Our intraday outlook is neutral, and our short-term outlook remains neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

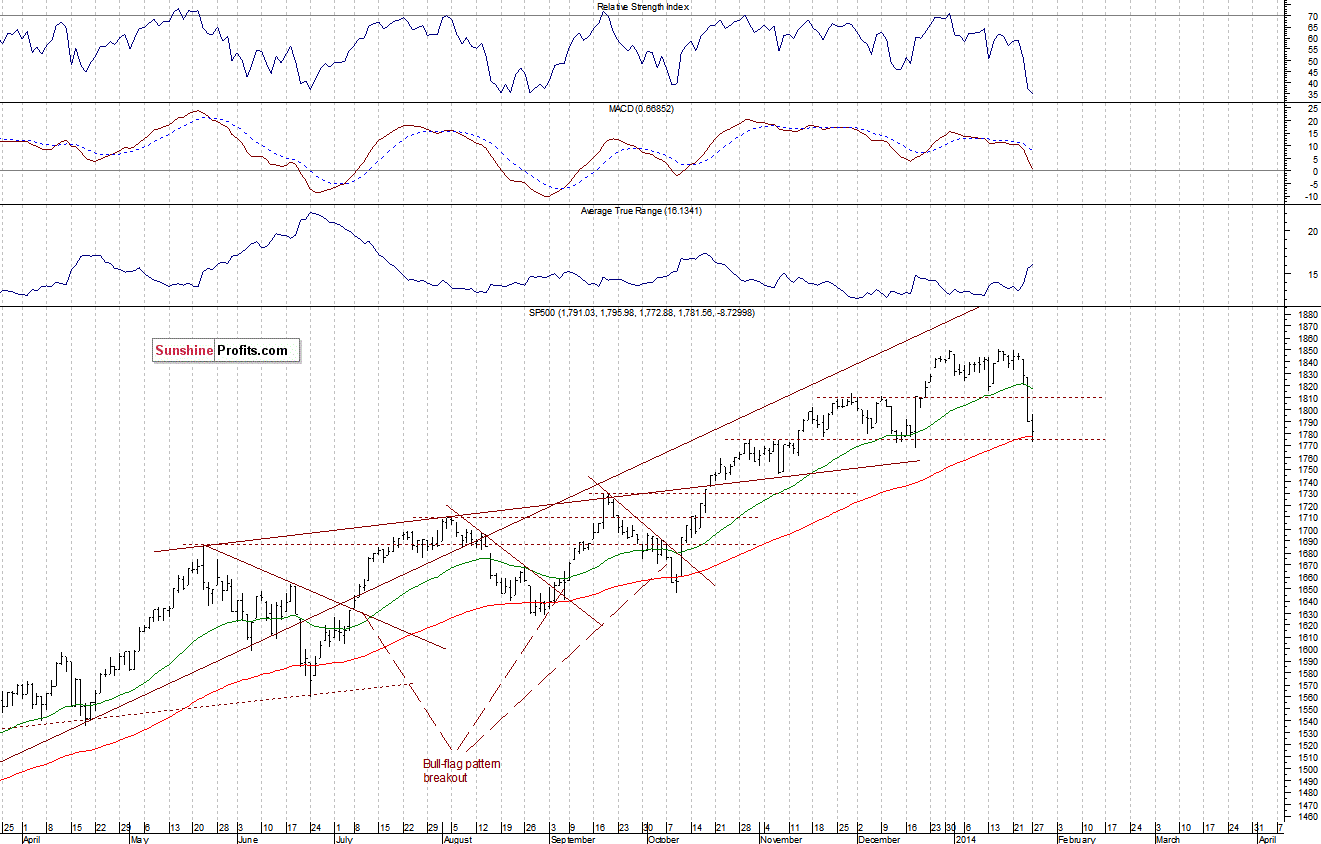

The U.S. stock market indexes lost between 0.3% and 0.9% on Monday, extending their recent move down. However, the S&P 500 index is in a 25-point consolidation below the level of 1,800. The nearest important resistance is at 1,800-1,810, marked by the previous support. On the other hand, potential support is at around 1,775, marked by the October-November consolidation, as we can see on the daily chart:

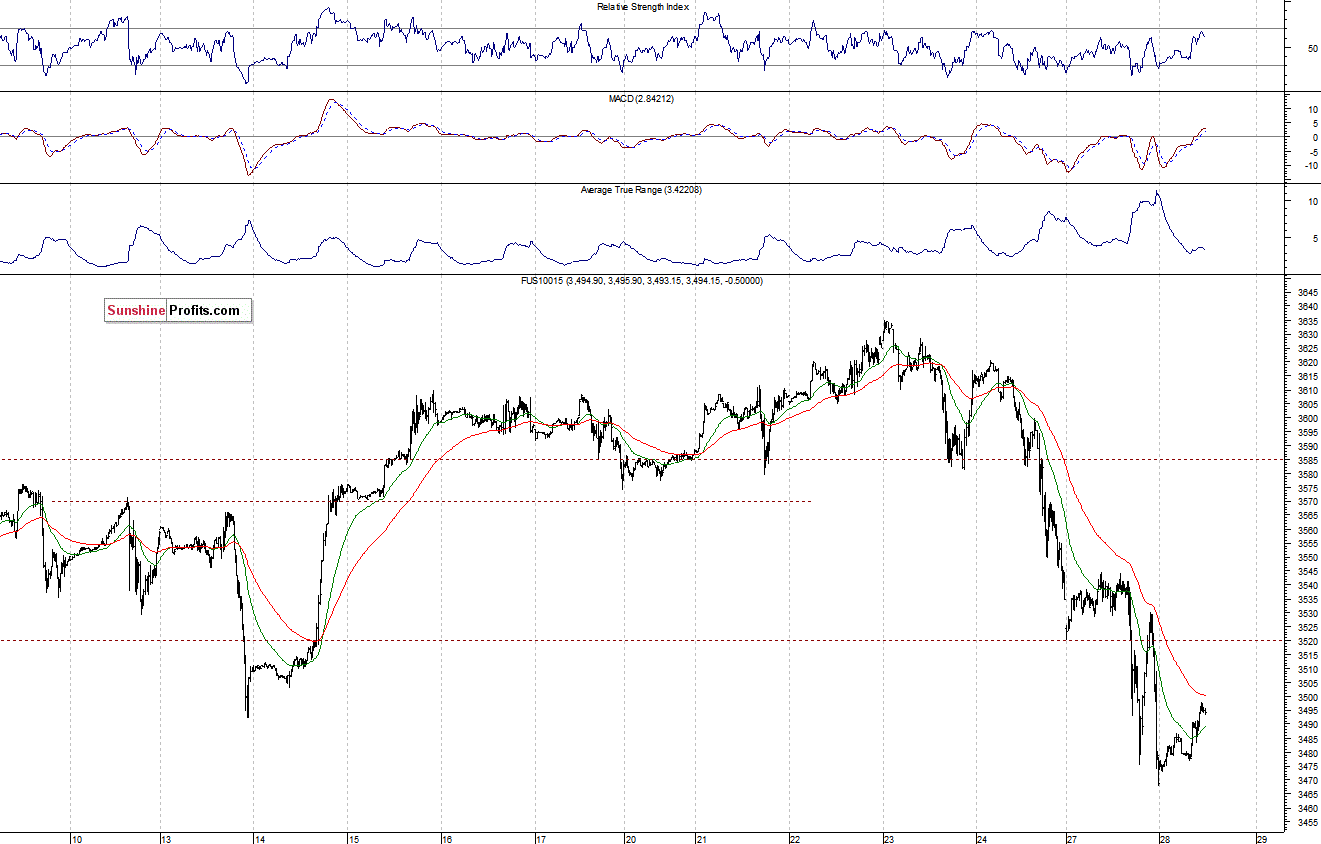

Expectations before the opening of today’s session are mixed, with index futures currently between -0.4% and +0.5%. The main European stock market indexes have gained 0.3-0.7% so far. Investors will now wait for some economic data announcements: Durable Orders at 8:30 a.m., Case-Shiller 20-city Index at 9:00 a.m., and the Consumer Confidence number at 10:00 a.m. The S&P 500 futures contract (CFD) bounced off yesterday’s low at around 1,770. For now, it looks like a flat correction within the recent downtrend. The nearest important resistance is at 1,790, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) sold off following yesterday’s after-hours Apple Inc. quarterly earnings release. The support is at around 3,470, and the nearest important resistance is at the psychological 3,500. We can see some increased volatility, which may lead to some kind of a short-term downtrend reversal pattern:

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts