Briefly: In our opinion short positions are still favored (stop-loss at 1,850, short-term profit target at around 1,800, S&P 500 index), and they have been already profitable.

Our intraday outlook is neutral, as the market may consolidate after selling off recently, and our short-term outlook remains bearish, following breakdown below March-April consolidation:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

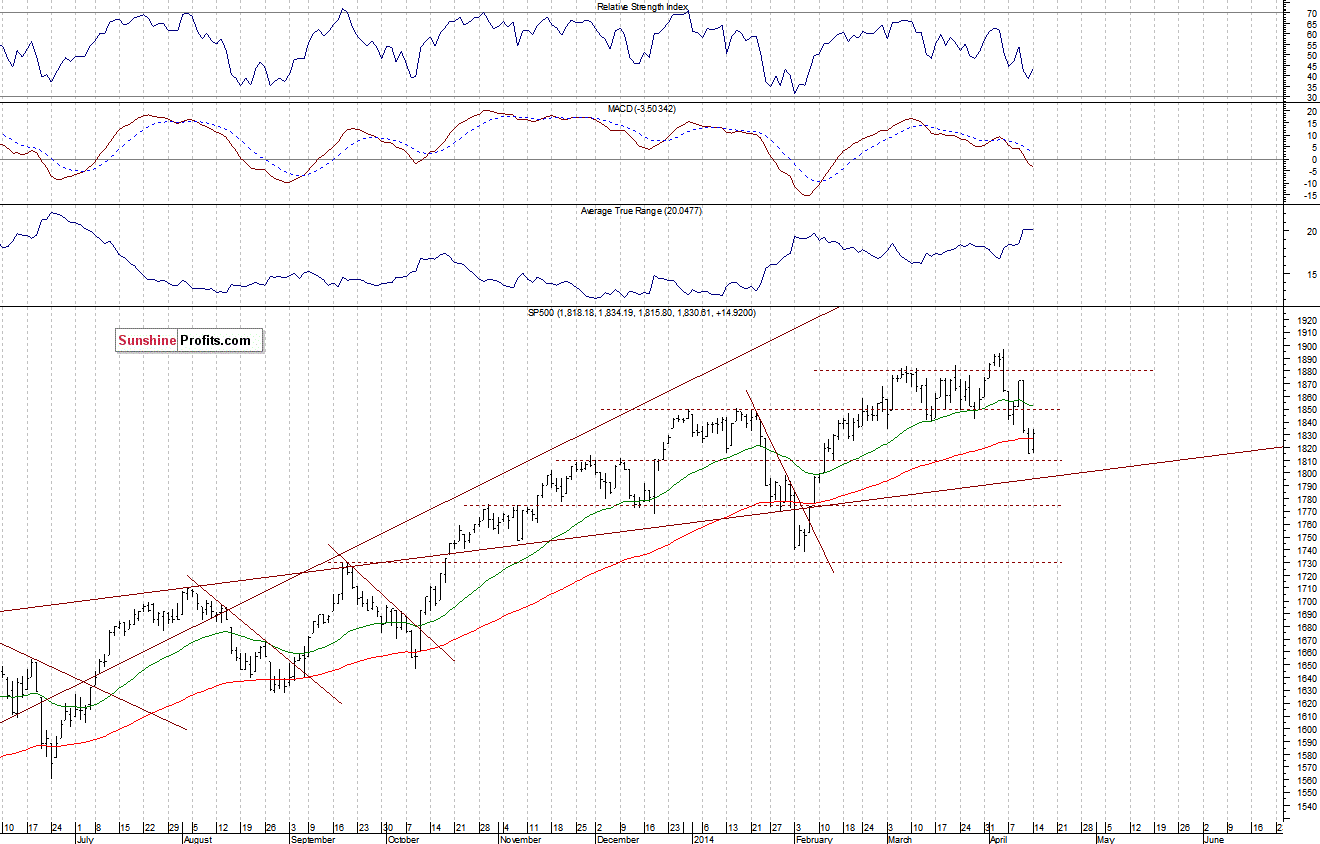

The U.S. stock market indexes gained 0.8-0.9% on Monday, retracing some of the recent move down, despite ongoing worries over Russia-Ukraine conflict, as investors awaited quarterly corporate earnings releases, economic data announcements. The S&P 500 index has managed to stay above the level of support at around 1,800-1,810, extending short-term consolidation following recent decline, just as we have predicted in our yesterday’s Stock Trading Alert. On the other hand, the resistance remains at 1,840-1,850. For now, it looks like a flat correction within short-term downtrend, as we can see on the daily chart:

Expectations before the opening of today’s session are slightly negative, with index futures currently down 0.1-0.2%. The main European stock market indexes have lost between 0.5% and 1.0%. Investors will now wait for some economic data announcements: Consumer Price Index, Empire Manufacturing number at 8:30 a.m., NAHB Housing Market Index at 10:00 a.m. They will also wait for some of today’s quarterly corporate earnings releases: JNJ, KO (before market open). The S&P 500 futures contract (CFD) trades in a relatively narrow intraday range, following a rebound off the support level at around 1,800. The resistance is at 1,825-1,830, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) continues to trade below the level of 3,500, as it consolidates after recent selloff. The nearest important support level is at around 3,430. For now, it looks like another flat correction within downtrend:

Concluding, there have been no confirmed short-term downtrend reversal signals so far. However, we can see some uncertainty, as investors await quarterly earnings releases, holiday season, still paying close attention to crisis in Ukraine.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts