Oil Trading Alert originally sent to subscribers on July 21, 2014, 10:26 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 2% as the combination of disappointing U.S. sentiment data and profit taking weighed on the price. Because of these circumstances, light crude erased most of the Thursday’s rally and approached the support zone once again. Did this drop change anything in the short-term outlook?

On Thursday, crude oil rallied to a one-week high as fears that the crisis between Russia and Ukraine will escalate and disrupt the global flow of crude oil (after news that a Malaysian Airlines plane was shot down near the Russia-Ukraine border). As it turned out on the next trading day, investors decided to lock in gains from this rally and sold the commodity for profits. On top of that, the disappointing University of Michigan report, which showed that consumer sentiment index declined to a four-month low of 81.3 in July (missing expectations for rise to 83.0) softened the price of crude oil as well. In this way, the commodity declined sharply and erased most of the Thursday’s rally. Will it drop any further? Let’s examine the charts below and find out (charts courtesy of http://stockcharts.com).

On Thursday, we wrote the following:

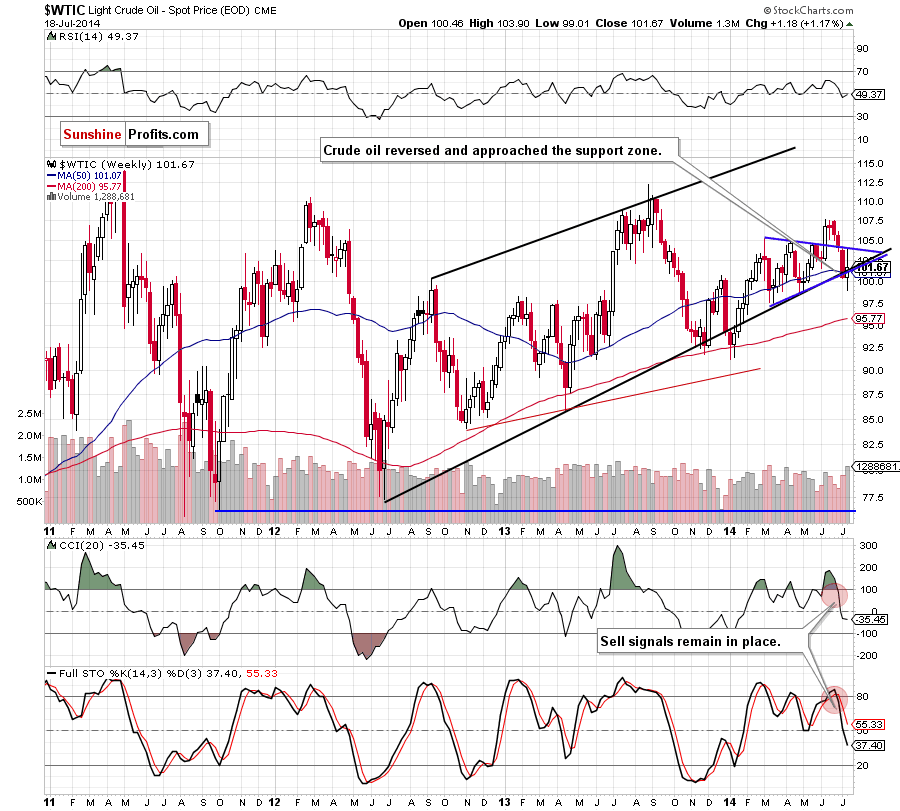

(…) crude oil extended gains and reached the upper line of the blue triangle. As a result, there is a threat of returning to the support zone created by the 50-week moving average and the lower border of the formation (especially when we factor in sell signals, which are still in play).

On Friday, the commodity reversed and declined to the above-mentioned downside target. If the support zone holds, we’ll see a rebound in the coming week and another attempt to break above the upper line of the triangle. However, if it is broken, crude oil will test the strength of the psychological barrier of $100. Where light crude head next? Will the daily chart give us any valuable clues? Let’s check.

Quoting our last Oil Trading Alert:

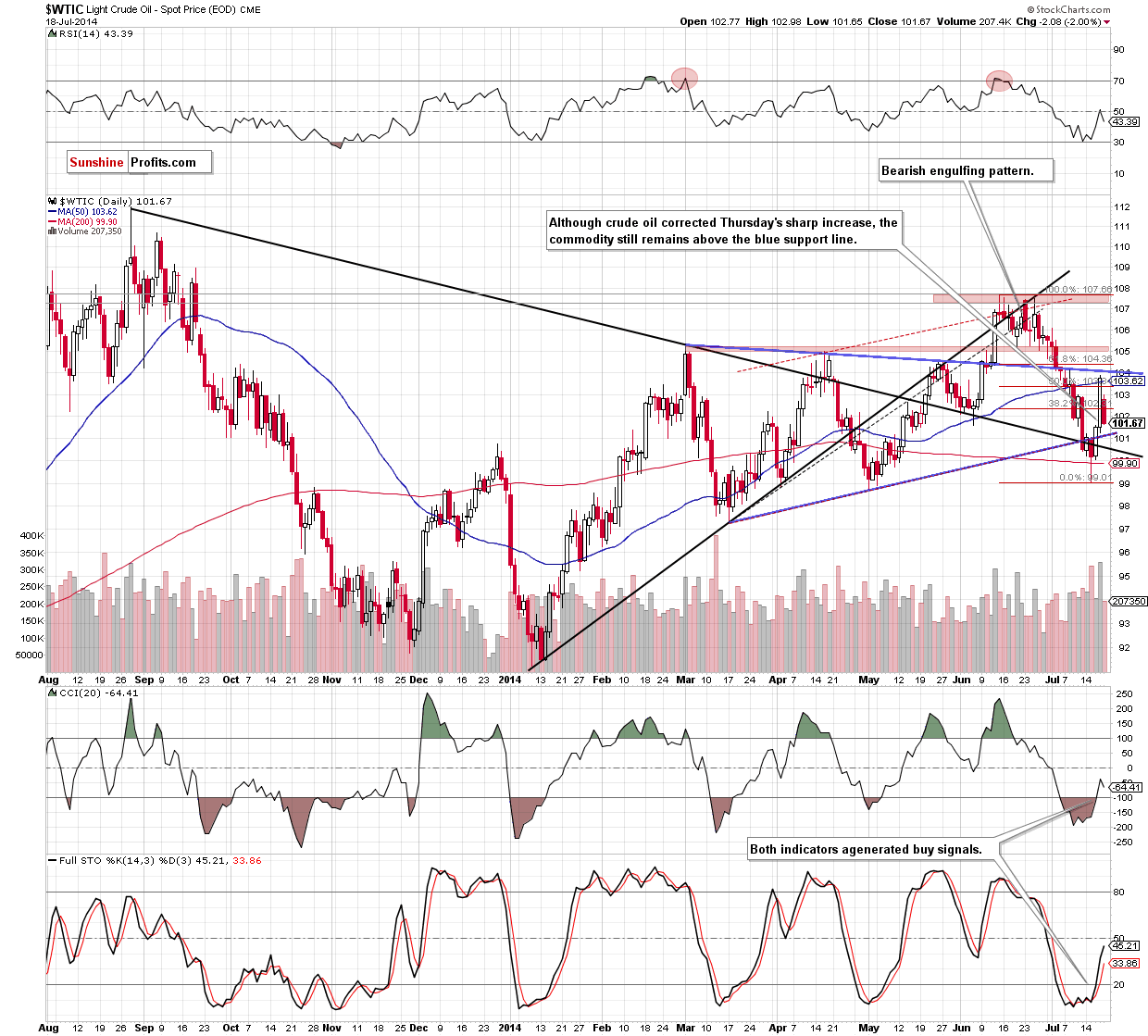

(...) the commodity approached its major resistance – the upper line of the blue triangle (please note that slightly above it is also the 61.8% Fibonacci retracement level, which usually is the last stop before further improvment). (...) if the proximity to the resistance zone encourages oil bears to act, the commodity will correct the rally. In this case, the initial downside target will be around $102, where the 38.2% Fibonacci retracement based on the recent increases is.

Looking at the above chart, we see that although oil bears realized the above-mentioned scenario, pushing crude oil below its initial downside target, the situation is unclear at the moment as the commodity remains inside the Thursday’s candclestick. Please note that a pulback under the 38.2% Fibonacci retracement suggests a drop to the next one (around $101.46), but we should keep in mind that even if we see such price action, the commodity will be still above Thursday’s low and the blue support line. Therefore, in our opinion, as long as there is no breakout above the resistance zone (created by the 50-day moving average, the upper line of the medium-term triangle and the 61.8% Fibonaci retracement) or a breakdown below the support zone (based on the blue and black support lines and reinforced by the 200-day moving average) another sizable move is not likely to be seen.

Summing up, although the situation in the medium- and short-term has deteriorated slightly as crude oil corrected Thursday’s rally, the commodity still remains between its key support and resistance zone. We would like you to be profitable investors, therefore, as long as there is no clear signal to go short or long, we do not suggest opening any positions.

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts