Based on the September 24th, 2013 Oil Investment Update

Last week, after the Fed said it would stick to its stimulus plan for now, the yellow metal gained more than 4%, leading the rally in commodities, and rose to a new one-week high. At the same time crude oil extended earlier increases and finally gained over 2% on Wednesday. However, during this euphoric rally, investors overlooked that it was fueled by a weaker economic outlook from the Fed. Therefore, the improvement didn’t last long and we saw a quick profit-taking during the last two sessions of the week. In this way, gold gave back almost 60% of the previous sessions’ gains and dropped to $1,325 an ounce on Friday. What’s interesting, at the same time light crude has declined sharply, erased all September’s gains and reached a new week low.

Taking the above into account, investors are probably wondering: which of these commodities should I choose? Which has a better upside potential in the near term? Can we find any guidance in the charts? Let‘s take a look at the charts below and try to find answers to these questions. We’ll start with the weekly chart of crude oil (charts courtesy by http://stockcharts.com.)

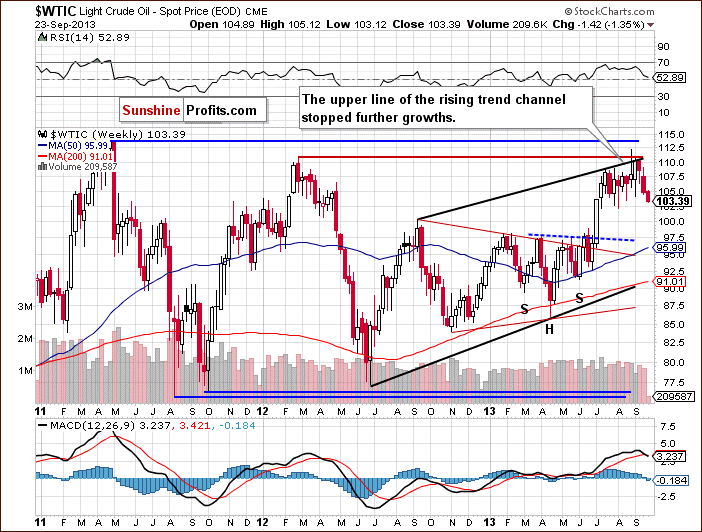

On the above weekly chart, we see that after three unsuccessful attempts to break above the strong resistance zone based on the March 2012 top and the upper border of the rising trend channel, oil bulls lost their power.

Just like in the previous week, oil bears noticed the opportunity to go short and triggered another corrective move, which pushed the price of crude oil slightly above the September low. On Monday, we saw further deterioration and light crude dropped to its lowest level since August 5.

From this point of view, the situation is somewhat mixed. On the one hand, crude oil still remains in the upper part of the rising trend channel, which is a bullish factor. On the other hand, three unsuccessful attempts to break above this level resulted in a decline to a new September‘s low, which doesn’t look so bullish. In spite of these facts we should keep in mind that the recent decline in light crude is just slightly bigger than the previous ones in the entire April-August rally.

Once we know the current medium-term outlook for crude oil, let’s take a closer look at the chart below and check the link between crude oil and gold. Will gold lead oil higher?

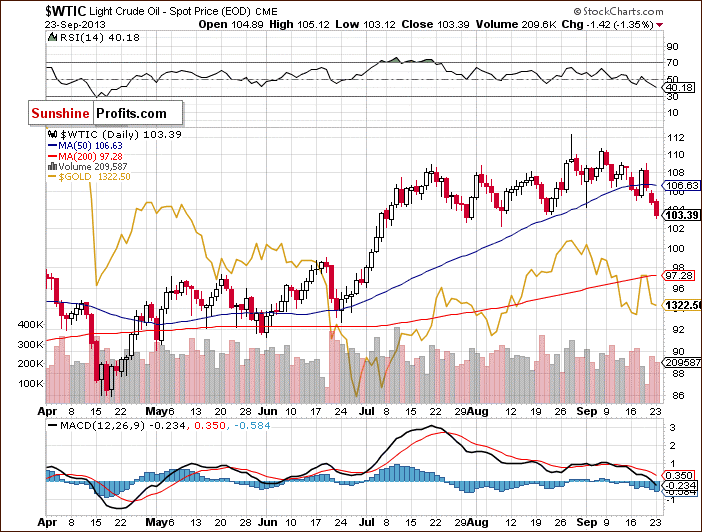

That’s still not likely. Looking at the above chart, we see that the connection between light crude and gold has changed in the recent days. Although, we saw a clear negative divergence earlier this month, both commodities moved pretty much in the same direction in the previous week.

They declined together in the first half of last week and then rebounded on Wednesday after the FED‘s statement. This improvement didn’t last long anyway, and in both cases we saw a downward move in the following days. At this point it’s worth mentioning that the recent decline took crude oil to a new week low, but we didn’t see such price action in gold, which means that the yellow metal was stronger in relation to light crude.

Summing up, although crude oil erased all September’s gains and reached a new month’s low, we should keep in mind that the recent decline in light crude is just slightly bigger than the previous ones in the entire April-August rally and the uptrend is not threatened at the moment. At the same time, the downtrend in gold remains in place. Consequently, at this time – and taking the short term into account – it seems that crude oil has greater upside potential than gold does.

=====

In other news, we have a major announcement. We are launching 2 new premium products (Oil Investment Updates and Oil Trading Alerts) In short, Oil Investment Updates are just like the current Premium Updates, but for the oil market and Oil Trading Alerts are just like the current Market Alerts, but for the oil market.

We realize that when the situation is unclear for the precious metals market or PMs decline for weeks, traders who focus on long trades might get discouraged. However, as we wrote previously, there is another market with a favorable fundamental situation that also has a favorable technical picture - crude oil. There was a major, long-term breakout on the crude oil market in June and we might see some trading opportunities on the crude oil market even if we don't see them in the case of gold, silver and mining stocks. This - along with the outcome of our recent survey - is why we are launching services for crude oil investors and traders. We have an oil expert aboard and this expert - Nadia Simmons - will be publishing Oil Investment Updates (weekly) and Oil Trading Alerts (daily + whenever necessary) just like we have been publishing Premium Updates and Market Alerts for the precious metals market. Naturally, Premium Updates and Market Alerts will remain in place - we are simply launching an additional level of service which will provide additional trading opportunities. Yes, we are sticking with the precious metals market as our preferred market for long-term investments. However, there are some trading opportunities in other markets as well.

How to utilize the information from Oil Investment Updates and Oil Trading Alerts? Let's say that on average you'll get twice as much trading signals and they will be equally profitable - you could either simply enter trades that are 50% smaller, which would effectively decrease your risk (it would be diversified into more smaller trades), or you could enter twice as much trades with the same capital, that would likely increase your profitability (of course unless you use too much of your capital for trading purposes; the final decision is up to you). You could also do something in between. Either way, you can gain a lot thanks to being updated on both: precious metals and crude oil market.

You have been reading the Oil Investment updates for a few weeks now, as they were available free of charge. You can re-examine them in their own section. Oil Investment Updates other than the one posted today are available free of charge for your review:

Oil Investment Updates section

Oil Trading Alerts were not published, but they have been created so that your editor could examine them and check if what we are about to provide is well-founded (your editor checks every premium service before providing it to you). We didn't want to publish them, but we finally decided to do it, so that you know what to expect in these alerts. They will cover a bit more of the fundamental side of the market and the current news than Market Alerts do in the case of the precious metals market but they will be just as detailed in technical terms. You can review the above-mentioned Oil Trading Alerts using the following links:

or by going to the Oil Trading Alerts section on the website - the alerts other than the one posted today are available free of charge for your review.

You can sign up for Oil Investment Updates and Oil Trading Alerts on our product page:

Sign up for Oil Investment Updates and Oil Trading Alerts

=====

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts