Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

The S&P 500 accelerated its advance yesterday, but this morning it’ll see a selling pressure – is it just a correction?

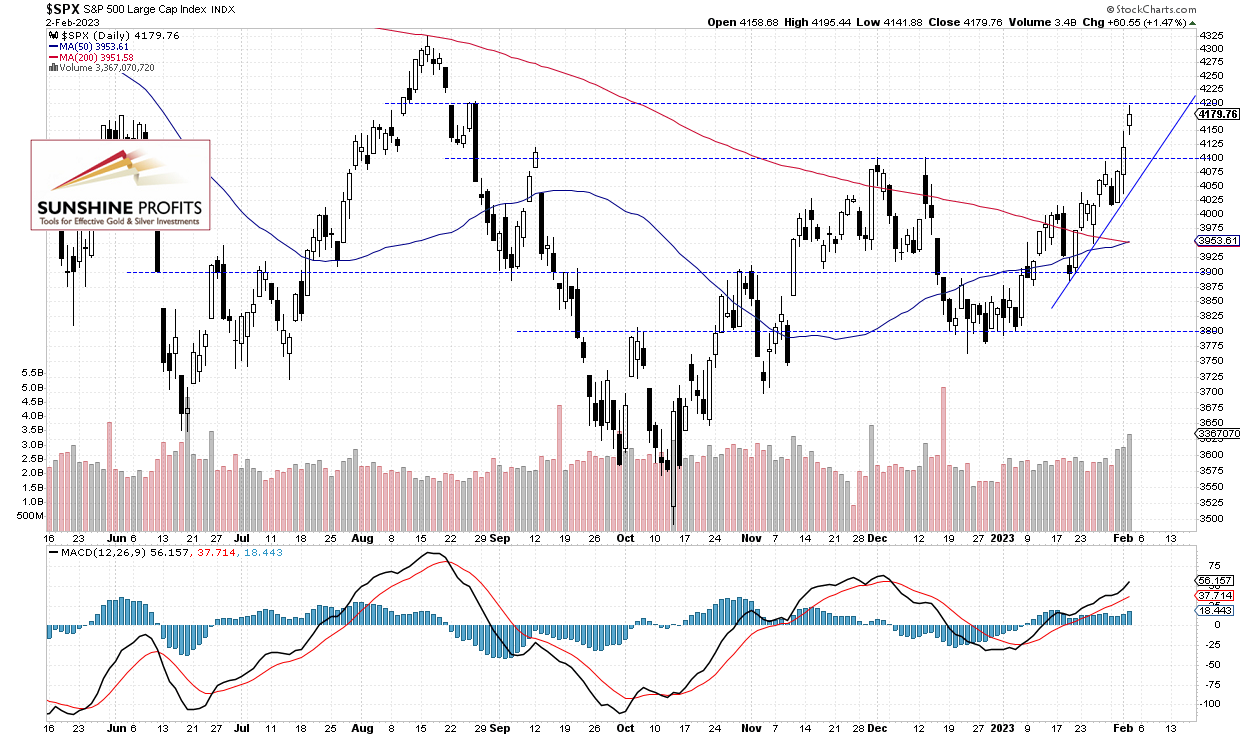

The S&P 500 index gained 1.47% on Thursday, as it extended its Wednesday’s advance of 1.1% following Fed, earnings releases. Yesterday’s daily high was at 4,195.44. It was the highest since August 26. Recently the broad stock market’s gauge was extending its bounce from January 19 local low of 3,885.54.

Stocks will likely open 1.2% lower following yesterday’s important earnings releases and today’s better-than-expected monthly jobs data (the monthly Nonfarm Payrolls number was at +517,000 vs. the expected +193,000). The S&P went the highest since late August of 2022 yesterday and it got very close to the last year’s August daily gap down resistance level of around 4,200, as we can see on the daily chart:

Futures Contract Bounced From 4,200

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market is trading lower this morning, as it is extending its yesterday’s afterhours downward correction. The nearest important support level is now at around 4,100, marked by the recent local high.

Conclusion

The S&P 500 will likely open lower this morning, as it is expected to retrace some of the recent rally following yesterday’s quarterly earnings releases from AAPL, AMZN and GOOG, today’s monthly jobs data. For now, it looks like a correction within an uptrend.

Here’s the breakdown:

- The S&P 500 reached almost 4,200 level yesterday, but this morning it will likely retrace some of the rally.

- For now, it looks like a correction within an uptrend.

- In my opinion, the short-term outlook is neutral and no positions are justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral and no positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care