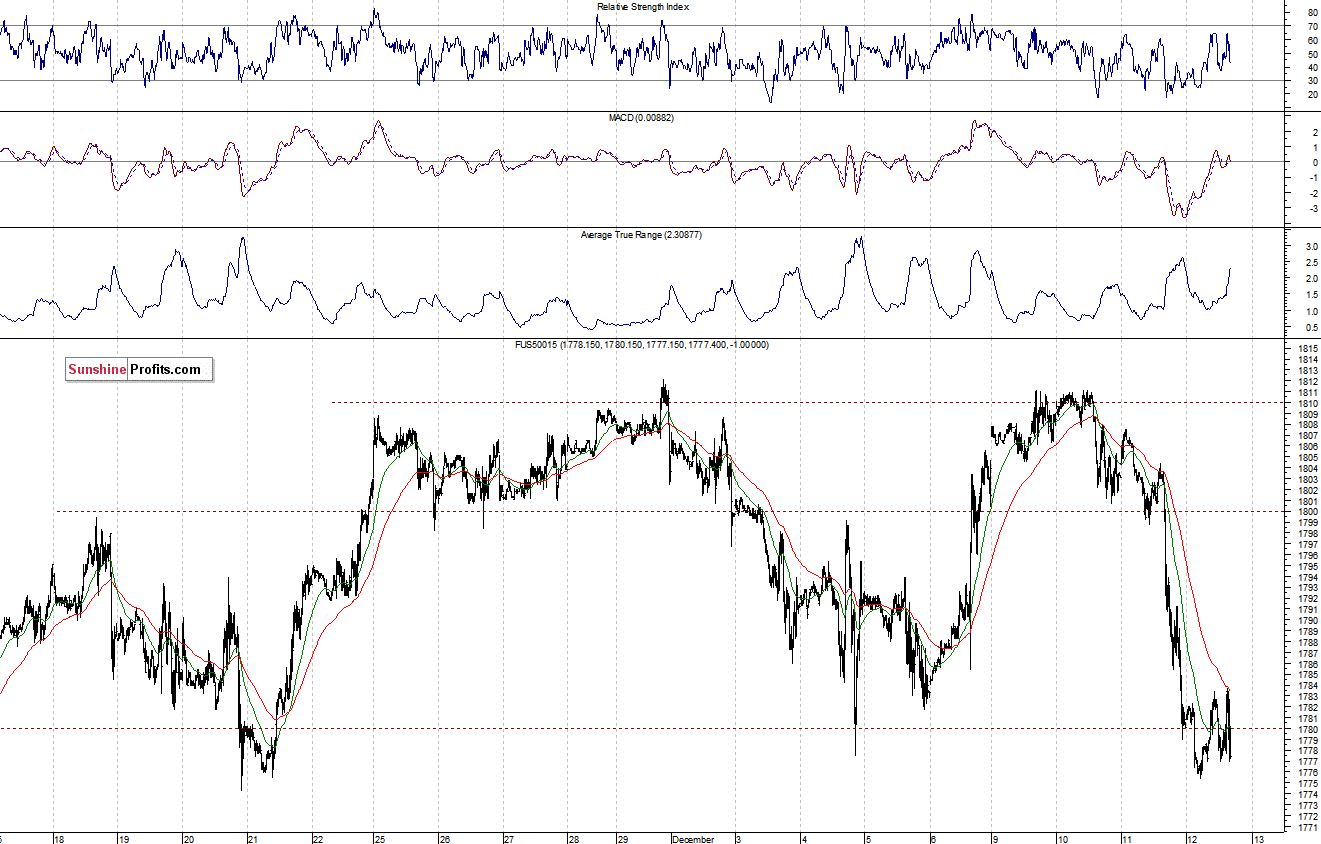

The U.S. stock market indexes are currently mixed between 0.0% and +0.1%, as investors hesitate following recent decline. The S&P 500 index remains at its crucial support of 1,770-1,775, with no clear short-term direction. The S&P 500 futures contract (CFD) extended the recent move down slightly, however it continues to fluctuate around the level of 1,770. The nearest important resistance is at 1,780-1,785, as we can see on the 15-minute chart:

The Nasdaq 100 futures contract (CFD) trades near its early December local low, at the support of 3,450, practically extending relatively narrow intraday consolidation below the resistance of 3,470-3,480, as the 15-minute chart shows:

Our intraday outlook remains bearish, and our short-term outlook is bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

Thank you,

Paul Rejczak