Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

Stocks extended their consolidation on Wednesday – will they sell off following PPI release?

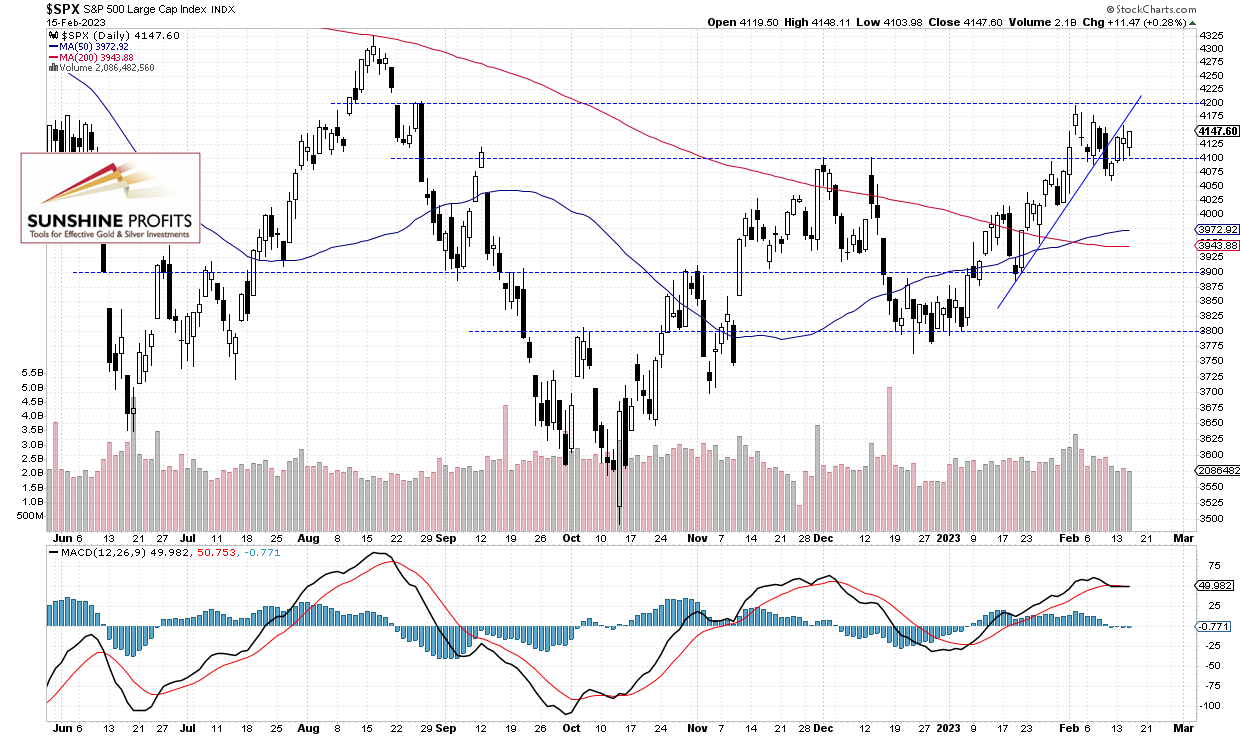

The S&P 500 index gained 0.28% on Wednesday, as it continued to fluctuate above the 4,100 level. On Tuesday the market extended the advance from Friday’s local low of 4,060.79, and it got close to the 4,160 level. Last week on Wednesday and on Thursday stocks were declining on stronger U.S. dollar, global markets’ sentiment. The S&P 500 retraced some of its January rally after bouncing down from 4,200 resistance level. On February 2 the S&P 500 reached new medium-term high of 4,195.44 and last Friday it fell to the mentioned low. Earlier the broad stock market’s gauge was extending its bounce from the January 19 local low of 3,885.54.

Stocks are expected to open 1.1% lower this morning, as the market will likely react to higher-than-expected Producer Price Index release. The PPI was at +0.7% m/m vs. the expected +0.4%. The S&P 500 broke below the upward trend line last week, as we can see on the daily chart:

Futures Contract Trades Below 4,150 Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. It broke below the 4,150 level following the PPI release this morning. The resistance level remains at 4,180-4,200, and on the other hand, the support level is at 4,050-4,100.

Conclusion

The S&P 500 will likely retrace its recent advances this morning. The stock market is expected to open lower following producer prices inflation release. However, the index continues to trade within an over two-week-long consolidation.

Here’s the breakdown:

- The S&P 500 will likely get closer to the 4,100 level again.

- Stock prices continue to fluctuate following their January advance.

- In my opinion, the short-term outlook is neutral and no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care