Briefly: In our opinion speculative long positions are favored (with stop-loss at 1,850, S&P 500 index)

Our intraday outlook is bullish, and our short-term outlook remains neutral:

Intraday

(next 24 hours) outlook: bullish

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

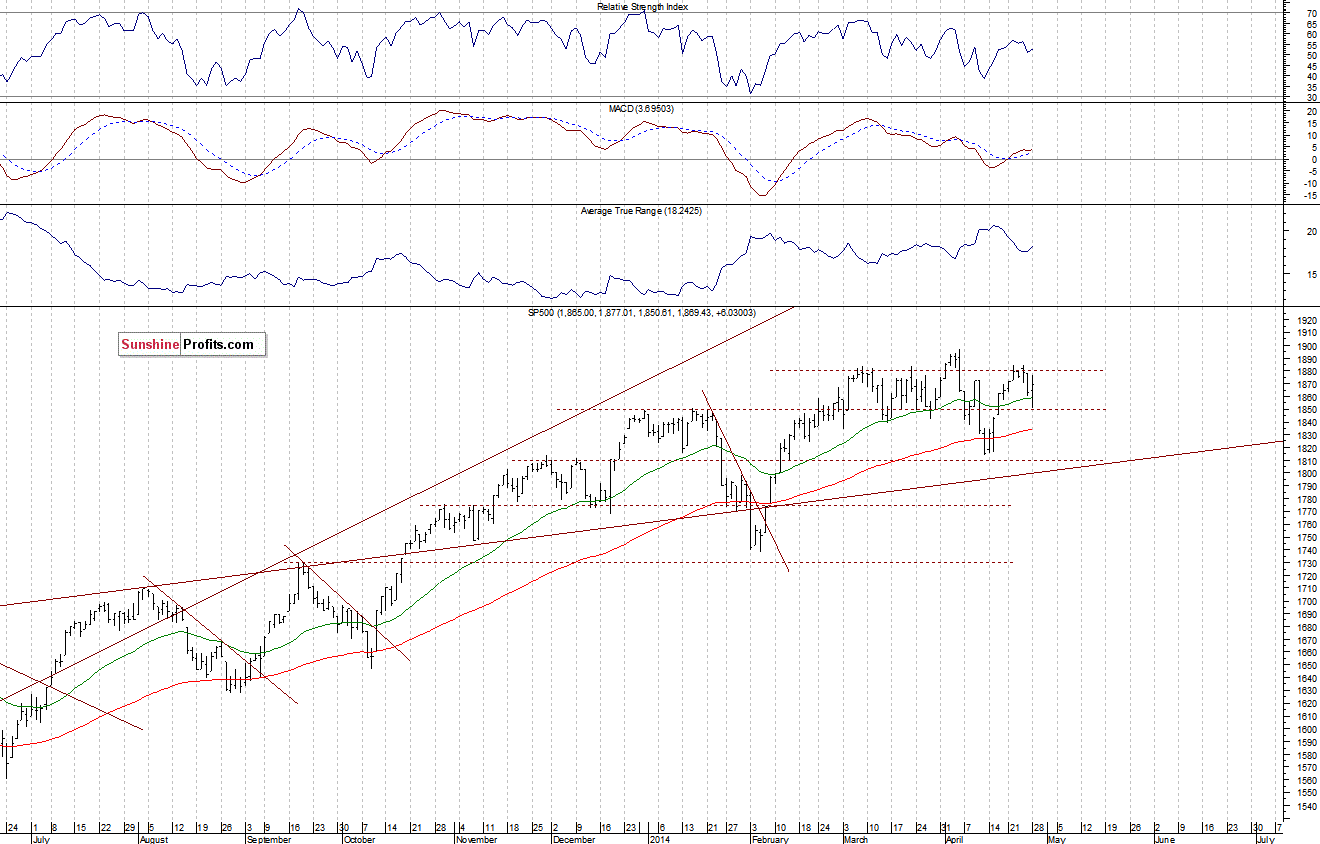

The U.S. stock market indexes gained between 0.3% and 0.5% on Monday, following volatile trading session, as investors continued to hesitate. Our yesterday’s neutral outlook has proved to be quite accurate. The S&P 500 index bounced off the support at around 1,840-1,850, which may be considered as a positive signal, however, the nearest important resistance remains at 1,880-1,900, marked by the April 4 all-time high of 1,897.28. There is still no clear short-term direction, as the broad market continues to fluctuate within its March consolidation. Investors weigh corporate earnings releases, economic data announcements (anxiously awaited Friday’s employment report, among others), tomorrow’s FOMC Rate Decision announcement, Russia-Ukraine conflict. These various factors seem to cancel each other – at least for now. Luckily, the chart analysis can give us some insight regardless of the above.

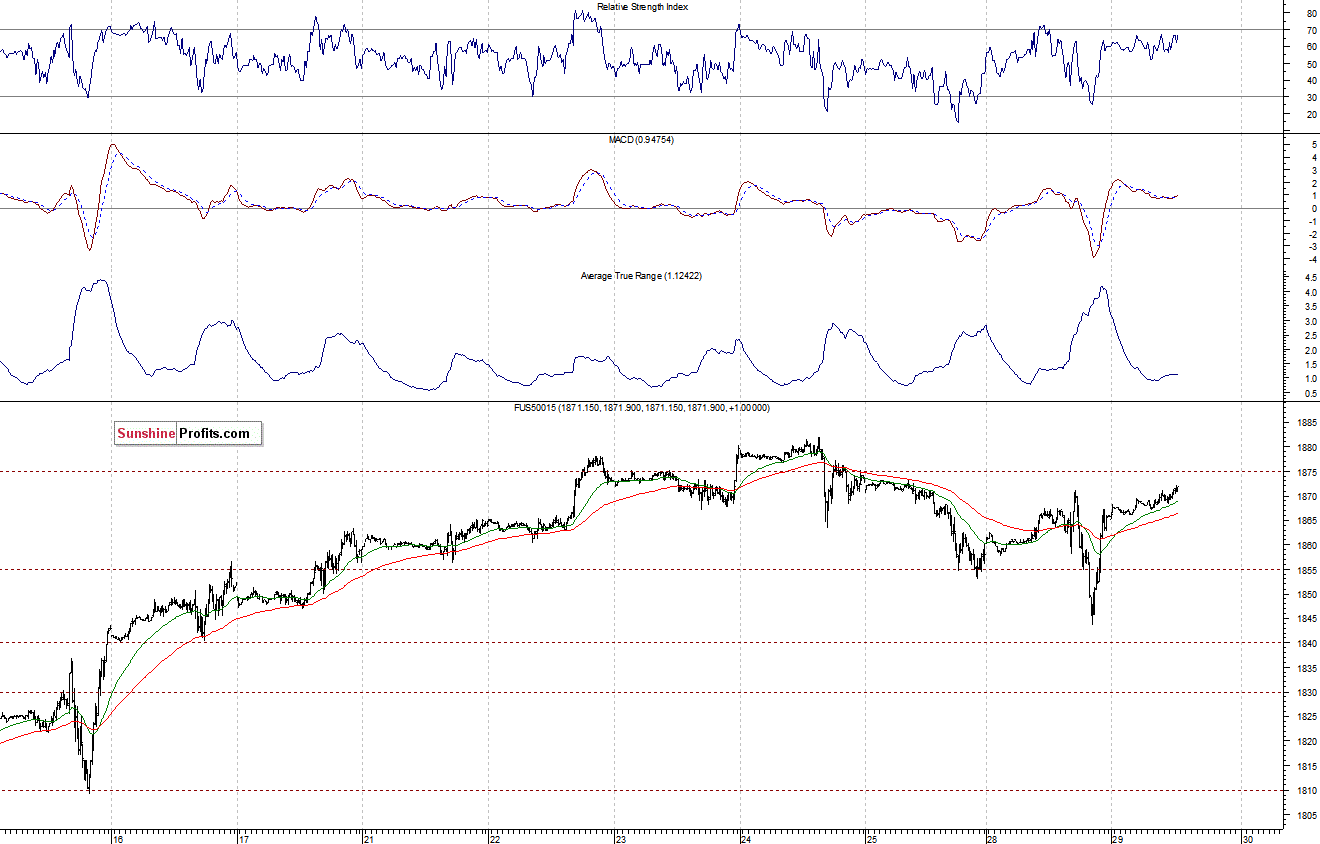

Expectations before the opening of today’s session are positive, with index futures currently up 0.2-0.3%. The European stock market indexes have gained 0.3-0.5% so far. Investors will now wait for some economic data announcements: Case-Shiller 20-city Index at 9:00 a.m., Consumer Confidence at 10:00 a.m. The S&P 500 futures contract (CFD) trades in an intraday uptrend, just below last week’s highs. The resistance is at 1,875-1,880, and the nearest important support is at around 1,860-1,865, as the 15-minute chart shows:

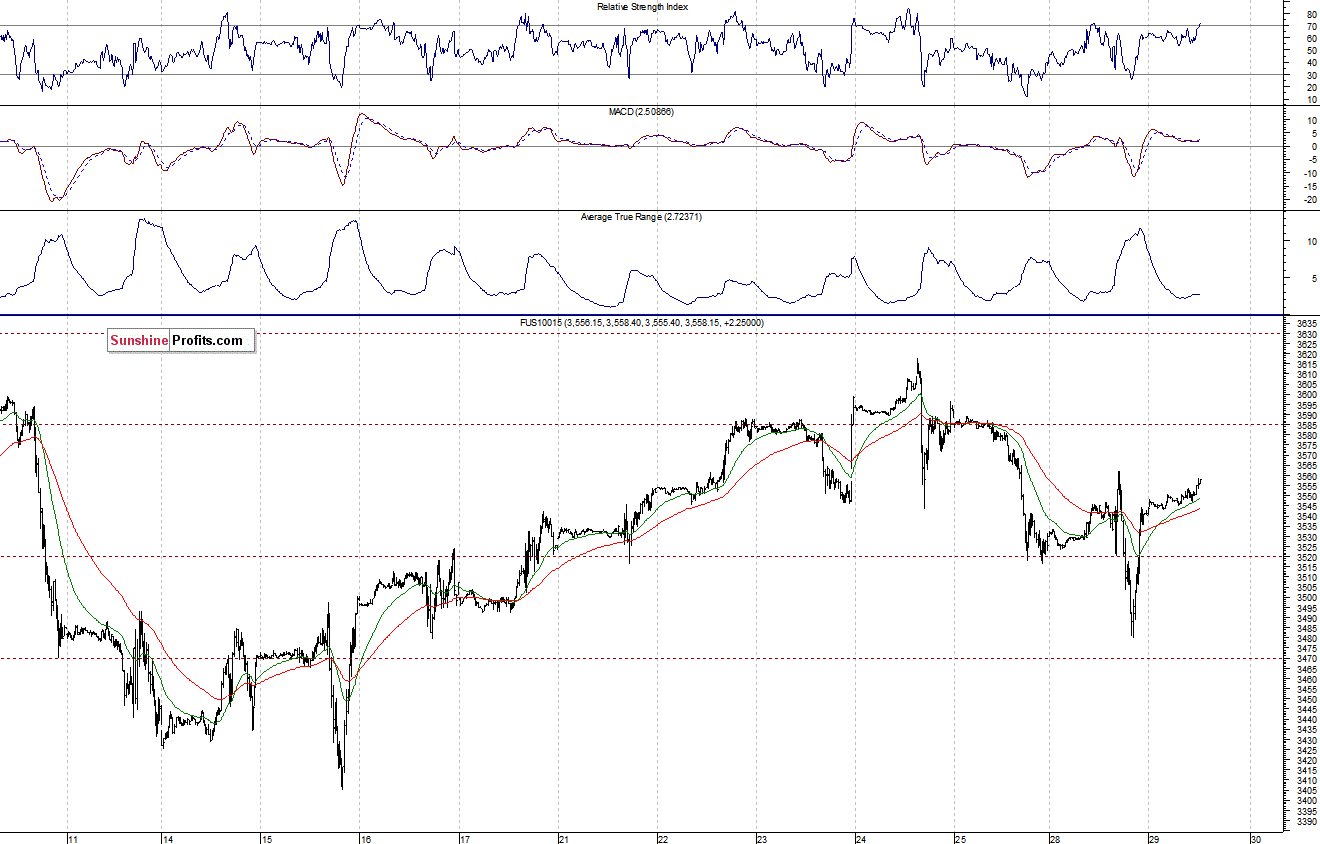

The technology Nasdaq 100 futures contract (CFD) bounced off the support at 3,480-3,500, which is a positive signal, as it may end its recent downward correction. However, the nearest resistance is at 3,600-3,620:

Concluding, yesterday’s market action has been quite bullish. We may see some short-term uptrend, however, the S&P 500 remains in a month-long consolidation. Will we see new all-time highs for the broad market? In our opinion, small speculative long position with a relatively tight stop-loss (at around 1,850 for the S&P 500 index) seems justified at this moment.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts