Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Stocks fluctuated following their recent rally – will the uptrend continue?

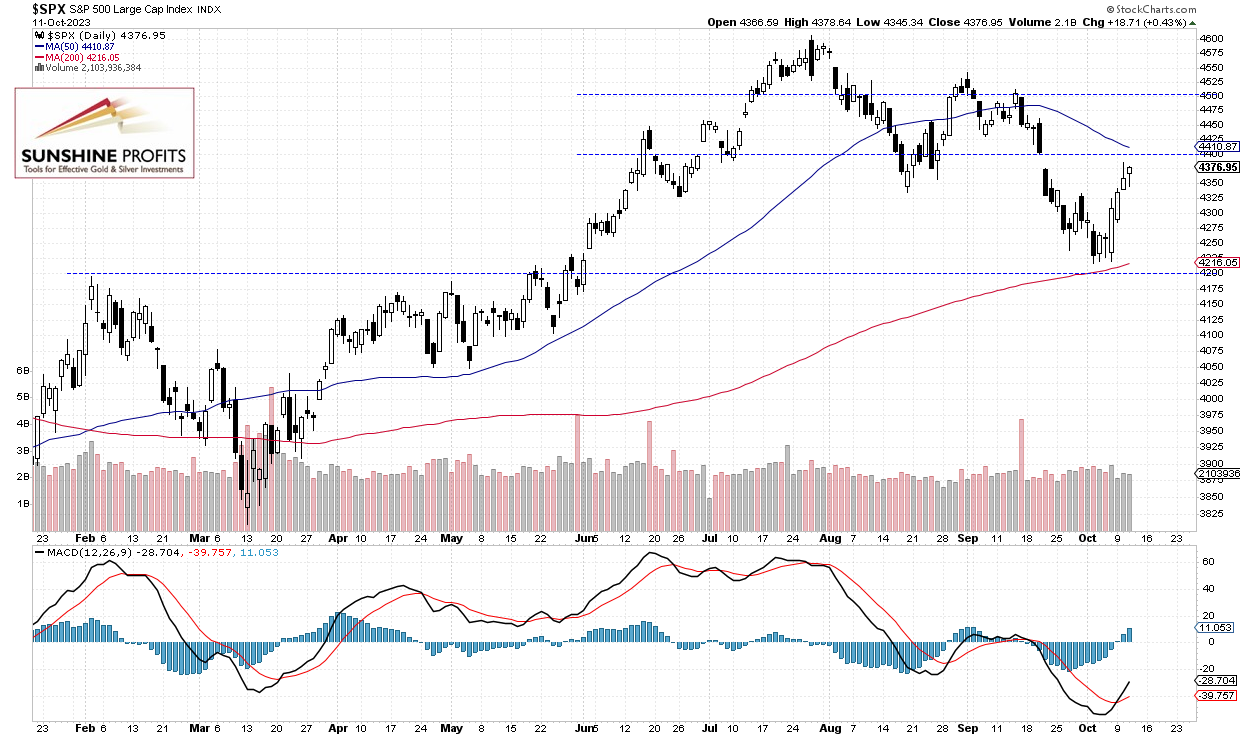

The S&P 500 index gained 0.43% yesterday as it basically went sideways following the recent advance. Stocks were gaining since last Friday and the monthly jobs data release. The index bounced from 4,220 level and on Tuesday it traded as high as 4,385.

Recently the broad stock market index retraced some of the declines, but eventually it went below the 4,300 level again. Last Friday it went back above it. There’s still a lot of uncertainty about monetary policy, economic growth and geopolitics.

Stocks are expected to open 0.2% higher this morning. So the market is rather calm following the CPI release. The Consumer Price Index has been slightly higher than expected at +0.4% m/m. The S&P 500 continues to trade within its Sept. 21 daily gap down of 4,375.70-4,401.38 as we can see on the daily chart:

Futures Contract Remains Above 4,400

Let’s take a look at the hourly chart of the S&P 500 futures contract. Last week on Tuesday it reached new low of around 4,235 before bouncing back above the 4,300 level. This morning it’s trading above the 4,400 level. The resistance level is at 4,420-4,440 and the support level remains at 4,350.

Conclusion

The S&P 500 will likely open 0.2% higher today. It may see some more short-term uncertainty and continue to fluctuate below the 4,400 level. For now, it looks like a flat correction within a short-term uptrend. The market will be waiting for the coming quarterly earnings announcements.

Here’s the breakdown:

- Stock prices may continue to fluctuate following the CPI release.

- The S&P 500 trades within its late September daily gap down; it is acting as a resistance level.

- In my opinion, the short-term outlook is still bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care