The U.S. stock market indexes gained between 0.3% and 0.7% yesterday, extending their recent uptrend, as investors awaited quarterly earnings reports, and today’s FOMC Rate Decision, amongst others. The S&P 500 index made a new all-time high at 1,772.04. The nearest important support is at around 1,760, marked by last week’s high of 1,759.33. The next support is at 1,733.45-1,735.74, marked by the October 18 daily gap up. The market continues its long-term uptrend, however, there is some overbought, as we can see on the daily chart:

Expectations before the opening of today’s session are positive, with index futures currently gaining 0.3-0.4%. The European stock market indexes have gained 0.5-0.6% so far. Investors will now wait for the economic data announcements: ADP Employment Change report at 8:15 a.m., GDP and Consumer Price Index at 8:30 a.m., and finally the FOMC Rate Decision at 2:15 p.m. The S&P 500 futures contract (CFD) remains in a short-term uptrend, reaching new highs above the level of 1,770. The nearest support is at 1,765-1,770, marked by some of the recent highs, as the 15-minute chart shows:

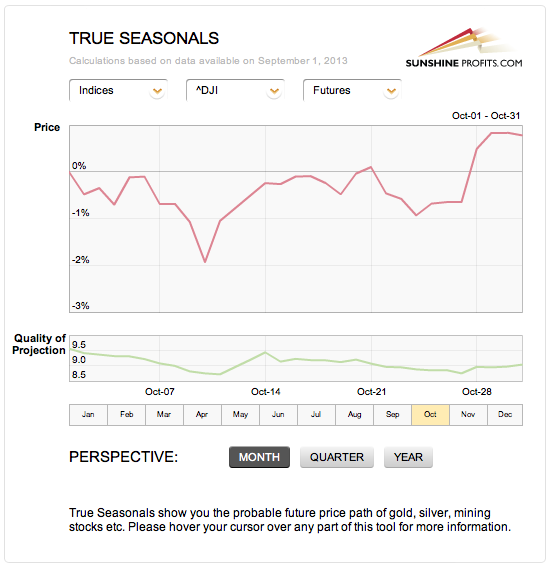

The recent uptrend seems to be in line with the seasonal pattern for the stock market behavior. Investors tend to buy stocks in the late October, as we can see on the True Seasonals chart:

Despite being wrong recently, our intraday outlook remains bearish, and our short-term outlook is still neutral, as there may be some uncertainty following recent rally:

Intraday outlook: bearish

Short-term outlook: neutral

Medium-term outlook: neutral

Long-term outlook: bullish

The above analysis is the first of today's 2+ Stock Trading Alerts. Stay as updated as possible on the current events and trends on the stock market by choosing our Stock Trading Alert subscription service

Thank you,

Paul Rejczak