Briefly: In our opinion no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is now neutral, following yesterday’s move up:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

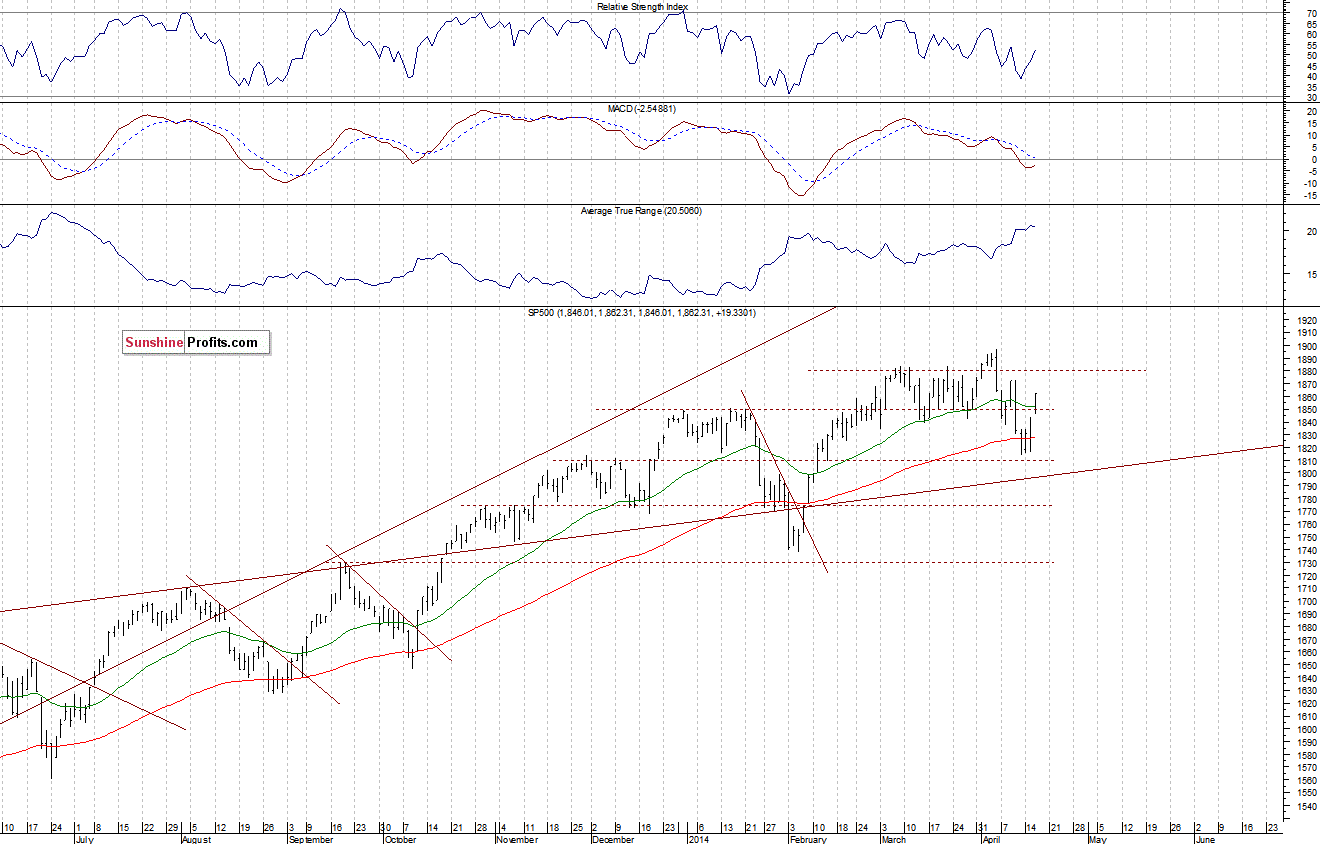

The U.S. stock market indexes gained between 1.0% and 1.3% on Wednesday, extending their recent move up, as investors bet that companies would post good first-quarter results. The S&P 500 index has broken above the resistance of 1,840-1,850, which is a positive signal. The support remains at around 1,800-1,810. The next possible resistance is at 1,880-1,900, marked by month-long consolidation, as we can see on the daily chart:

Expectations before the opening of today’s session are slightly negative, with index futures currently down 0.1-0.2%, following yesterday’s worse-than-expected quarterly earnings report release from Google Inc. The main European stock market indexes have lost 0.1-0.3% so far. Investors will now wait for some economic data announcements: Initial Claims at 8:30 a.m., Philadelphia Fed number at 10:00 a.m. The S&P 500 futures contract (CFD) trades in a relatively narrow intraday range, along the level of 1,850. The nearest important resistance is at around 1,865, marked by last week’s local highs. On the other hand, the support is at 1,830-1,840, among others, as the 15-minute chart shows:

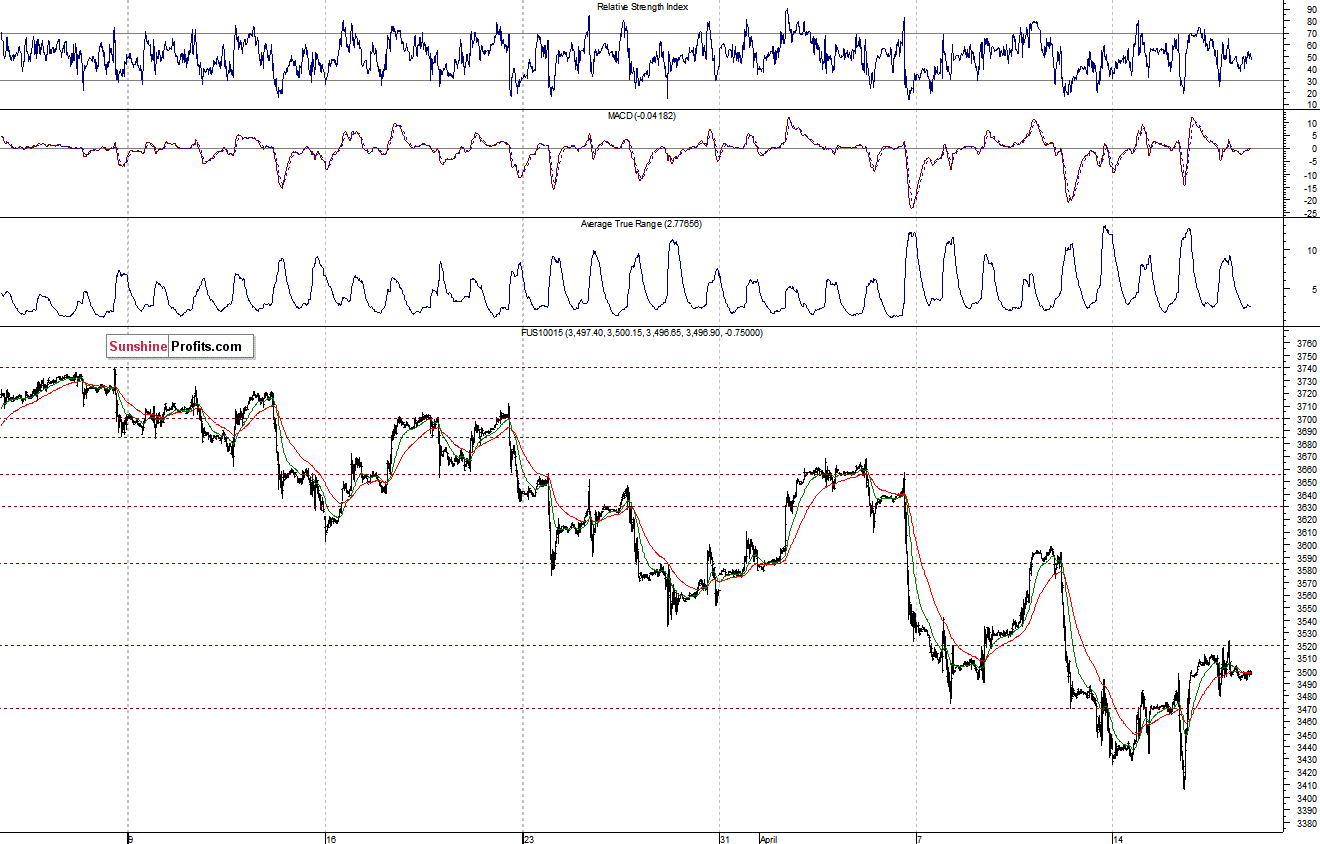

The technology Nasdaq 100 futures contract (CFD) trades along the level of 3,500, following a rebound from recent selloff. The resistance is at around 3,500-3,520, and the nearest important support is at 3,470-3,490. For now, it looks like a correction within downtrend, as there have been no confirmed downtrend reversal signals so far:

Concluding, this week’s move up doesn’t look so corrective anymore. However, there is still no clear medium –term uptrend, as the S&P 500 index continues to consolidate along its December-January local highs. We will wait for another opportunity to open a trading position - at this time opening one doesn't seem justified from the risk/reward point of view.

Due to Holiday travel plans there will be no Stock Trading Alert on Monday, April 21,

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts