Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are currently justified from the risk/reward point of view (since Feb. 27 before session’s open).

Stocks went sideways on Wednesday – are they forming a short-term bottom?

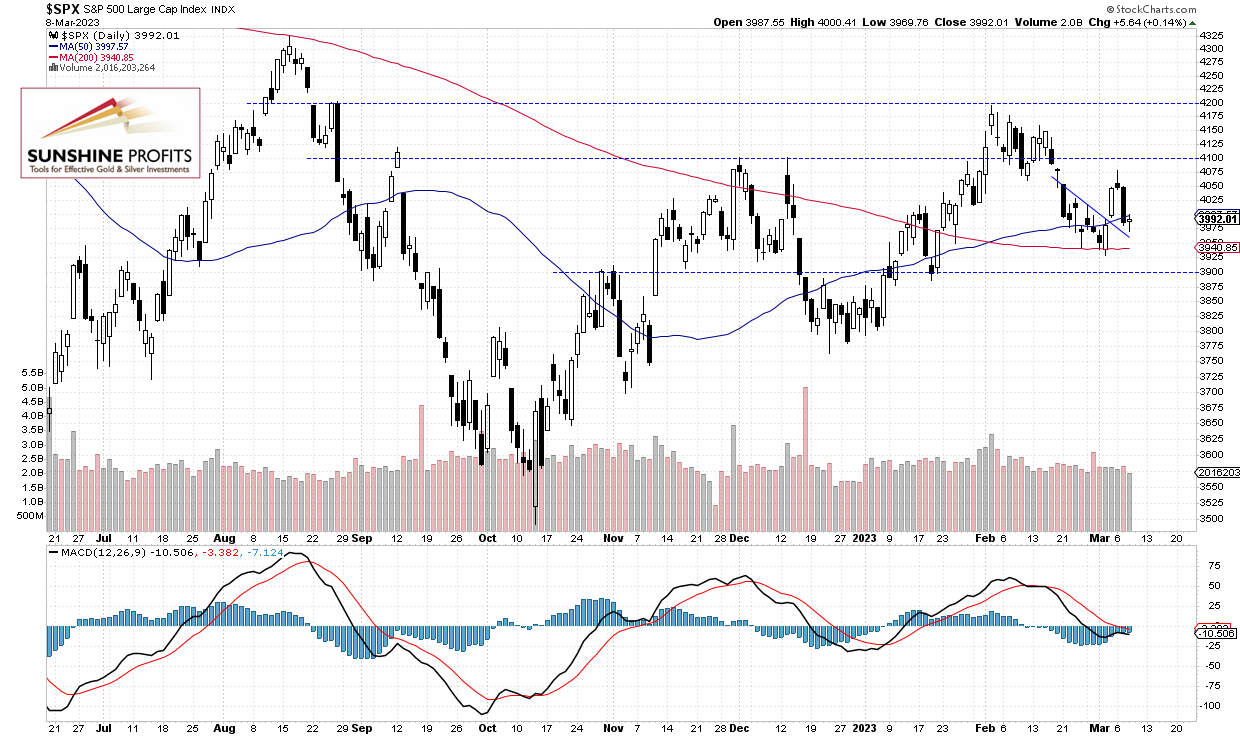

The S&P 500 index gained 0.14% on Wednesday, following its Tuesday’s sell-off of 1,5%, as investors hesitated after a hawkish testimony from the Fed Chief Powell. On Monday the index reached local high of 4,078.49, and yesterday the daily low was at 3,969.76.

Recently the index was selling off on interest rate, Russia-Ukraine war fears, among other factors, and last week on Thursday it bounced from the local low of 3,928.16. This week it came back below the 4,000 level following Jerome Powell’s hawkish testimony.

The S&P 500 index is expected to open virtually flat this morning after an overnight decline and a bounce in a reaction to worse-than-expected Unemployment Claims number release. The S&P 500 remains close to the 4,000 level, as we can see on the daily chart:

Futures Contract Extends a Consolidation

Let’s take a look at the hourly chart of the S&P 500 futures contract. It is still trading sideways following Tuesday’s sell-off. The support level is at 3,930-3,950 and on the other hand, the resistance level is at 4,000-4,020.

Conclusion

Stocks will likely continue sideways this morning, as investors await tomorrow’s monthly jobs data release. For now, it looks like a relatively flat correction within a short-term downtrend. However, it may also be a bottoming pattern before an upward reversal. There have been no confirmed positive signals though.

Here’s the breakdown:

- The S&P 500 will extend its short-term consolidation this morning.

- Investors will be waiting for tomorrow’s monthly jobs data release.

- In my opinion, the short-term outlook is bullish and long positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are currently justified from the risk/reward point of view (since Feb. 27 before session’s open).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care