Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,030, and a profit target at 1,900, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday

(next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

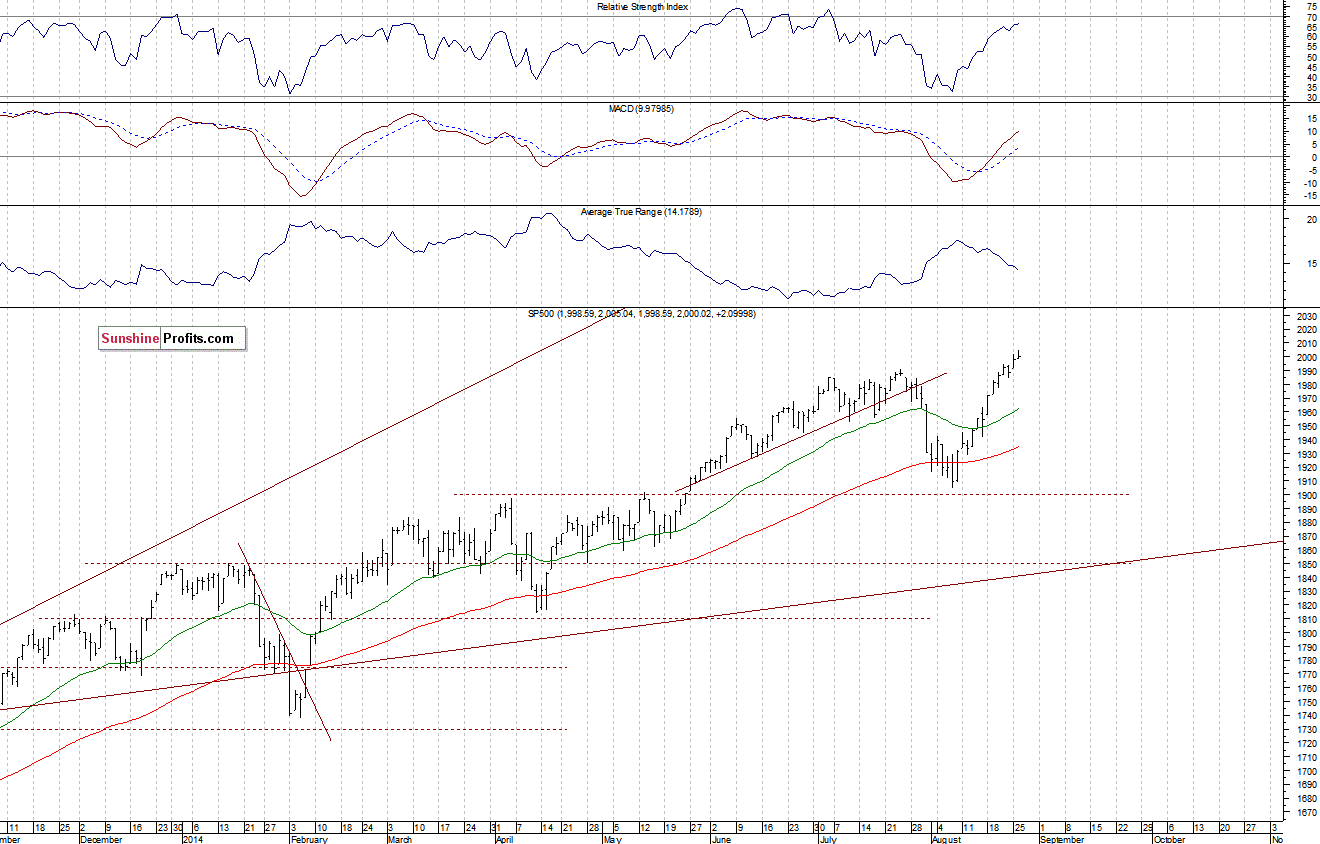

The U.S. stock market indexes gained 0.1-0.2% on Tuesday, extending their recent move up, as investors remained optimistic. Our yesterday’s neutral intraday outlook has proved quite accurate. The S&P 500 index has reached yet another new all-time high of 2,005.04. However, it closed below the level of 2,000. The nearest important resistance level is at around 2,000-2,005, marked by the all-time high. On the other hand, the level of support is at 1,885-1,890, among others. There have been no confirmed negative signals so far. However, we can see negative technical divergences, accompanied by some overbought conditions:

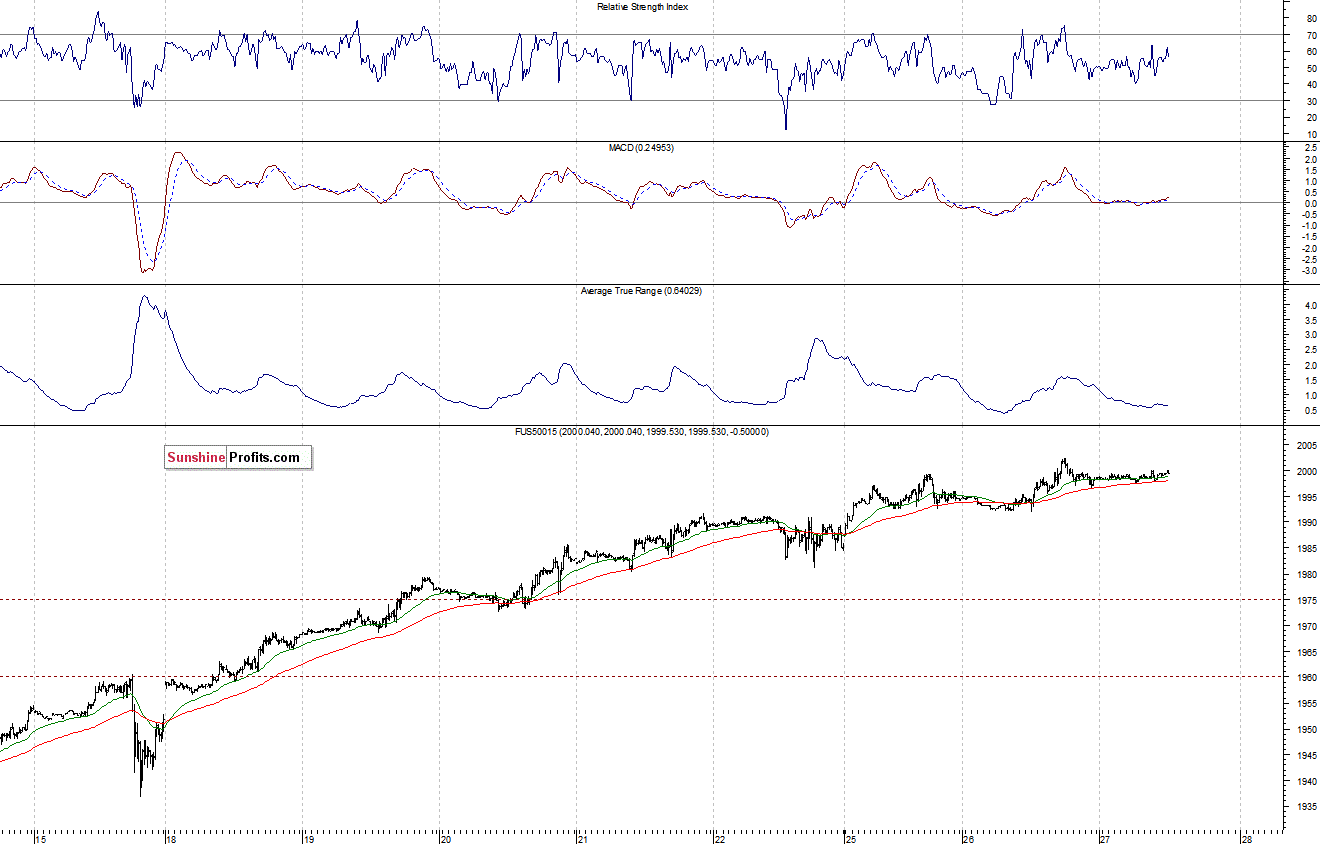

Expectations before the opening of today’s session are virtually flat. The main European stock market indexes have been mixed so far. The S&P 500 futures contract (CFD) is in a relatively narrow intraday trading range, as it fluctuates along the level of 2,000. The nearest important level of support is at around 1,980-1,985, marked by some of the recent local lows, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract (CFD) is in a similar consolidation, as it trades along the level of its long-term high. The resistance level is at around 4,080-4,100, and the nearest important support level remains at 4,050-4,060, among others, as the 15-minute chart shows:

Concluding, the broad stock market remains close to its record high, as the S&P 500 index trades along the level of 2,000. There have been no confirmed negative signals so far. However, we decide to open a speculative short position at the opening of today’s session (S&P 500 index – cash market), as a potential risk/reward ratio seems favorable at this moment. The stop-loss level is at 2,030, and potential profit target is at 1,900 (S&P 500 index).

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts