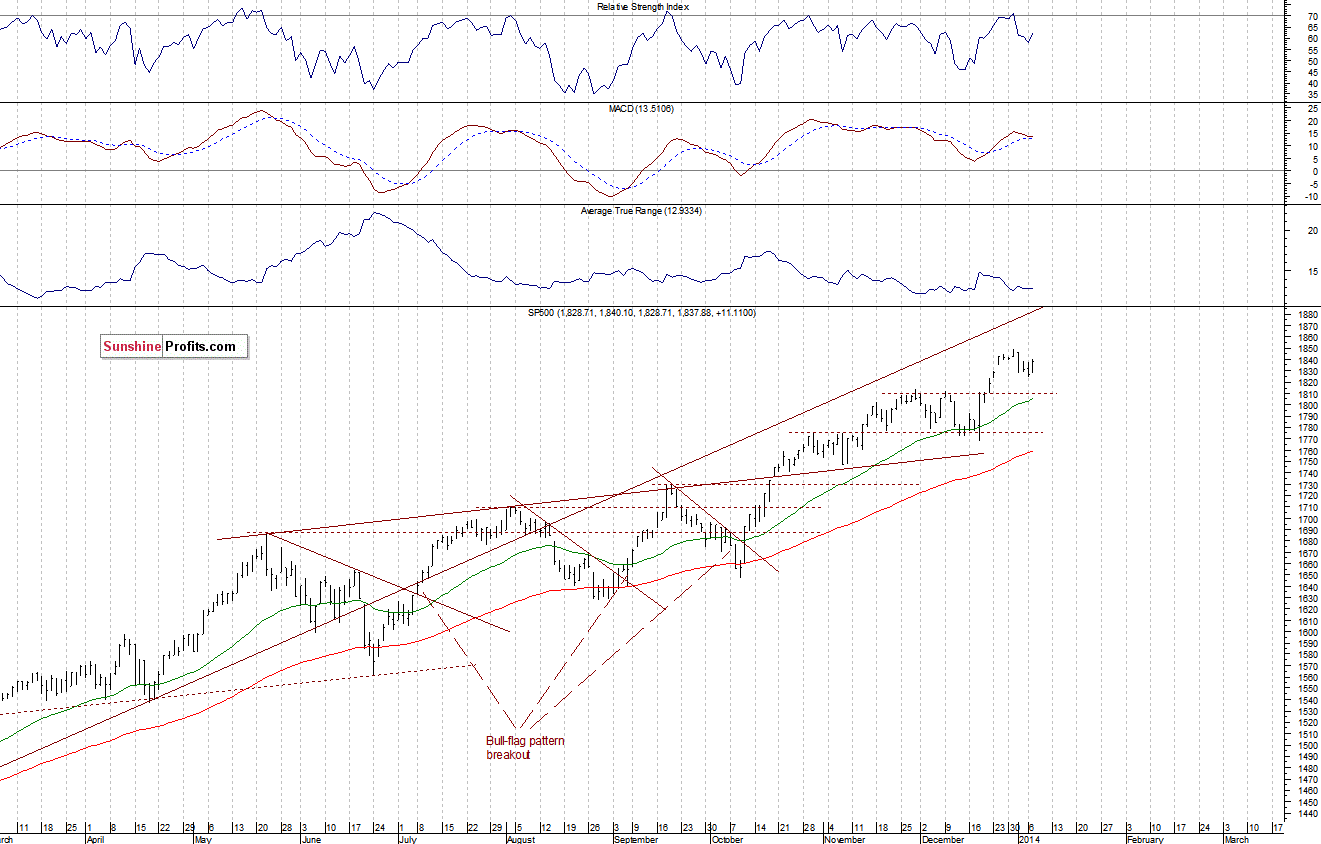

The U.S. stock market indexes gained between 0.6% and 0.9% yesterday, as investors were buying the latest dip. The S&P 500 index bounced off the support at around 1,830, marked by the December 26 daily gap up of 1,829.75-1,834.96. However, it is early to say downward correction has ended. The nearest important resistance is at around 1,840-1,850, marked by the December 31 all-time high of 1,849.44. For now, it looks like a short-term consolidation, as we can see on the daily chart:

Expectations before the opening of today’s session are virtually flat, with index futures contracts currently down 0.1%. The main European stock market indexes have lost 0.1-0.4% so far. Investors will now wait for some economic data announcements: ADP Employment Change report at 8:15 a.m., FOMC Minutes release at 2:00 p.m. The S&P 500 futures contract (CFD) continues to fluctuate below the resistance of 1,830-1,835, extending its week-long consolidation. The support remains at around 1,820. The market trades within the late December daily gap up, as the 15-minute chart shows:

The Nasdaq 100 futures contract (CFD) bounced off support at around 3,500-3,520, retracing around 61.8% of its recent decline. The resistance remains at around 3,560-3.590, marked by the long-term highs, and year-end double top pattern:

Our intraday outlook is now neutral, and our short-term outlook remains neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

Thank you,

Paul Rejczak