Our intraday outlook is neutral, and our short-term outlook remains neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

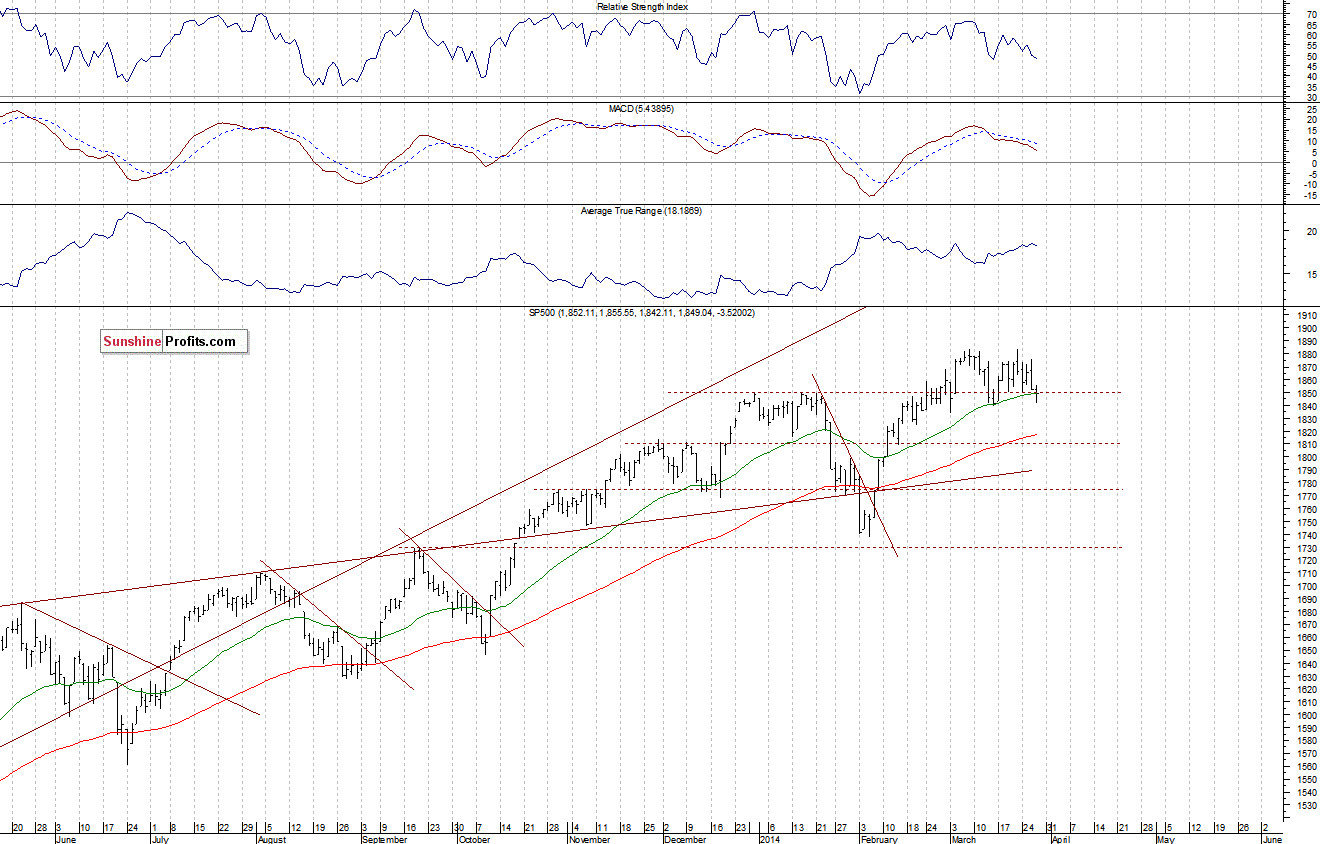

Long-term outlook (next year): bullish

The main U.S. stock market indexes were mixed between -0.6% and 0.0% on Thursday, as investors hesitated following recent move down. The S&P 500 index trades within its month-long consolidation, testing the support at around 1,840-1,850. For now, it looks like a flat correction within long-term uptrend, however, a medium-term downward correction scenario cannot be excluded. The resistance remains at 1,880-1,900, as we can see on the daily chart:

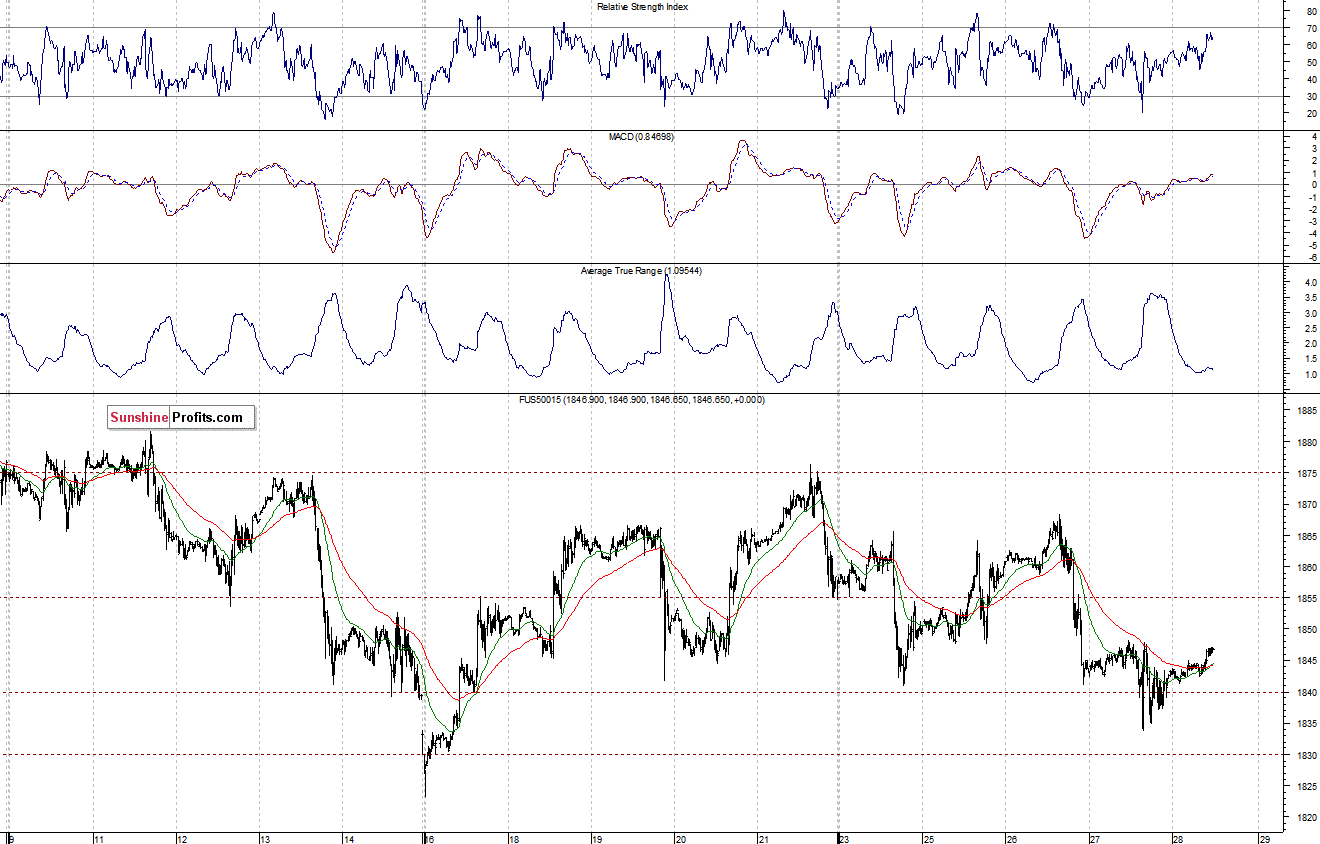

Expectations before the opening of today’s session are positive, with index futures currently up 0.3-0.5%. The European stock market indexes have gained 0.6-0.9% so far. Investors will now wait for some economic data announcements: Personal Income, Personal Spending, PCE Prices – Core indicator at 8:30 a.m., Michigan Sentiment at 9:55 a.m. The S&P 500 futures contract (CFD) continues to fluctuate in its few week long trading range. The nearest important support is at around 1,830-1,840. There is no clear short-term trend, as the 15-minute chart shows:

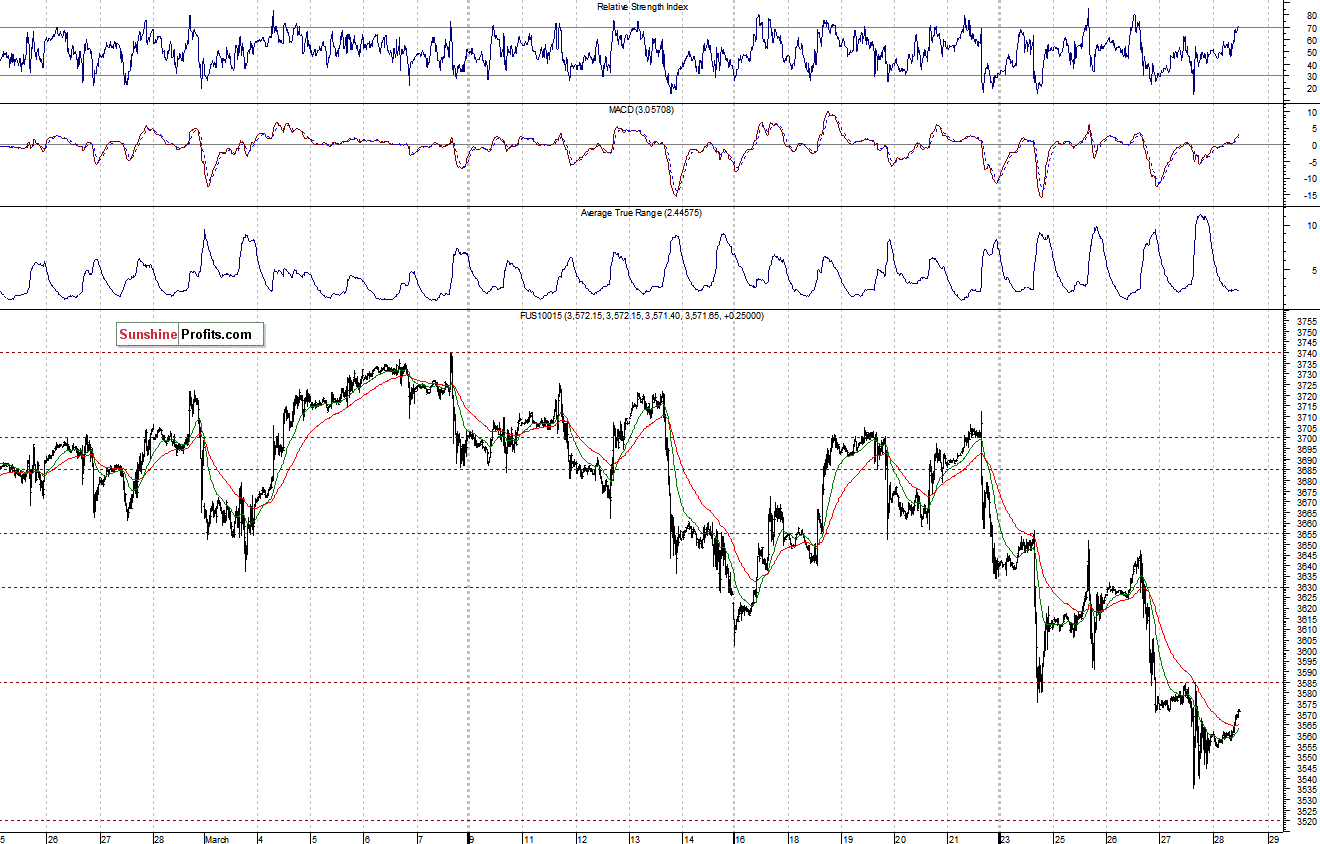

The technology Nasdaq 100 futures contract (CFD) remains relatively weaker, as it trades below its recent low. The resistance is at 3,680-3,700, and the nearest support is at around 3,540, marked by yesterday’s low. The market remains in a short-term downtrend:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts