Our intraday outlook is neutral, and our short-term outlook remains bearish:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

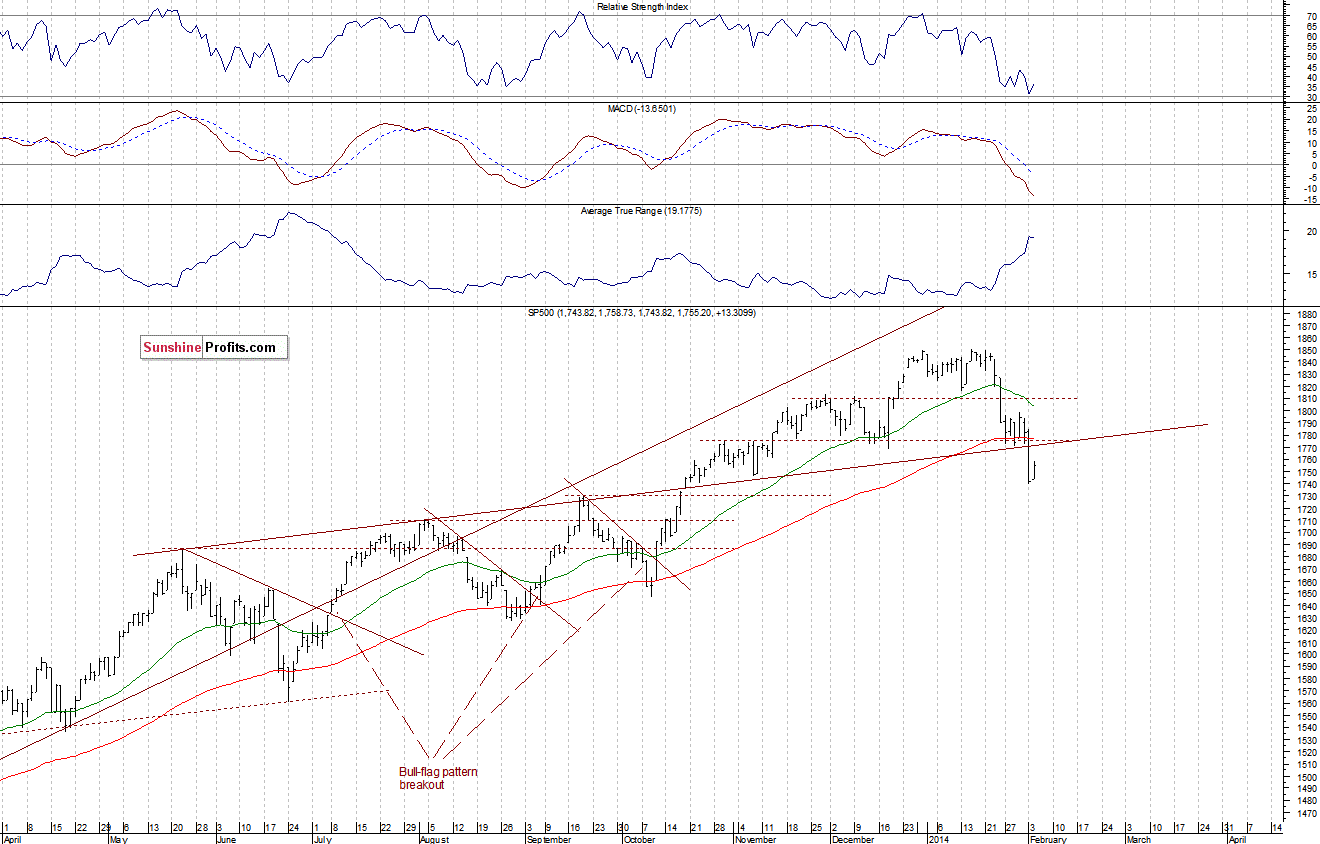

The U.S. stock market indexes gained between 0.5% and 0.9% yesterday, bouncing off recent lows, as investors hoped for a short-term downtrend reversal. The S&P 500 index traded within the lower half of Monday’s trading range, below the resistance off 1,770-1,775, marked by previous support. On the other hand, there is a possible support at around 1,730, marked by last September’s local high of 1,729.86. For now, it looks like a rather flat correction following recent sharp decline, as we can see on the daily chart:

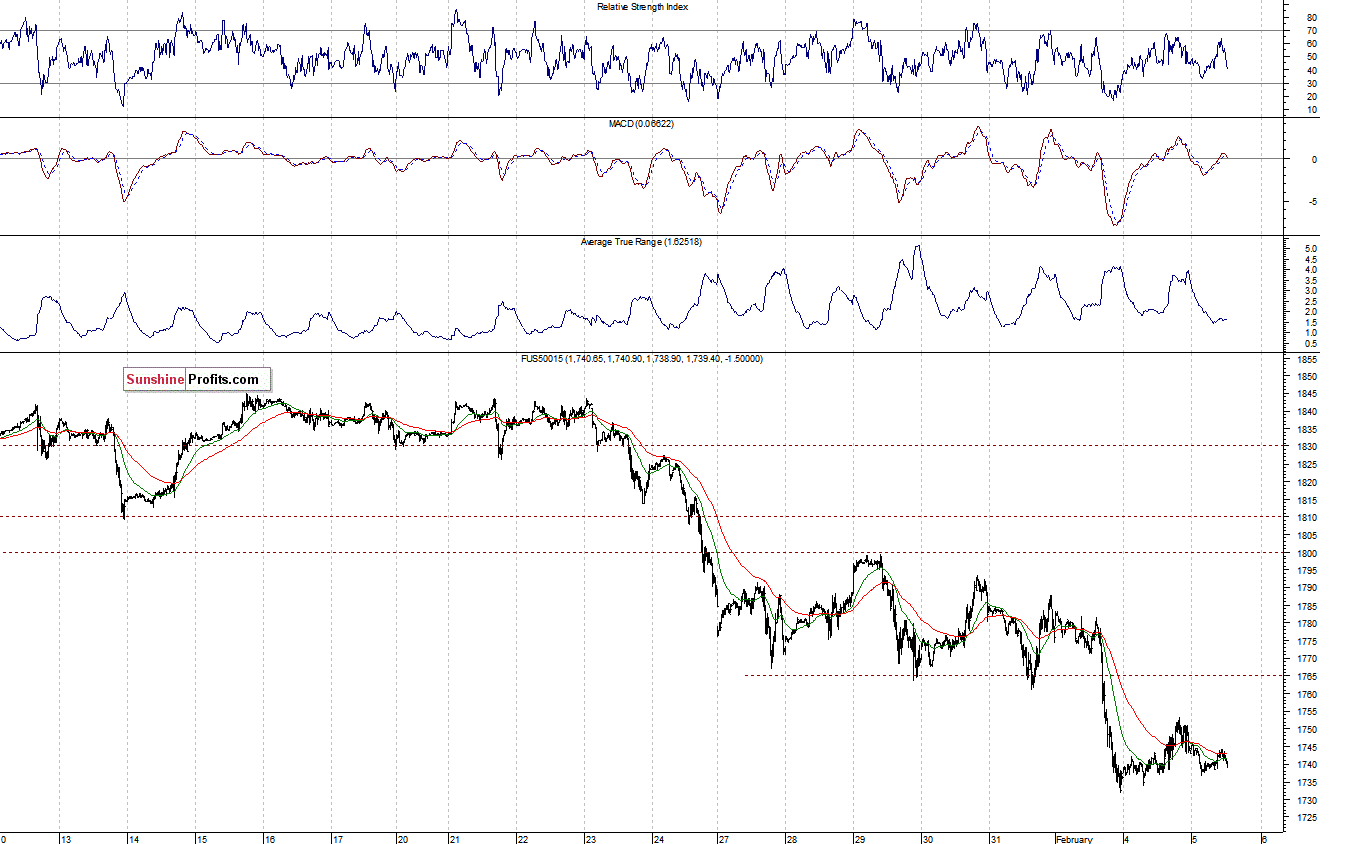

Expectations before the opening of today’s session are negative, with index futures currently down 0.2-0.3%. The main European stock market indexes have been mixed so far. Investors will now wait for some economic data announcements: ADP Employment Change report at 8:15 a.m., ISM Services number at 10:00 a.m. The S&P 500 futures contract (CFD) remains in a relatively narrow trading range, extending consolidation following Monday’s selloff. The support is at around 1,735-1,740, and the resistance is at 1,750:

The technology Nasdaq 100 futures contract (CFD) bounced off Monday’s low, however, there is no clear trend, just a consolidation following recent move down. The resistance is at around 3,470, and the support is at 3,425-3,430, as the 15-minute chart shows:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts