Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral, and no positions are currently justified from the risk/reward point of view.

The first trading day of the year brought declines in stock prices; more uncertainty may be coming.

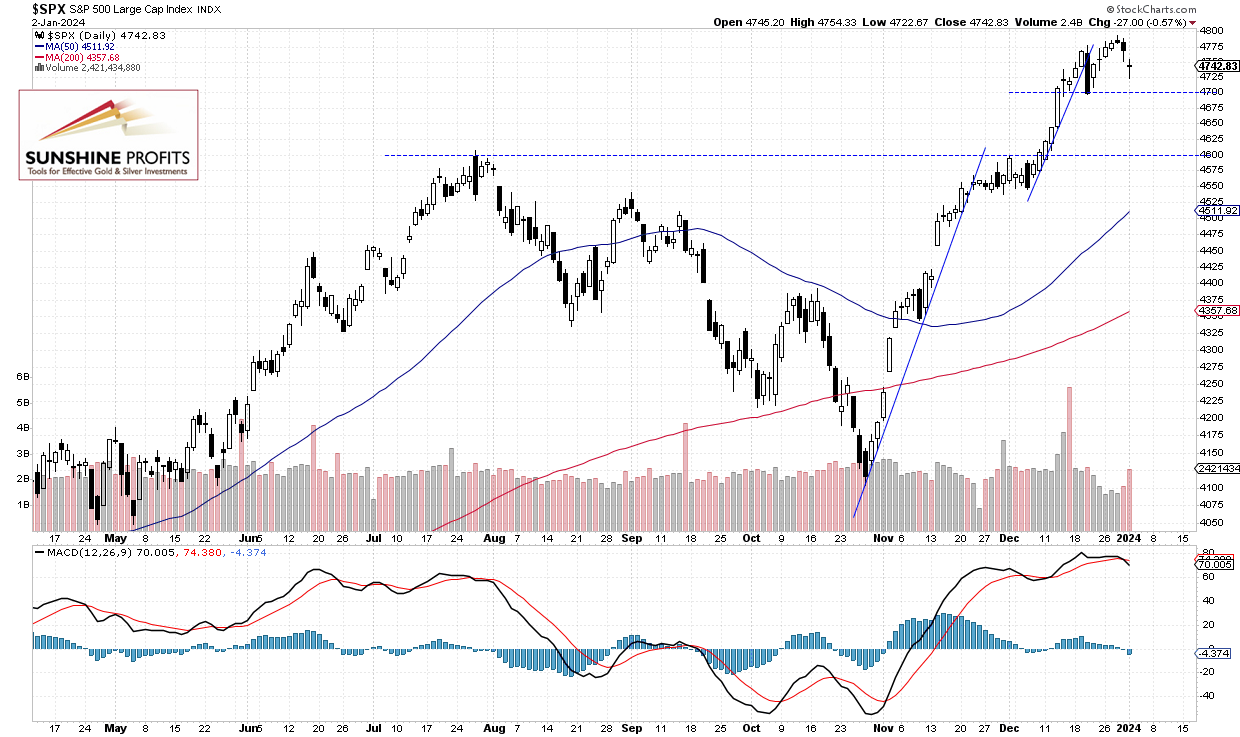

On Tuesday, the S&P 500 index continued its last Friday’s decline and retreated from Thursday’s local high of 4,793.30. Investors took short-term profits off the table following last week’s rally, causing the market to bounce from the 4,800 level and the resistance marked by January 4, 2022, all-time high of 4,818.62. Investors’ sentiment remains bullish; however, last Wednesday’s AAII Investor Sentiment Survey showed that 46.3% of individual investors remain bullish, which is lower than the previous reading of 52.9%. The AAII sentiment is likely to decline further today.

As mentioned on the previous Friday, maintaining a bullish bias is still justified, and the market may have another opportunity to reach new high. However, it’s crucial to pay close attention to the trading action, as there could be more uncertainty and volatility ahead. Friday’s volatility and yesterday’s weakness showed some short-term negative signals; therefore I have decided to close the profitable long position at the opening of yesterday’s cash market’s trading session.

The market has been extending the uptrend since the release of the FOMC Statement on December 13, which marked a pivot in the Fed’s monetary policy. In early December, the S&P 500 broke above the late July local high of around 4,607, resuming a rally from the local low of 4,103.78 on October 27.

This morning, the S&P 500 futures contract is indicating a lower opening of the trading session, currently 0.4% below the Tuesday’s close. As mentioned the previous Thursday, “the likely scenario is a consolidation along 4,700-4800”, and this prediction is proving accurate. How can we capitalize on such trading action? It’s better to shorten the timeframe of the trades and look for buying opportunities at support levels and selling at resistance levels.

On Friday, it became obvious that the 4,800 level will be a strong resistance, as we can see on the daily chart.

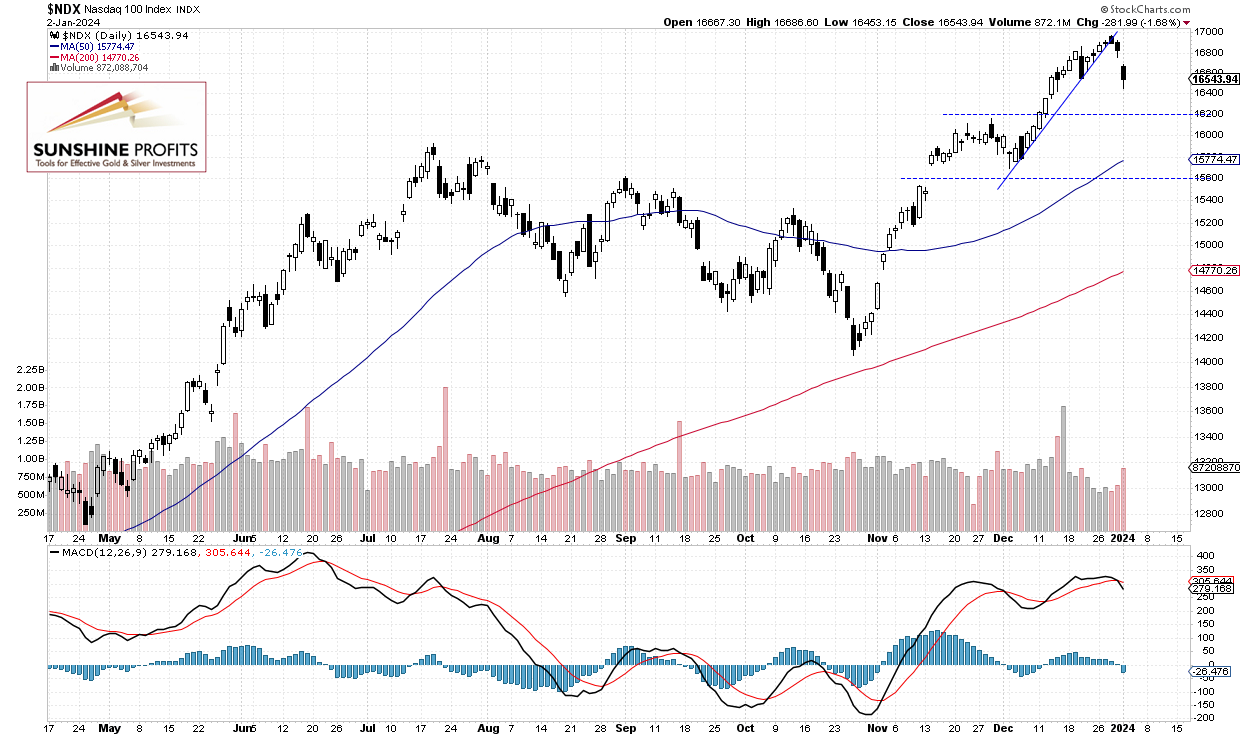

Nasdaq 100 Sparks More Fear Than the S&P 500

The technology-focused Nasdaq 100 index extended its uptrend last week, reaching a new all-time high of 16,969.17 on Thursday. On Friday, I wrote, “While it continues to trade above its month-long uptrend line, there are, however, short-term overbought conditions that may lead to a downward correction at some point.”. Indeed, the market experienced a quite sharp sell-off yesterday. Although it still appears to be just a downward correction, caution is advised, as there are no confirmed buying signals at present.

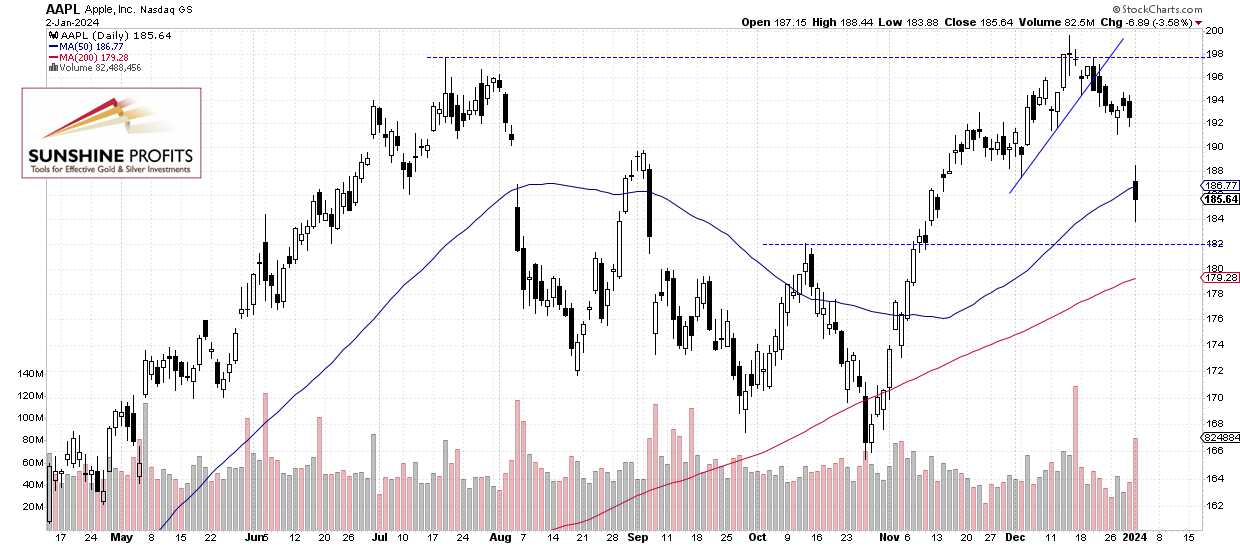

Apple Continues to Lead the Market Lower

Let’s move on to an individual stock – Apple, which is one of the most important market movers. On Friday, it failed to continue its short-term advance after rebounding from $191 level, and yesterday it sold off, closing 3.6% lower. The decline has been significant, suggesting a change in trend. The $200 price level remains an important medium-term resistance level here.

Futures Contract Trades Along Local Low

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning, it’s trading below the 4,800 level again, influenced by weakness in Europe, a stronger U.S dollar, among other factors. The resistance level remains at 4,800, with support at 4,750, marked by the recent local low.

Conclusion

In light of the recent market’s volatility, technical overbought conditions, and the prevailing bullish sentiment, I decided to close the profitable long position at the opening of yesterday’s cash market’s trading session. Overall, it gained 752.8 index points from the opening level of 3,992.4 on Feb. 27.

In the near future, I will shift focus to a more short-term oriented trading strategy. For now, my short-term outlook remains neutral and I think that no positions are justified from the risk/reward point of view.

Stock prices are expected to remain under pressure this morning, and the index may slightly extend its downward correction as the S&P 500 futures contract trades 0.4% lower. In the previous Thursday’s analysis, I mentioned that “in a short-term the market may see some more uncertainty and volatility”, and indeed, there is a lot of uncertainty following an early-December rally and the breakout of the S&P 500 above the 4,700 level. There is still a chance of extending the uptrend, as no confirmed medium-term negative signals have emerged. However, the short-term market picture is more blurry right now, and indexes may be beginning their downward correction or the mentioned consolidation.

In the coming days, the market will await important economic data. Today we will get the ISM Manufacturing PMI, JOLTS Job Openings, and FOMC Meeting Minutes releases. Tomorrow, the ADP Non-Farm Employment Change, and on Friday, the Nonfarm Payrolls, Unemployment Rate, and ISM Services PMI releases are scheduled.

Here’s the breakdown:

- The S&P 500 is poised to slightly extend its recent declines this morning.

- Nevertheless, it remains within a 4,700-4,800 consolidation.

- Short-term uncertainty and volatility may favor trading based on support and resistance levels.

- In my opinion, the short-term outlook is neutral, and no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral, and no positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care