Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,910, S&P 500 index).

Our intraday outlook is neutral, and our short-term outlook remains bullish:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bullish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

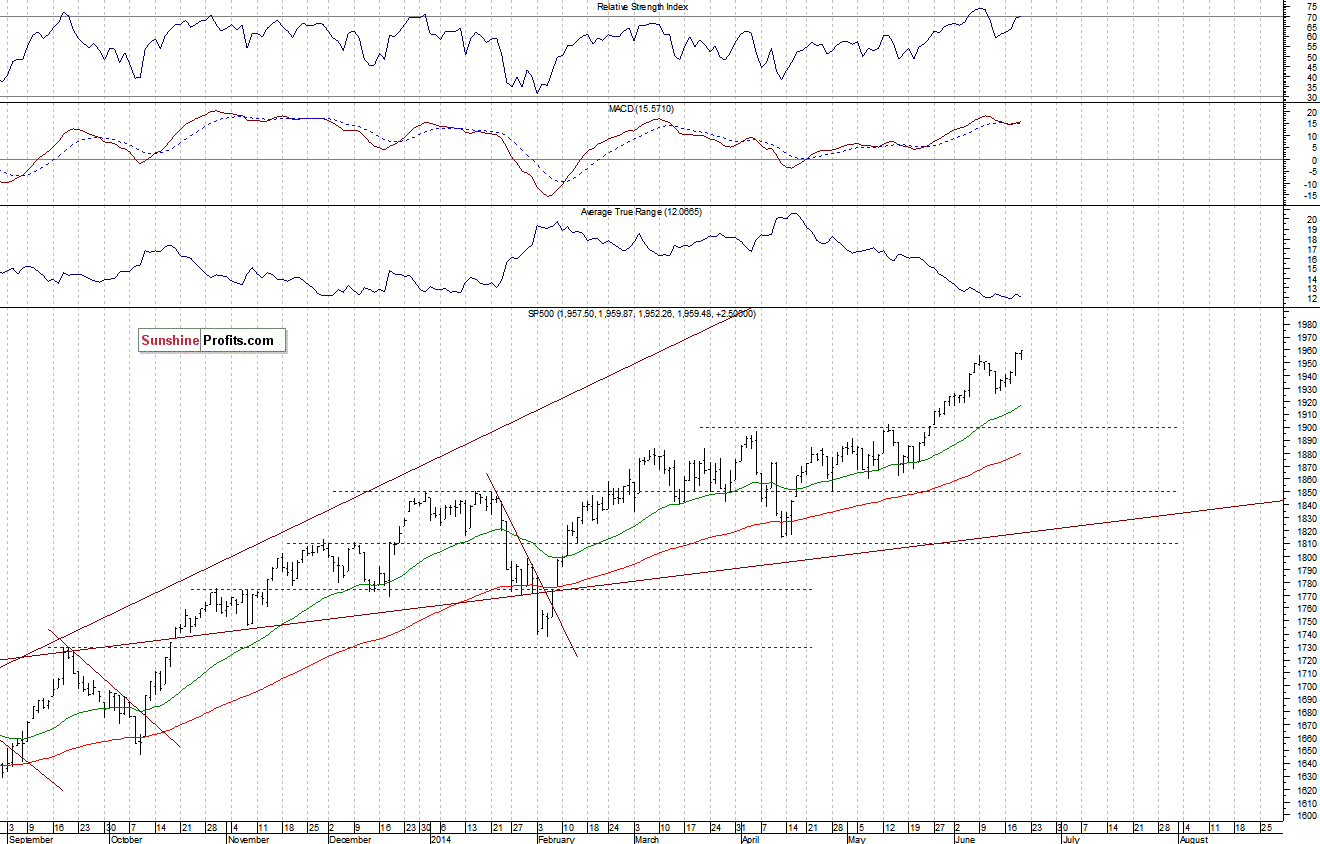

The U.S. stock market indexes were virtually flat yesterday, following Wednesday’s advance, as investors took some profits off the table. Still, our Wednesday’s short-term bullish outlook has proved to be right – it was worth to ride out the correction as our long positions are even more profitable today. The S&P 500 index has managed to reach a new all-time high of 1,959.87. The nearest important support level is at around 1,940, marked by some of the recent local extremes, and the next support is at 1,915-1,925. There have been no confirmed negative signals so far, however, we can see some overbought conditions, as the daily chart shows:

Expectations before the opening of today’s session are virtually flat. The main European stock market indexes have gained 0.1-0.2% so far. The S&P 500 futures contract (CFD) trades close to its long-term highs, as it extends short-term consolidation along the level of 1,950. The nearest important level of support is at around 1,940. There have been no confirmed negative signals so far:

The technology Nasdaq 100 futures contract (CFD) continues to fluctuate slightly below the level of resistance at 3,800. On the other hand, the support is at 3,750-3,760. For now, it looks like a flat correction within an uptrend, as we can see on the 15-minute chart:

Concluding, the broad stock market made new all-time high which is always a positive sign. We continue to maintain our already profitable long position, expecting some more upside, as there have been no confirmed sell signals. The stop-loss (protect-gain) remains at 1,910 – S&P 500 index.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts