Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

S&P 500 trades within a consolidation – will it get back to recent highs?

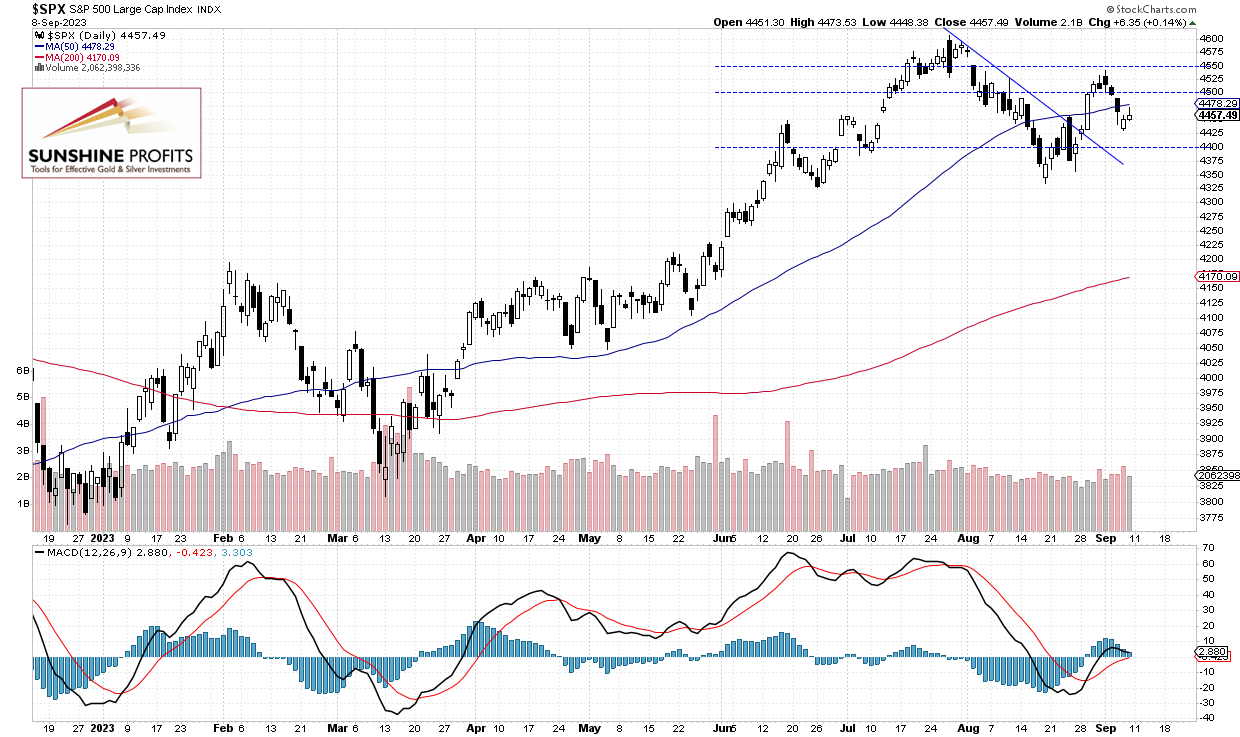

The S&P 500 index gained 0.14% on Friday as it went sideways following its last week’s downward correction. The market is now waiting for the important Consumer Price Index release on Wednesday. There’s still a lot of uncertainty about monetary policy and economic growth. Stock prices continue to move sideways following their advances from March to July. Recently investors took profits off the table due to strengthening U.S. dollar, among other factors.

The S&P 500 is expected to open 0.5% higher this morning, so it will likely get closer to the 4,500 level again. Last week it was trading along the 4,450 level as we can see on the daily chart:

Futures Contract Extends the Advance

Let’s take a look at the hourly chart of the S&P 500 futures contract (the continuous contract series has changed to December one). This morning it’s trading higher. The resistance level is at around 4,550, among others.

Conclusion

Stock prices will likely advance this morning. The market is expected to break above a short-term trading range and the S&P 500 may get closer to 4,500 level again.

Recently the investors’ sentiment improved as the pressure for further monetary policy tightening somewhat eased. But stocks retraced most of their late August rally after bouncing off their mid-July’s local lows resistance level.

Here’s the breakdown:

- Stock prices will likely retrace more of their recent declines

- Investors will be waiting for the important inflation data on Wednesday.

- In my opinion, the short-term outlook is still bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care