Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27 before session’s open).

Stocks bounced sharply on Thursday, but that doesn’t mean the downtrend is over.

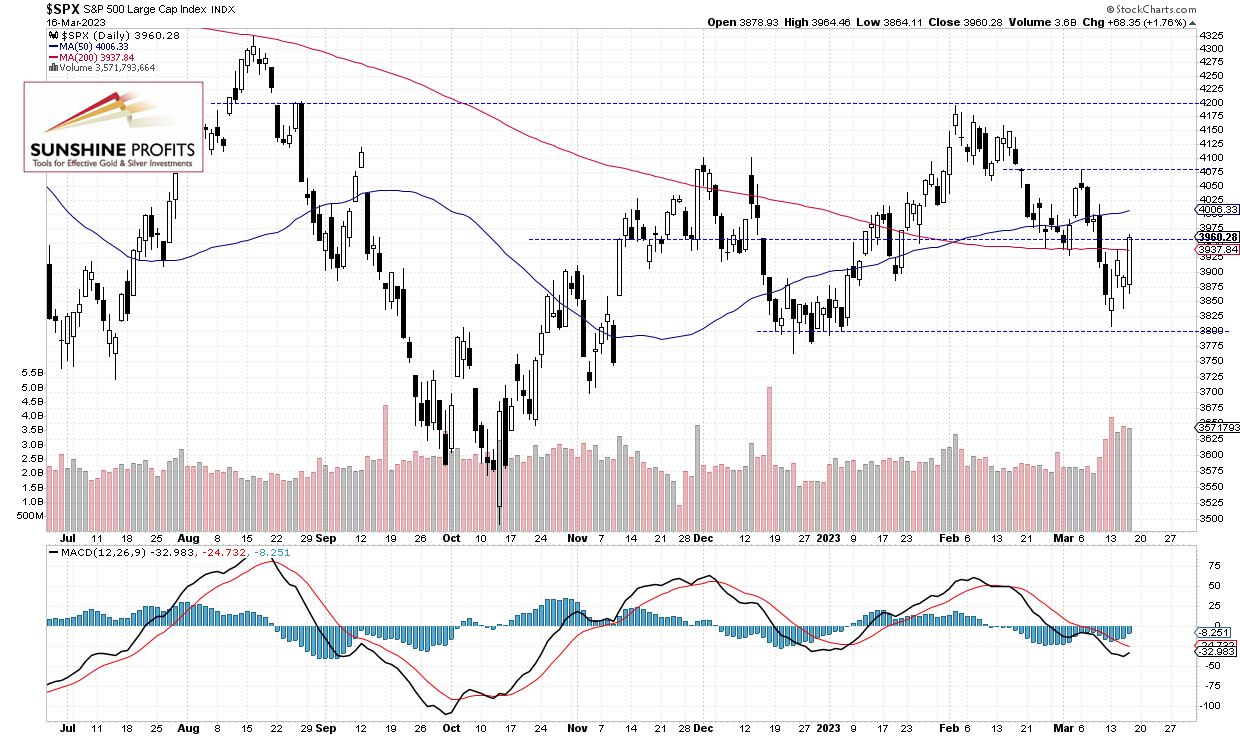

The S&P 500 index gained 1.76% on Thursday, as it retraced most of its recent declines. The market got closer to the important 4,000 level again – the daily high was at 3,964.46. On Monday the index bounced from the local low of 3,808.86, and it was the lowest since January 5. Stocks extended their downtrend earlier this week on news about the Silicon Valley Bank (SIVB) and the other mid-sized U.S. banks’ situation.

This morning the S&P 500 is expected to open 0.9% lower on global stock markets’ weakness. The index will likely extend its consolidation below the 4,000 level as we can see on the daily chart:

Futures Contract Bounced from 4,000

Let’s take a look at the hourly chart of the S&P 500 futures contract. It went above the 4,000 level this morning, but then it retraced the advance. The resistance level remains at 3,980-4,000, and the support level is at 3,950, among others. (June S&P futures contract).

Conclusion

The S&P 500 will likely open lower this morning. So the market will continue to fluctuate following its recent sell-off. It may be forming a short-term bottom here, however, there have been no confirmed positive signals so far.

Here’s the breakdown:

- The S&P 500 will extend its short-term consolidation as it is expected to retrace some of yesterday’s rally.

- The market may be forming a bottom here, however, it may see more volatility.

- In my opinion, the short-term outlook is bullish and long positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27 before session’s open).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care