Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are currently justified from the risk/reward point of view (since Feb. 27 before session’s open).

Stocks reversed their intraday advance yesterday – was it a change of trend?

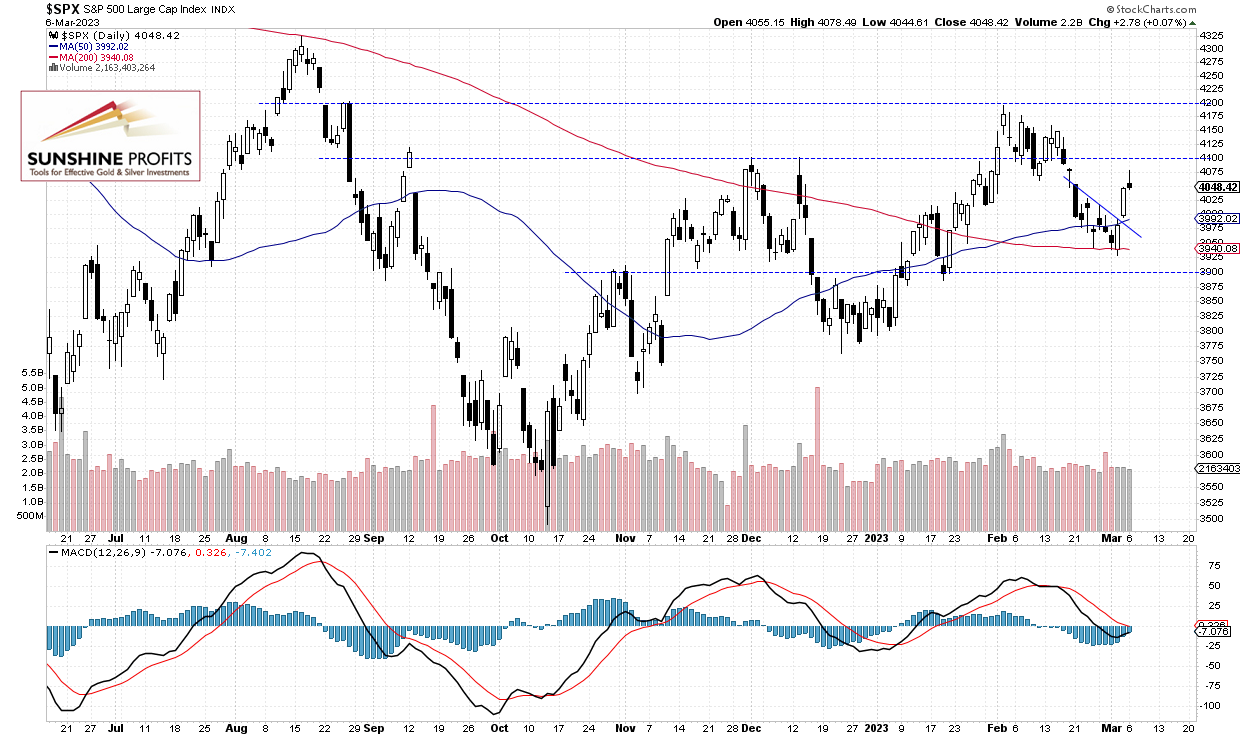

The S&P 500 index gained 0.07% on Monday following its Friday’s advance of 1.6%, as it continued its short-term uptrend. However, the market reached the intraday high of 4,078.49 before going back slightly below the 4,050 level. Recently the index was selling off on interest rate, Russia-Ukraine war fears, among other factors, and on Thursday it bounced from the local low of 3,928.16.

The S&P 500 index will likely open 0.1% higher this morning. It may see a short-term consolidation and some more profit-taking action. The market will be waiting for the Fed Chair Powell’s testimony at 10:00 a.m. On Monday the index broke above its short-term downward trend line, as we can see on the daily chart:

Futures Contract Fluctuates Along 4,050

Let’s take a look at the hourly chart of the S&P 500 futures contract. It’s trading within a consolidation following yesterday’s intraday retreat. The nearest important resistance level is at around 4,080-4,100. On the other hand, the support level is at 4,000-4,020, among others.

Conclusion

Stocks are expected to open relatively flat this morning. For now, it looks like a profit-taking action following a rally from the mentioned last Thursday’s local low. There have been no confirmed negative signals.

Here’s the breakdown:

- The S&P 500 will likely extend its short-term consolidation this morning; the market will react to the Fed’s Powell’s testimony.

- Stocks fluctuate following their Thursday’s-Monday’s rally.

- In my opinion, the short-term outlook is bullish and long positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are currently justified from the risk/reward point of view (since Feb. 27 before session’s open).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care