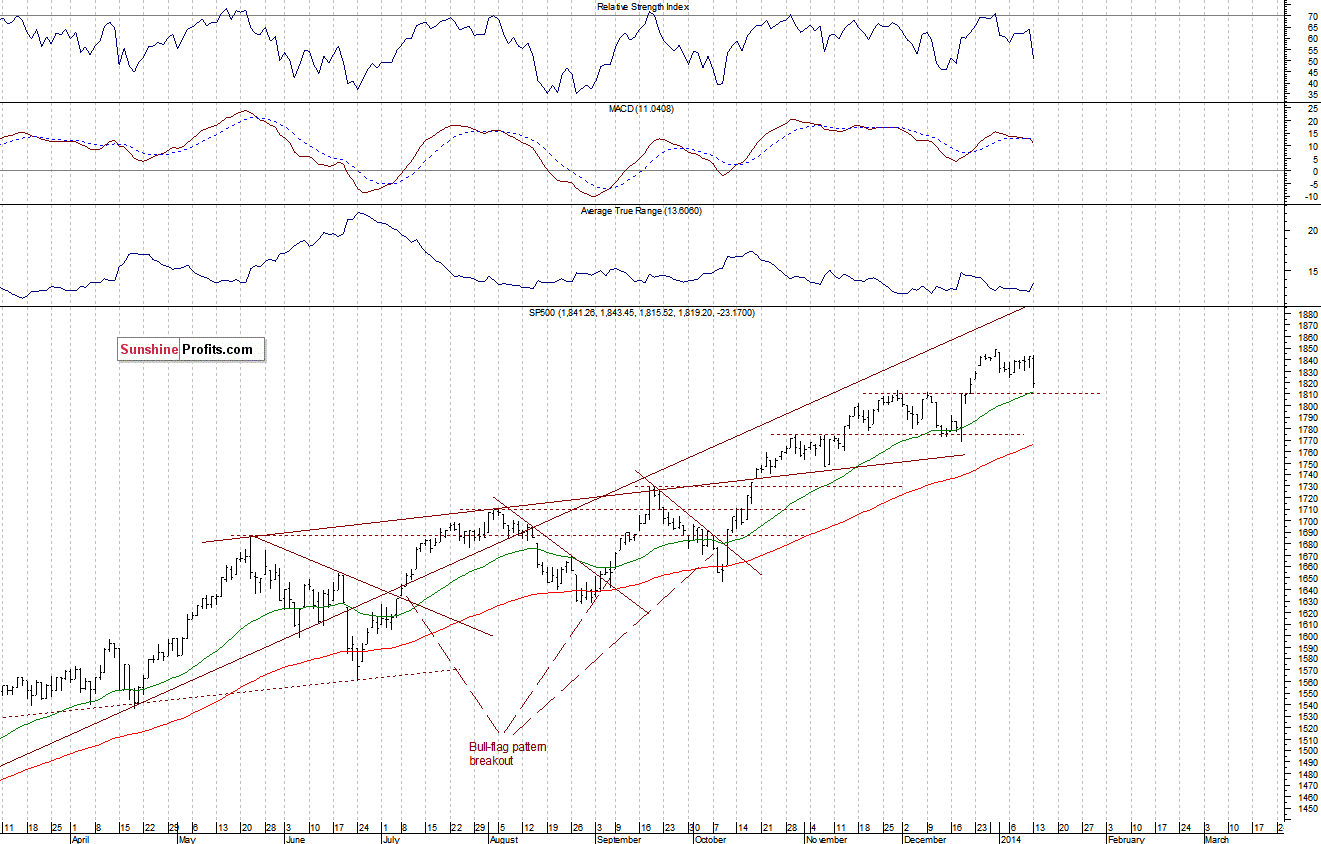

The main. U.S. stock market indexes lost between 1.1% and 1.5% on Monday, as investors feared that the Fed will continue to taper its bond purchases program. The S&P 500 index broke below the support at around 1,830, marked by the December 26 daily gap up of 1,829.75-1,834.96. The nearest important support is at 1,800-1,810, marked by the November-December consolidation. On the other hand, the resistance is 1,830, marked by the previous support, as we can see on the daily chart:

Expectations before the opening of today’s session are virtually flat, with index futures between 0.0% and +0.1%. vs. their Monday’s closing prices. The European stock market indexes have lost 0.2-0.6% so far. Investors will now wait for some economic data announcements: Retail Sales at 8:30 a.m., Business Inventories at 10:00 a.m. The S&P 500 futures contract (CFD) trades below its recent consolidation, which is a negative signal:

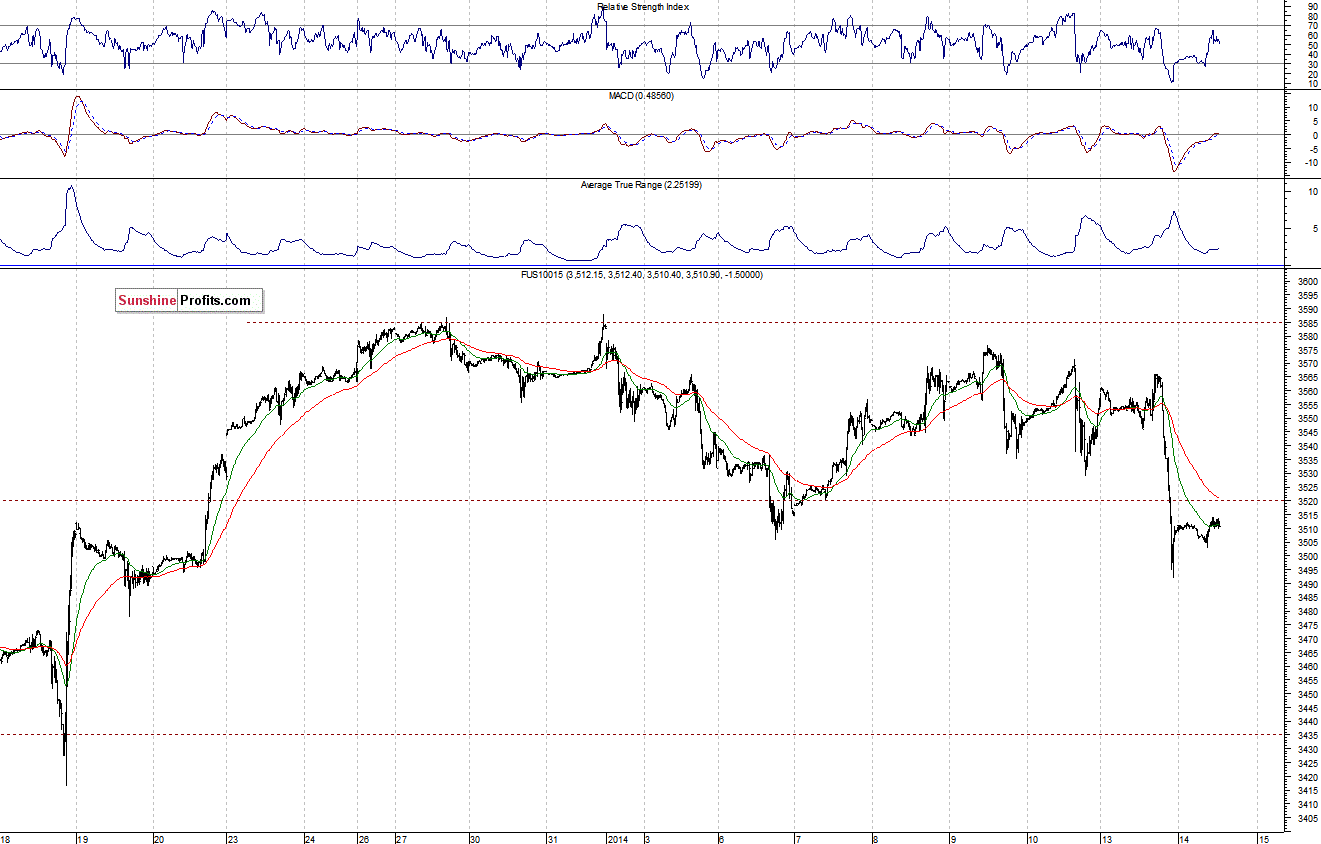

The Nasdaq 100 futures contract (CFD) is below its early January local low. The resistance remains at around 3,580-3,600. On the other hand, the nearest important support is at the psychological level of 3,500. It may be hard for the market to remain above this support level, as yesterday’s selling pressure indicates quite strong downward momentum, as the 15-minute chart shows:

Our intraday outlook is neutral, and our short-term outlook is now bearish as indexes broke below their recent trading range:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

Thank you,

Paul Rejczak