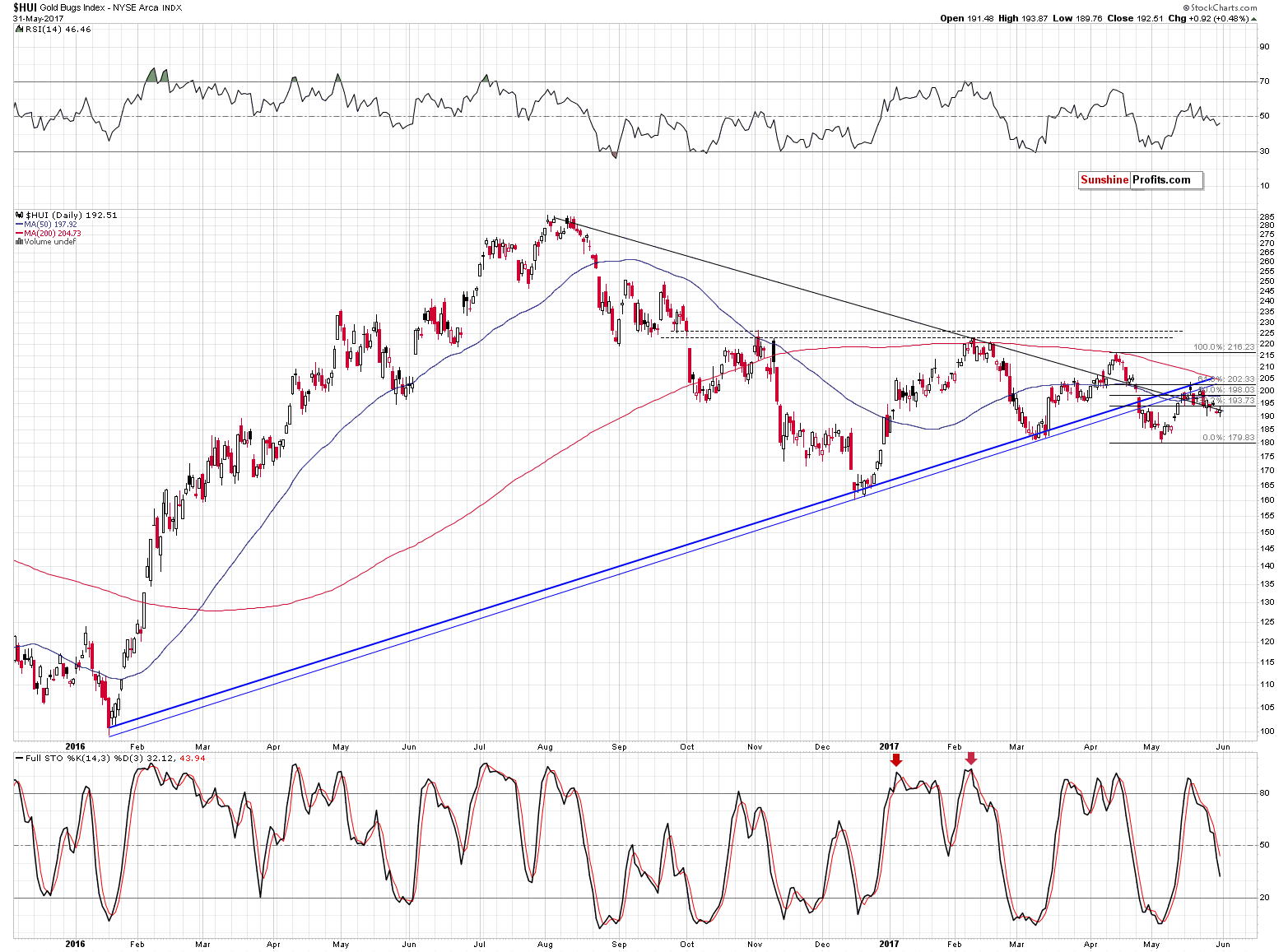

Yesterday’s session was yet another one in row when mining stocks underperformed the yellow metal, which continues to have bearish implications. Nonetheless, gold moved to new short-term highs and in today’s alert we’re going to discuss the implications of this move.

In short, there are no important ones. Let’s see why (charts courtesy of http://stockcharts.com).

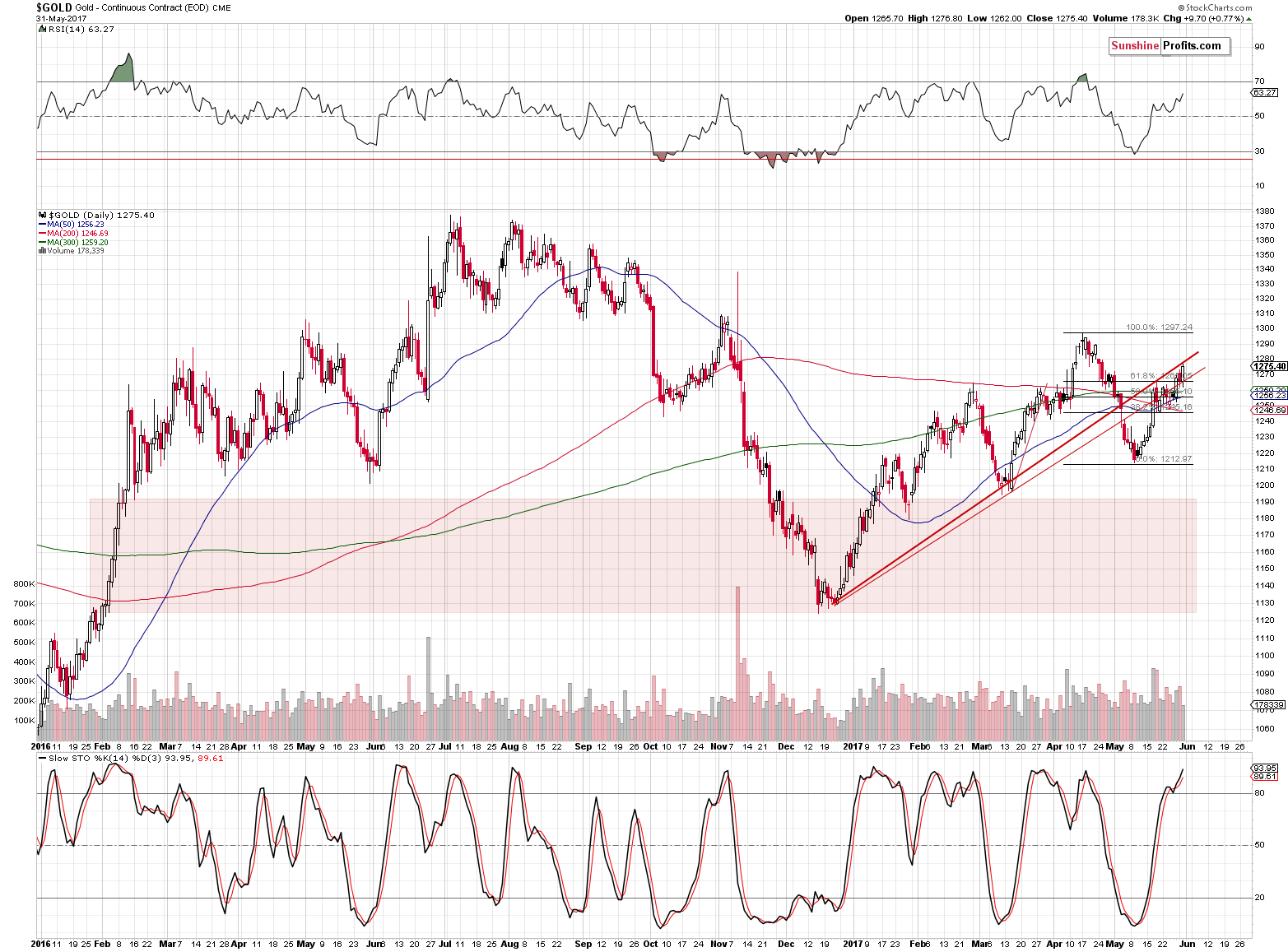

The key reason is that gold didn’t break above the rising resistance line based on the previous major lows (in terms of daily closing prices). Without the above, there is no breakout to discuss, so the outlook is just as it was previously.

The additional reason for us to view yesterday’s move as something negligible is the size of the volume – it was relatively small, which suggests that “up” is not the true direction of gold and that the buying power is drying up. The volume was not extremely low, though, so it doesn’t have to be the case that the top is already in (especially that the USD Index hasn’t moved to 96.4 yet), but it does indicate that even if another move higher is to be seen, it’s not likely to be significant.

Another reason to think that nothing really changed is a really minor change with regard to Monday’s session. If we use kitco.com’s prices instead of the above ones, Friday’s closing price was about $1,267 and yesterday’s closing price was $1,268.60 – basically nothing changed despite an intra-day price spike in the meantime.

Gold stocks have once again changed very little and they are very far from making new highs – their underperformance continues. Moreover, please note that the HUI Index is not only below the rising blue resistance lines, but also below the black declining line (based on the August 2016 and February 2017 highs). Consequently, last month’s upswing appears to have been nothing more than just a verification of the breakdown below the rising blue line, especially that miners corrected only to the 61.8% Fibonacci retracement without closing above it. The outlook for miners remains bearish.

With no changes in gold’s technical picture, no price changes in silver, no price changes in miners and the continued underperformance of the latter, there are indeed no changes in the overall outlook for the precious metals sector and we can summarize today’s alert just like we summarized the previous issues - we remain to be in a situation where there are pennies to the upside (literally in silver and mining stocks) and dollars to the downside and thus short positions appear to be justified. Naturally, the above could change in the coming days and we’ll keep our subscribers informed, but that’s what appears likely based on the data that we have right now. If you enjoyed reading our analysis, we encourage you to subscribe to our daily Gold & Silver Trading Alerts. If you're not ready to subscribe yet, suggest that you sign up for our free gold newsletter - our daily letter with most important developments regarding the precious metals market and our free articles (including the upcoming article on gold price in June). Sign up to our gold newsletter today.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts