Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

The S&P 500 extended its consolidation yesterday – will it break higher?

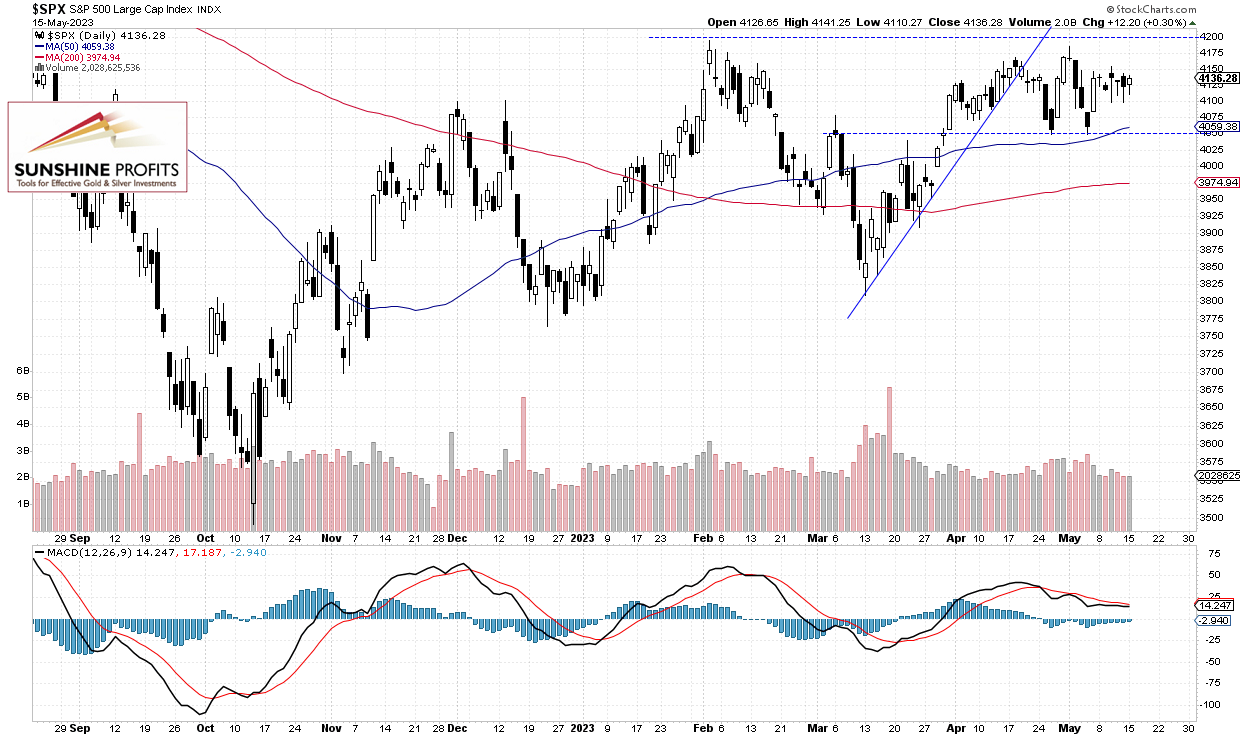

The broad stock market index gained 0.30% on Monday as it continued to fluctuate within a week-long consolidation along the 4,100-4,150 level. Stocks went sideways following last Wednesday’s CPI and Thursday’s PPI releases. On Thursday May 4 the S&P 500 fell to the local low of 4,048.28, but it quickly got back to around 4,150. Since then it has been fluctuating within a relatively narrow trading range.

The S&P 500 will likely open 0.2% lower today following weaker than expected Retail Sales number release. So the stock market see more short-term uncertainty. In early May the index bounced from the important 4,200 resistance level as we can see on the daily chart:

Futures Contract Is Slightly Below 4,150

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is still trading close to the 4,150 level. The nearest important resistance level remains at around 4,160-4,200, and the support level is at 4,120, among others.

Conclusion

Stocks will likely open slightly lower this morning and they may further extend a week-long consolidation. The market continues sideways despite the recent economic data releases. It still looks like a consolidation after March-April advances.

Here’s the breakdown:

- The S&P 500 - still no clear direction following recent data releases.

- The market extends a few-week-long consolidation.

- In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care