Our intraday outlook is neutral, and our short-term outlook remains neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

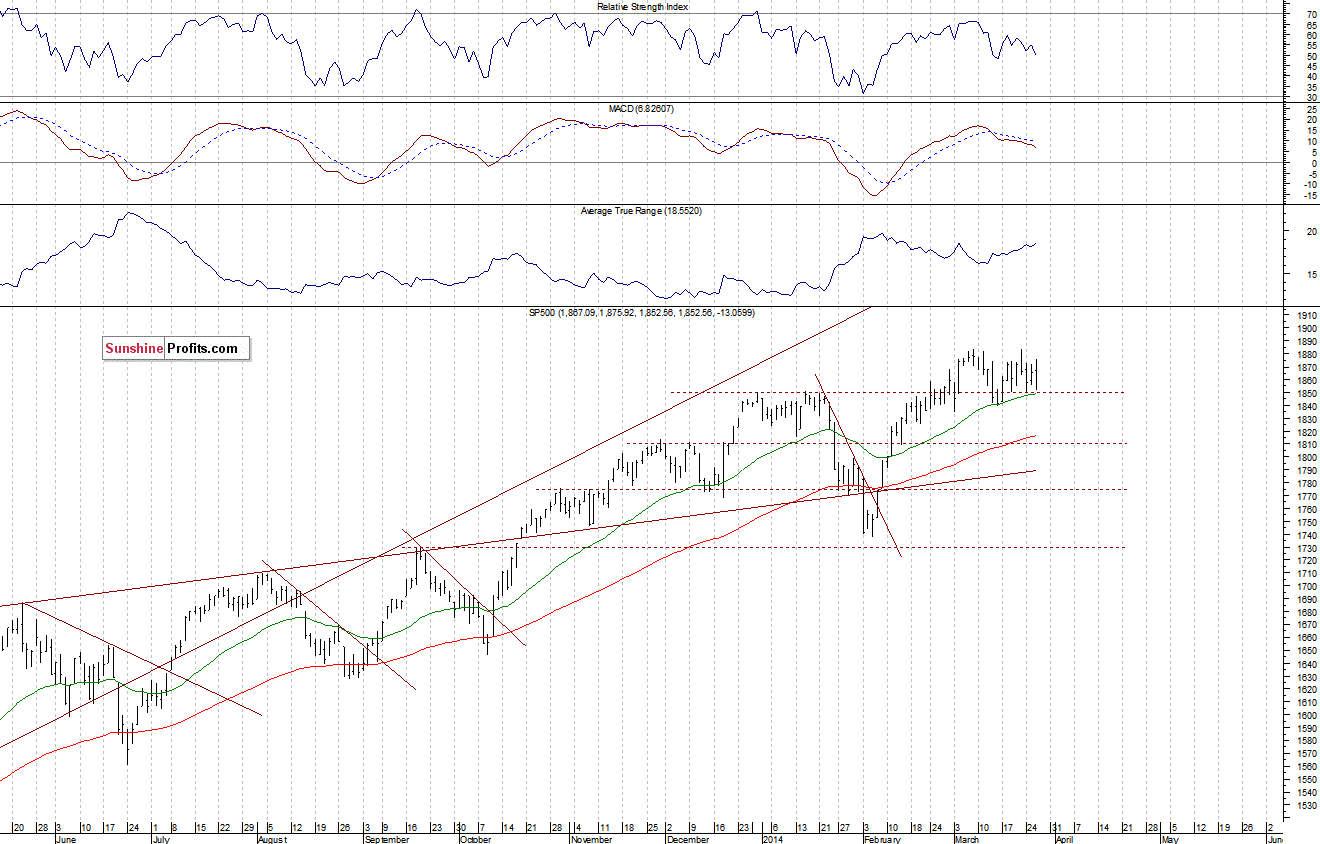

The U.S. stock market indexes lost 0.6-1.3% yesterday, moving away from their long-term highs once again, as investors reacted to some geopolitical news concerning Russia-Ukraine conflict, among others. However, the S&P 500 index remains in a month-long consolidation, still above the support level of 1,840-1,850. The resistance is at 1,880-1,900. There is no clear short-term trend, as we can see on the daily chart:

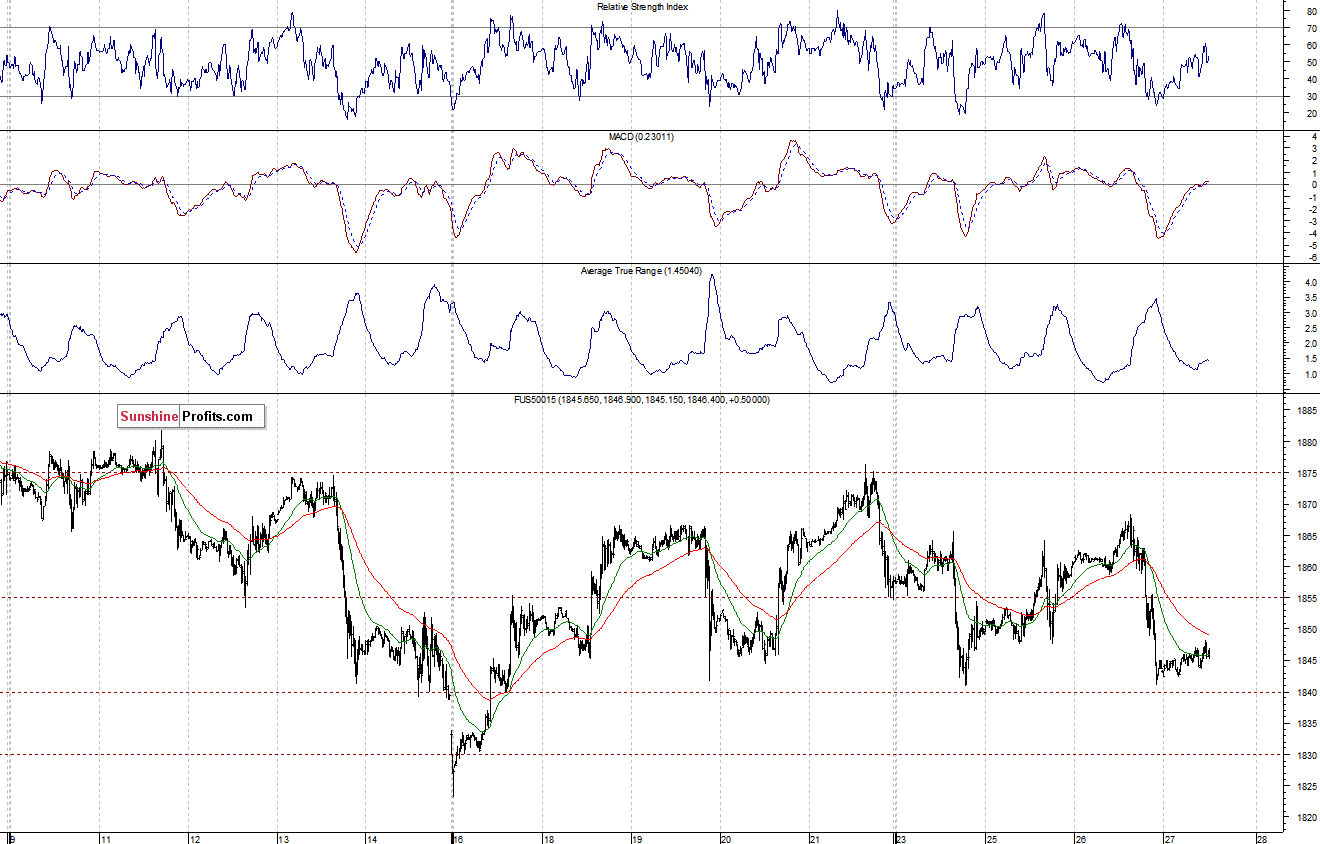

Expectations before the opening of today’s session are slightly positive, with index futures currently up 0.2%. The main European stock market indexes have been mixed between -0.5% and +0.1% so far. Investors will now wait for some economic data releases: Initial Claims, Q4 GDP at 8:30 a.m., Pending Home Sales number at 10:00 a.m. The S&P 500 futures contract (CFD) continues to trade in a short-term consolidation. The nearest important support is at around 1,840, as the 15-minute chart shows:

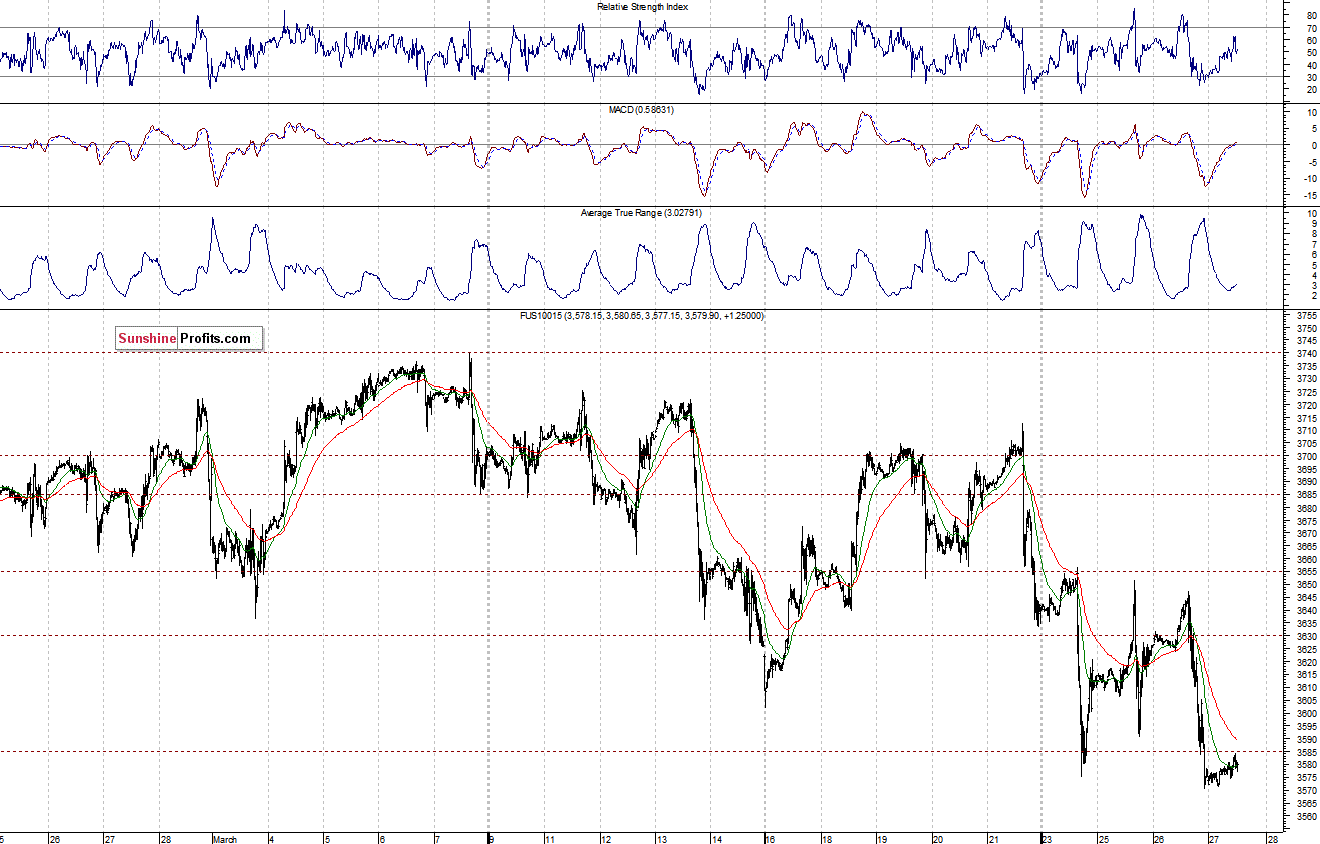

The technology Nasdaq 100 futures contract (CFD) extended its recent move down, remaining relatively weaker, as it broke below the level of 3,600. We can see some increased volatility. There have been no confirmed short-term downtrend reversal signals so far:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts