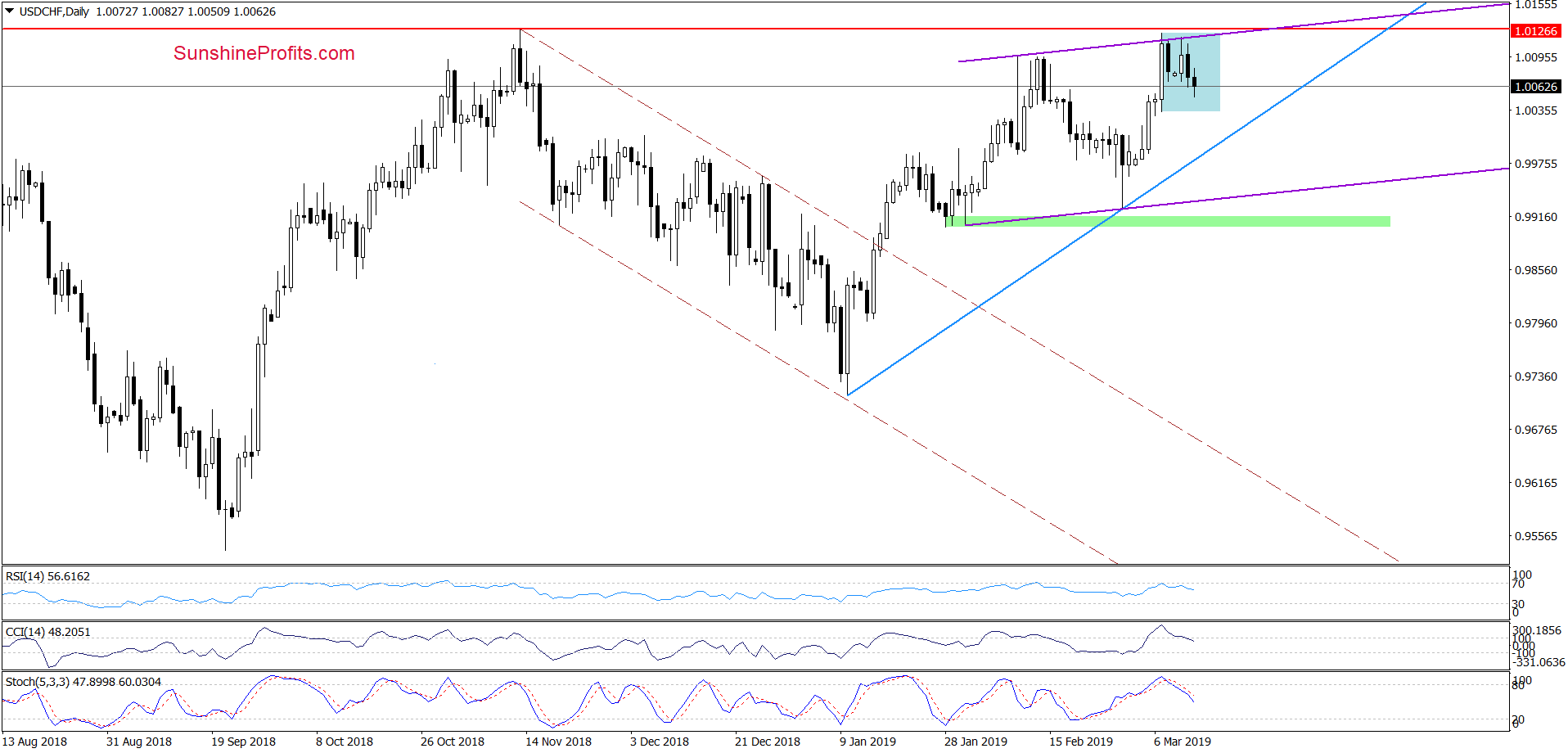

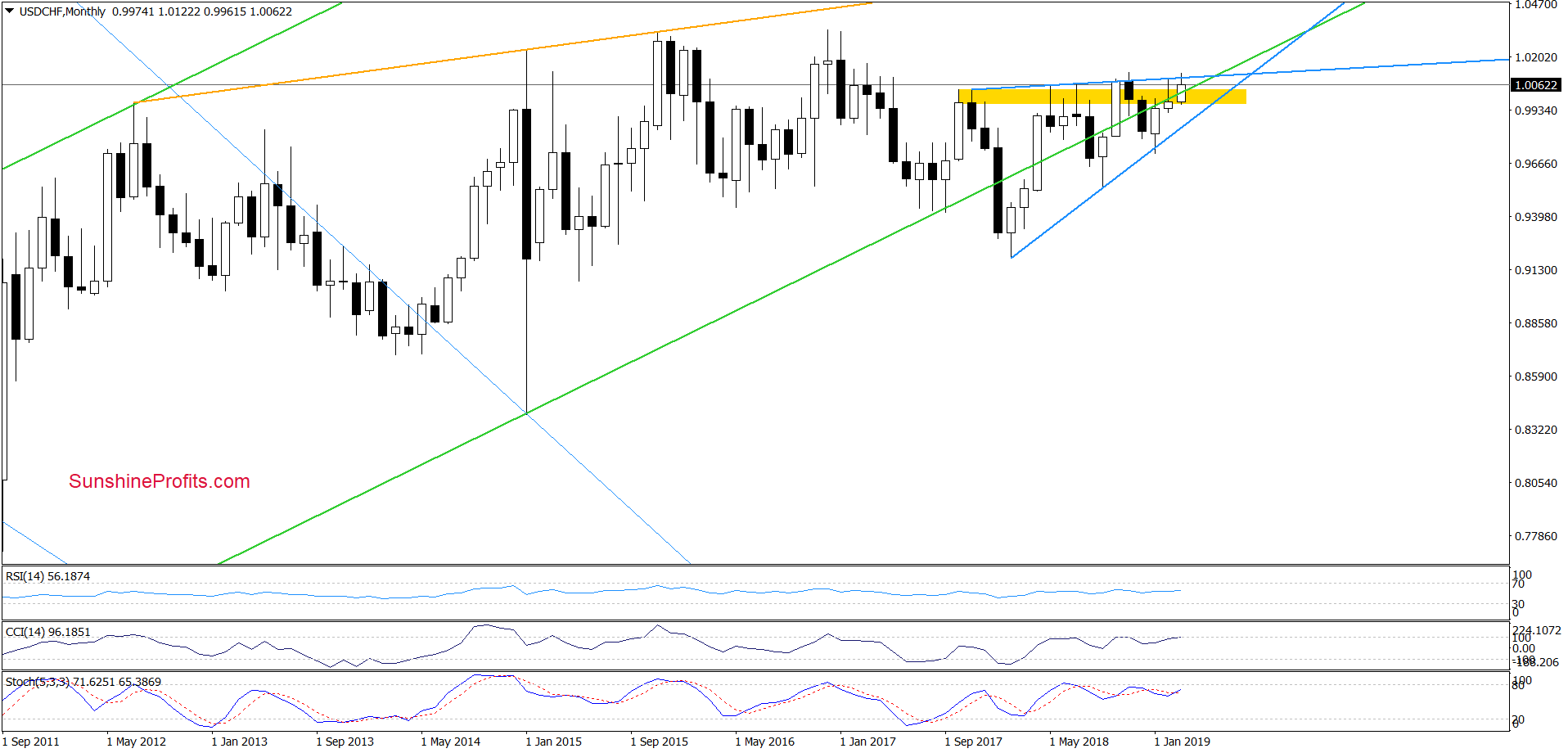

USD/CHF

Although USD/CHF extended losses in recent days, the pair is still trading inside the blue consolidation. Our Monday’s commentary remains up-to-date also today:

(…) USD/CHF moved sharply higher on Thursday, which resulted in a breakout above the February peaks. However, the pair is still trading below the red horizontal line based on the mid-November peak, which is likely to keep further gains in check.

Additionally, the daily indicators generated their own sell signals, which suggest that even if the pair moves a bit higher, a bigger move to the downside nonetheless remains just around the corner. Especially so when we factor in the long-term picture of USD/CHF.

So, let’s check the monthly perspective now.

No change here either. Since late 2017, the pair still remains constrained by the blue rising wedge. It means that as long as there is no successful breakout above the upper line of the formation (or a breakdown below the lower line), another sizable move has a questionable shelf life and short-lived moves in both directions should not surprise us.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

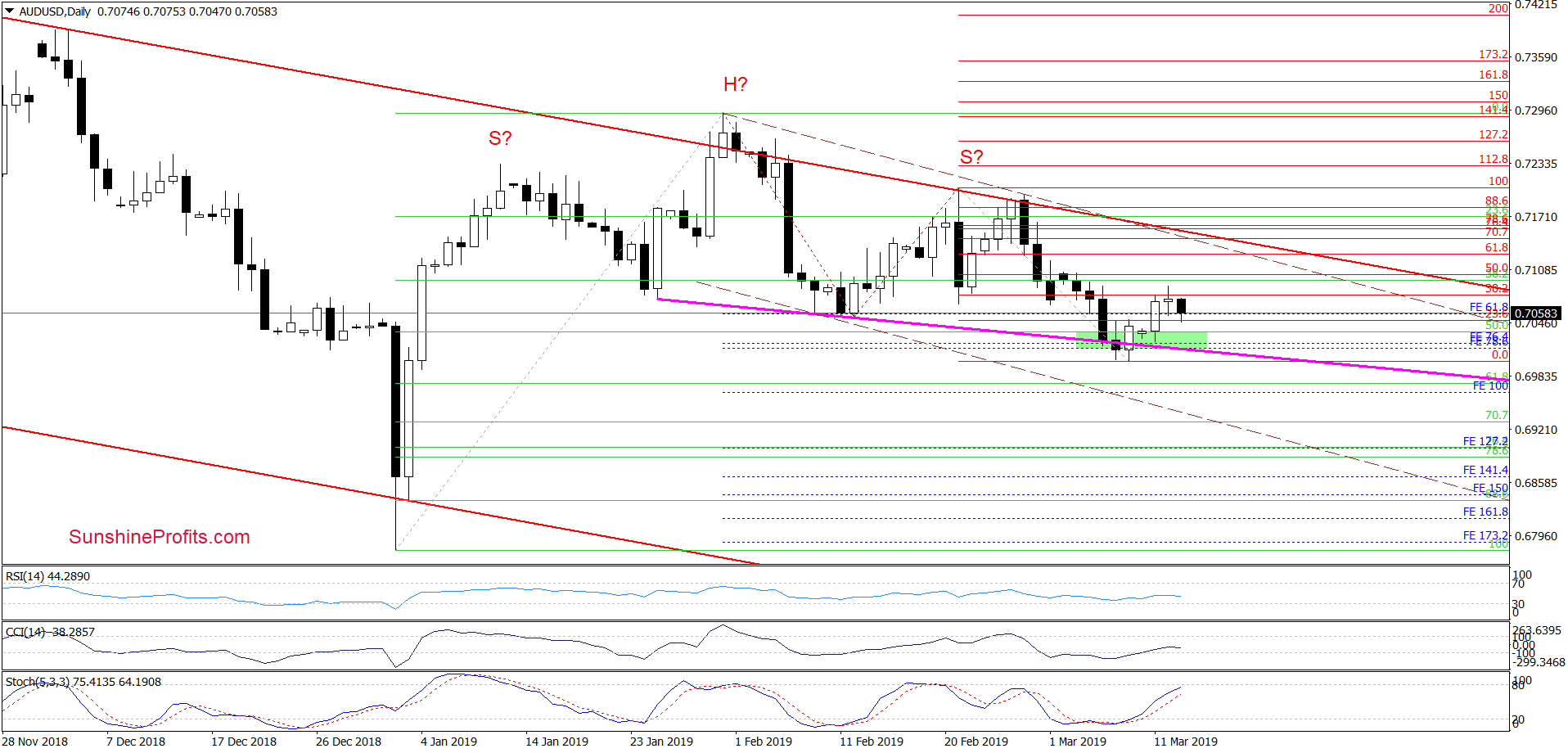

AUD/USD

In recent days, AUD/USD made a meek move above the green support zone. The size of rebound was indeed disappointing. The bulls reached the 38.2% Fibonacci retracement based on the entire February-March downward move only to see the rate roll over and aim down earlier today.

It appears that we’ll first see a verification of the earlier breakout above the green zone before another move to the upside becomes more likely again.

Therefore, waiting at the sidelines seems justified from the risk/reward perspective at the moment. Your capital is too precious to risk in similar circumstances and we are in for the long game. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No short positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist