Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is now neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

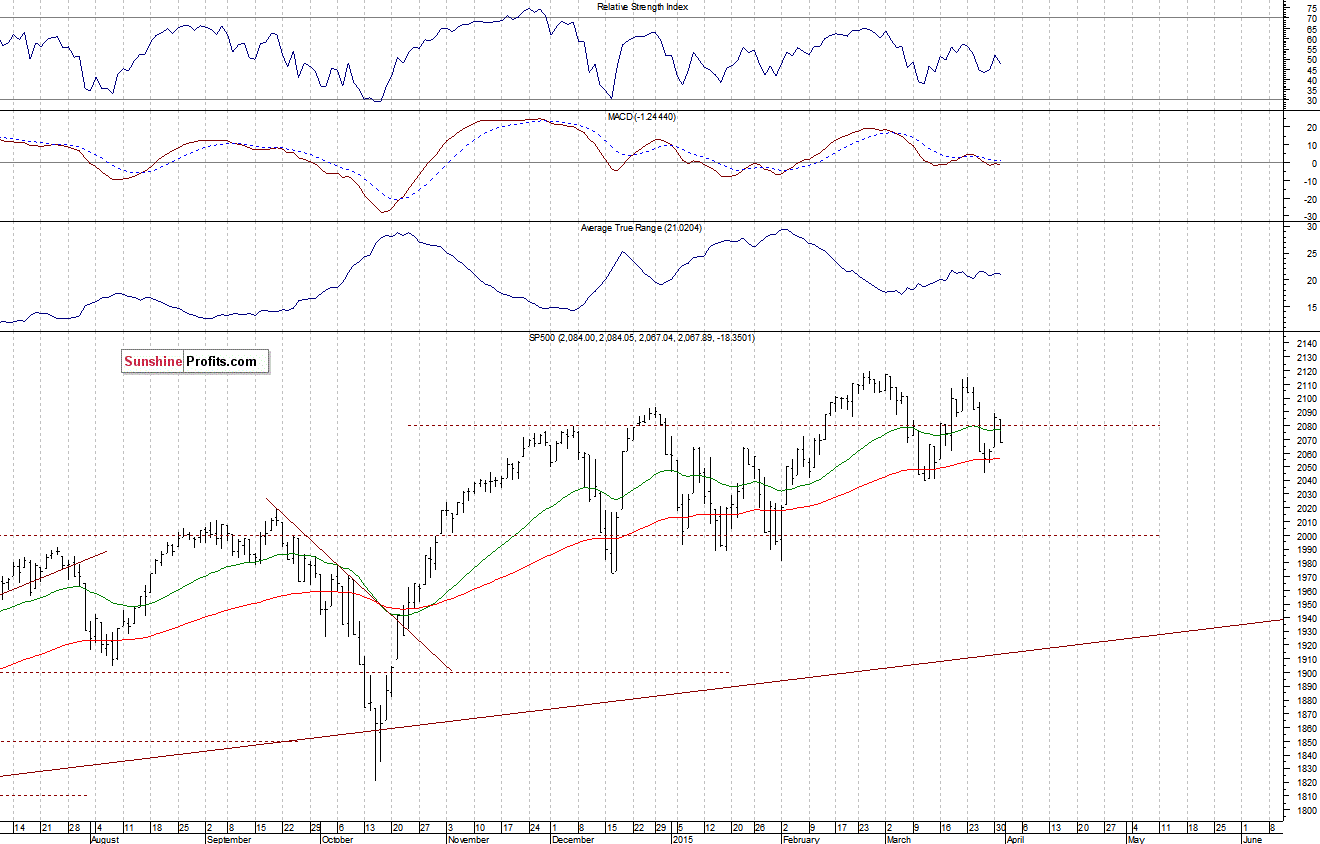

The U.S. stock market indexes lost 0.9-1.1% on Tuesday, as they retraced their recent move up and extended short-term uncertainty. The S&P 500 index bounced off its level of resistance at around 2,080-2,090, marked by previous local extremes. On the other hand, support level is at 2,040-2,050. For now, it looks like some further fluctuations within medium-term consolidation following October-November rally:

Expectations before the opening of today's trading session are virtually flat. The main European stock market indexes have gained 1.0-1.5% so far. Investors will now wait for some economic data announcements: ADP Employment Report at 8:15 a.m., ISM Index, Construction Spending at 10:00 a.m. The S&P 500 futures contract (CFD) is within an intraday uptrend, as it retraces yesterday's after-hours selloff. The nearest important level of resistance is at around 2,060. On the other hand, support level is at 2,030-2,050, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it retraces yesterday's move down. The nearest important level of resistance is at around 4,350, marked by recent consolidation. On the other hand, support level is at 4,300, as the 15-minute chart shows:

Concluding, the broad stock market extended its short-term consolidation, as investors remained uncertain ahead of economic data announcements, quarterly corporate earnings releases. For now, it looks like further medium-term consolidation, following last year's October-November rally. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts