Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Stock prices extend their consolidation – which direction is next?

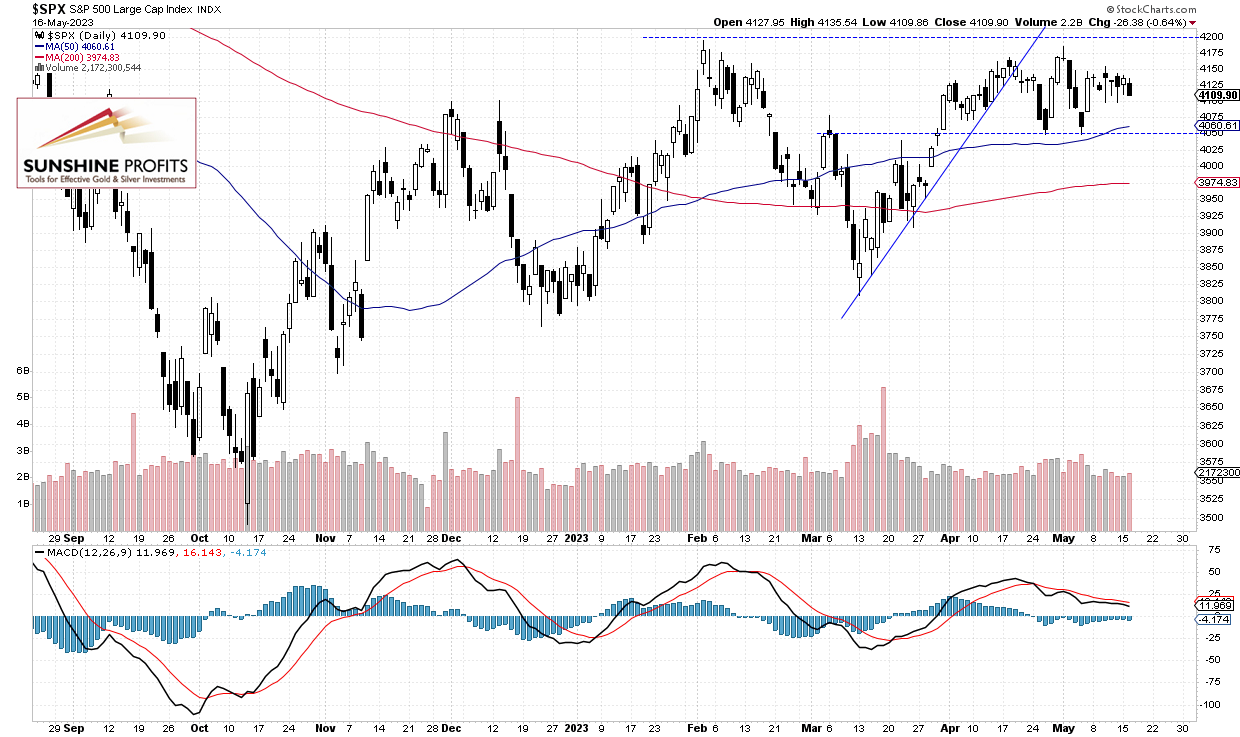

The S&P 500 index lost 0.64% on Tuesday as it remained within an over week-long consolidation along the 4,100-4,150 level. Stocks went sideways following last Wednesday’s CPI and Thursday’s PPI releases. On Thursday May 4 the S&P 500 fell to the local low of 4,048.28, but it quickly got back to around 4,150. Since then it has been fluctuating within a relatively narrow trading range.

The S&P 500 is expected to open 0.4% higher today. So it may see an attempt at breaking above the recent trading range. In early May the index bounced from the important 4,200 resistance level as we can see on the daily chart:

Futures Contract Continues Sideways

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is still trading along the 4,150 level. The nearest important resistance level remains at around 4,160-4,180, and the support level is at 4,100-4,120, among others.

Conclusion

Stocks are expected to open higher this morning and they will likely extend a

a week-long consolidation. The market continues sideways despite the recent economic data releases. It still looks like a consolidation after March-April advances.

Here’s the breakdown:

- The S&P 500 - still no clear short-term direction.

- The market extends a few-week-long consolidation.

- In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care