Briefly: In our opinion speculative long positions are still favored (with stop-loss at 1,850, S&P 500 index).

Our intraday outlook is bullish, and our short-term outlook remains neutral:

Intraday

(next 24 hours) outlook: bullish

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

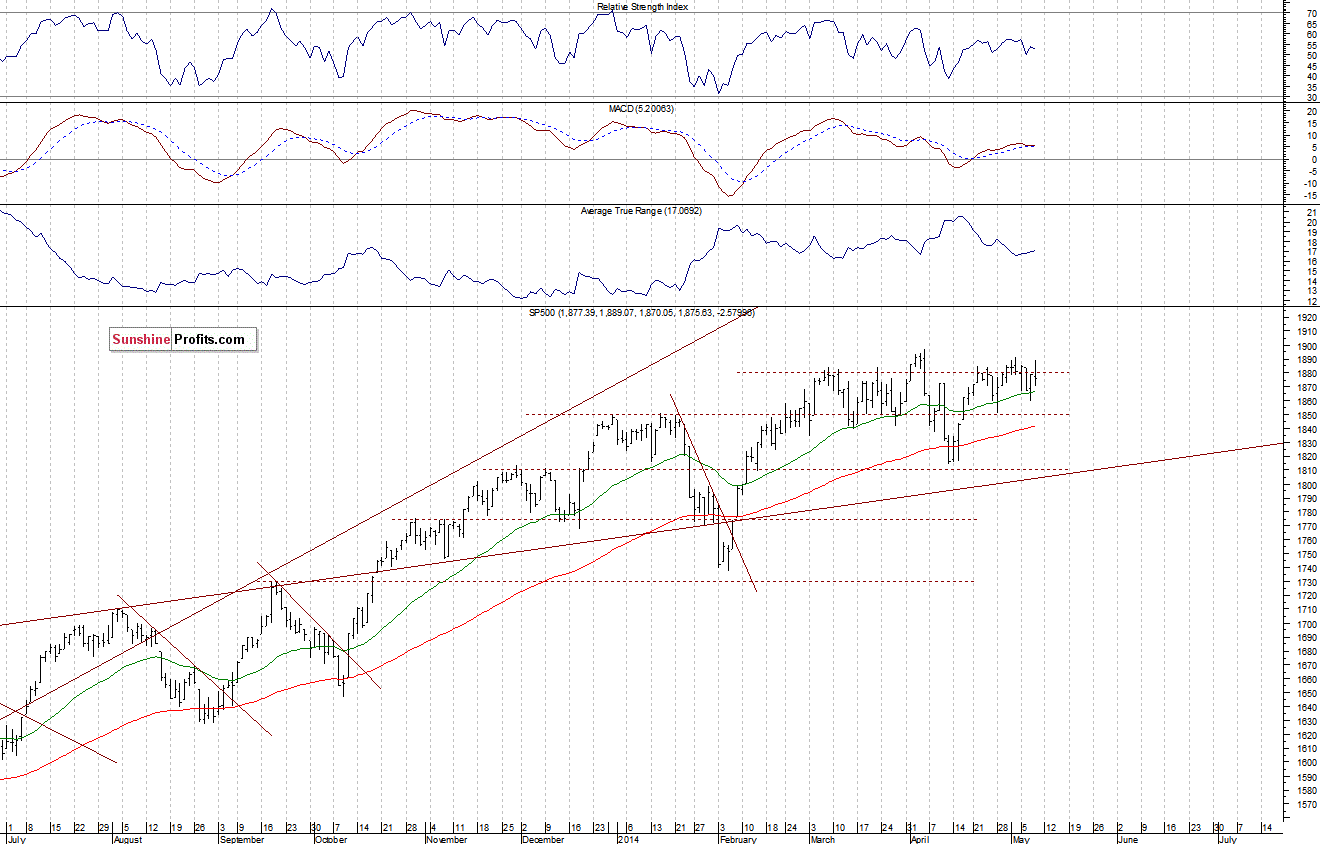

The U.S. stock market indexes were mixed between -0.2% and +0.2% on Thursday, following volatile trading session, as investors pushed stocks higher in the morning, then drove them lower, extending recent uncertainty. The S&P 500 index remains within its few week long consolidation, just below the resistance of 1,880-1,900. The nearest important level of support is at 1,850. There have been no confirmed negative signals so far, however, lack of decisive action may lead to some profit taking following long-term uptrend:

Expectations before the opening of today’s session are slightly negative, with index futures currently down 0.2-0.3%. The main European stock market indexes have lost 0.3-0.6% so far. Investors will now wait for some economic data releases: Wholesale Inventories, JOLTS – Job Openings number at 10:00 a.m. The S&P 500 futures contract (CFD) continues to trade within few week long consolidation, with the resistance level at around 1,880-1,885, and the support at 1,845-1,855. There is no clear short-term trend, as we can see on the 15 minute chart:

Analogously, the technology Nasdaq 100 futures contract (CFD) extends its fluctuations. However, it is relatively weaker than the broad market. The resistance remains at the psychological level of 3,600, and the support is at 3,480-3,500, as the 15-minute chart shows:

Concluding, the broad market extends its sideways movement. Long-term trend points upward, so we expect the stock market to break out above this current consolidation. However, a negative, bearish scenario cannot be ruled out. We continue to maintain our speculative long position, with the stop-loss at 1,850 (S&P 500, cash market).

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts