The gold prices are swinging back and forth very frequently, and it is very easy for one to lose his/her focus and act emotionally. This can be more or less dangerous to your portfolio. Less if you realize what speculation really is, when you should speculate, and what risks it involves. More if you do not realize that. In the past essays, besides giving commentary on the short term situation on the market, I emphasized that timing the exact bottom IS speculation and should be approached with caution. This week I will concentrate on what should be always kept in mind when conducting just any type of analysis – the fundamentals.

The purpose of this article is to put the recent sharp declines and upswings into proper context. While doing technical analysis, I start with the long term and then narrow the time, so that I always know what the ‘bigger picture’ looks like. The first step is always looking at the fundamentals. I usually do not write about it, as the fundamental situation does not change quickly and therefore writing the same introduction in every essay might be tiresome to my Readers. However, the volatility on the market has recently been very high, so I think that a quick reminder of the fundamental situation right now might be useful.

Supply & Demand

Most mining products are rather inelastic on the supply side, which is caused on the fact that it usually takes 5-7 years from the moment of discovery, before a given commodity can be sold on the market. This means that prices can rise very high and stay there for a considerable amount of time. As far as the existing mines are concerned, even if prices do increase, the operating mines will not necessarily boost the output of a given commodity (here: gold, silver, and platinum). The reason is that the production process is optimized with the longevity of the mine in mind, not the short term profits. When prices are higher, it is profitable to extract gold from the lower grade ore, so this is exactly what is done. This way, when the times are tough, a mining company can switch to the higher grade ore and remain profitable even despite lower prices of a given commodity.

The demand side of the precious metals market is just as appealing to investors. Most gold, platinum, and especially silver physical characteristics makes them very difficult to substitute, which makes the demand inelastic to a significant extent.

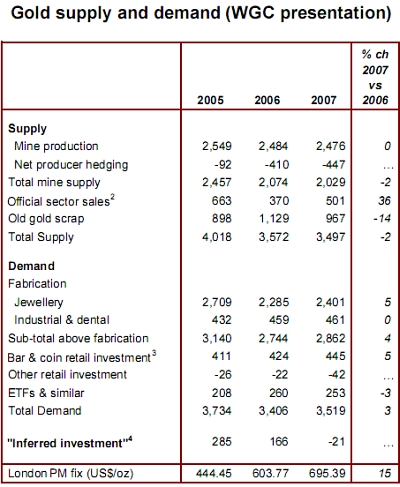

The purpose of this essay is strictly ‘putting things into perspective’, not in-depth analysis of the supply / demand situation, so I will use gold as a proxy for the whole precious metals market. The table below (source: GMFS Ltd., World Gold Council) presents gold supply and demand in the recent years.

Not getting into details of the controversial ‘inferred investment’, please take look at the last column – price increased 15%, demand increased 3% and supply decreased by 2% (with the official sector sales increasing 36%!). This confirms what I have just written about the specific way the supply and demand works in the medium term in the mining business. This is not a one-year phenomenon. The average rate that the gold supply and demand changed in the 2003 – 2006 period is about -2.4% for supply and +2.7% for demand.

This means that if there are other factors pointing to higher prices in the precious metals, this (secular) bull market will not end soon. And yes, there are many factors suggesting much higher prices in the future.

The decline in the prices of real estate

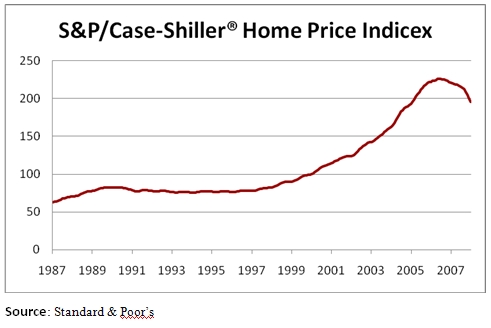

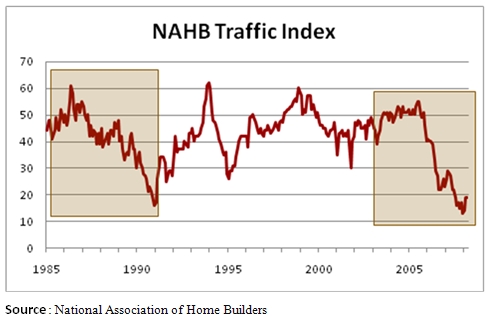

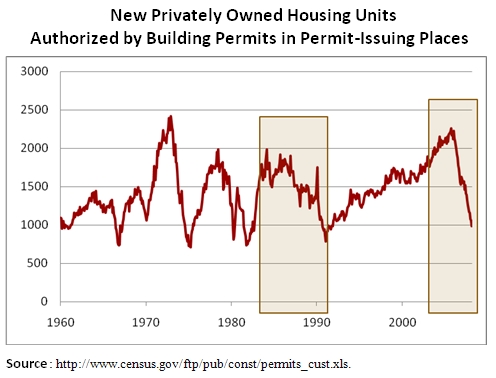

Once the home prices start to fall, it takes a lot of time for them to reverse their direction. More in this topic can be found in the Irrational Exuberance by Robert J. Schiller. Below charts present the long term situation on the real estate market in the U.S.

The prices of real estate turned south two times on the above chart – at the beginning of the 1990 and in 2006. Back then it meant years of lower prices. Unfortunately, this chart has a linear scale, and it makes the previous decline to look very mild. There are more similarities between the two periods – take a look at the following charts.

If the prices are indeed declining than what does it mean for the precious metals? If the money is leaving this sector it will be put somewhere else and I believe a hefty share of it will end up in the precious metals sector. After all, people see that the general stock market is pretty much where it was in 2002, whereas gold has almost tripled since that time.

Emerging economies

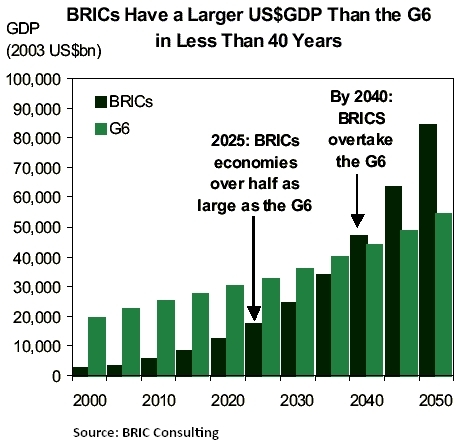

Contrary to popular belief, it is not only about China. China has and will continue to have a huge impact on the demand side of all commodities regardless of the recent downswing on the Shanghai Stock Exchange. The rate of growth may slow, but this huge country has still a lot of catching up to do.

As indicated earlier, there is much more to the story about the emerging markets. The Goldman Sachs report from 2003 about the BRIC countries mentions also Brazil, Russia and India. Was that not enough, at the end of 2005 the same company introduced the idea of the Next Eleven (N-11) – the group of eleven countries, all with promising outlooks for investment and future growth. This is another source of the future demand for all commodities, including the precious metals.

The current economic cycle

We are in a secular bull market in all commodities, and in the previous century these cycles usually run for 15-20 years. This time the fundamentals are more favorable than ever, so I assume that this time we may experience even a longer bull market then it was the case in the past. Taking a look at the chart (courtesy: chartsrus.com) below should convince you that this bull market has not run out of steam just yet. Remember – the lower the Dow / Gold ratio goes, the higher the gold price will go.

Today, this ratio equals about 10, still a long way to go down – 3 to 4 times lower to reach the levels that previously stopped the decline. We could get even lower this time – and the price of gold could even surpass the value of the Dow Jones Industrial Average.

So why has gold been declining?

So why is the price dropping despite the positive fundamentals and even along with the growth in the holdings of the precious metals ETFs?

Because someone pushed the button and sold large amounts of gold most likely on the derivatives market. As simple as that, and as complicated as that. The fundamental outlook determines the direction in which the price of a particular commodity will head – simply because it makes sense. However in the short term, many other factors may influence buyers and sellers of any commodity. Emotions are one thing, and I wrote about the emotionality on the market many times. However during this decline, there is one more very important thing to consider.

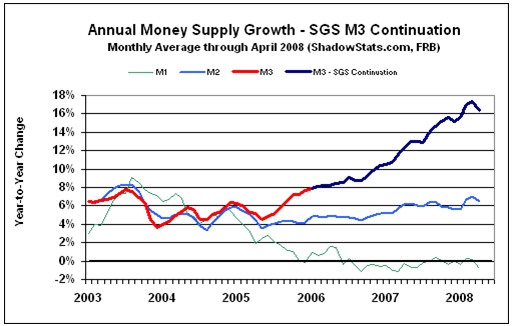

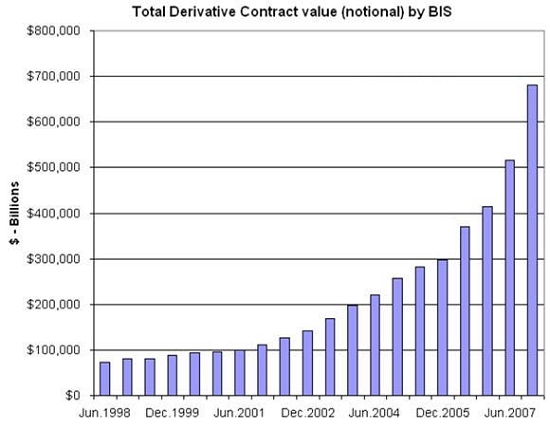

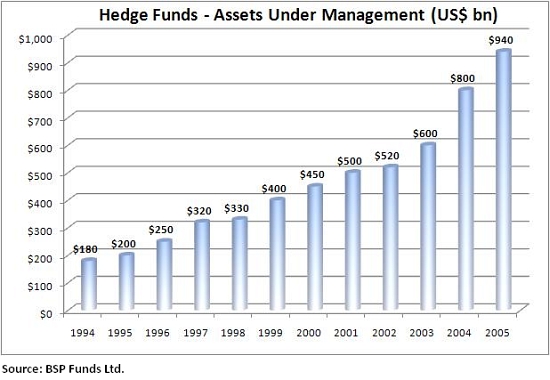

Deleveraging. Too much money supply and the development of the derivatives market caused the hedge fund business to thrive. The charts below provide you with a detailed view on how serious the situation really is.

These (and other) investment funds have put pressure on many markets for a long time. However now, with the financial domino falling, they too suffer losses caused by the credit contraction. As they need to raise cash to offset their losses in the credit market (CDOs and similar), they close their positions in other markets – for example the precious metals market.

As these institutions lose money, they sell whatever they can, to offset their losses. These entities usually operate in the derivatives market. Ultimately it will be the real, physical market that will set the price, but right now the derivatives market still exists and we need to take the phenomenon called arbitrage into account.

The Investopedia (www.investopedia.com) says that the arbitrage is the simultaneous purchase and sale of an asset in order to profit from a difference in the price. This usually takes place on different exchanges or marketplaces.

The discounted value of the future price must be close to the spot price, because otherwise it would be possible to achieve a high risk-free rate for return. One would just need to buy gold futures contract for let’s say $100 per ounce and sell physical gold for $800. When the futures contract expires this investor would take delivery of his/her gold. He/she would then have the same amount of gold then at the beginning but also the $800 - $100 = $700 risk-free per ounce. Of course I am exaggerating here, but thanks to this it is easy to grasp why the prices need to be similar in both physical and futures market.

How similar will that be depends on various factors including the risk-free interest rate and the tightness of the physical market, but that is not the point here. The point is that currently the price set on the futures market and the spot price are connected. Therefore if the hedge funds sell large amounts of gold on the futures market, it will also cause the spot price to fall.

Summing up, the fundamentals for the precious metals are still favorable and that is what will ultimately drive the prices higher. Short term volatility is caused by emotions, which has recently been intensified by the process of deleveraging. If you wish to stick to the long-term investing, then there is no need to panic, just because the price of your favorite metal suddenly dropped – it will get back, because the fundamentals are positive.

However, if you decide to take the additional step and mix your strategies by dedicating a part of your capital to speculation you should get all the support that you can. I recommend that you regiser today at my website and gain access to the Tools section. Additionally, from time to time I send out a Market Update or Speculative Alert. Registration is free and you may unregister anytime.

Back