Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- WTI Crude Oil [CLM22] Long around the $100.28-101.99 support area (yellow band) with stop just below $96.52 and targets at 107.76, 110.74 & 113.07.

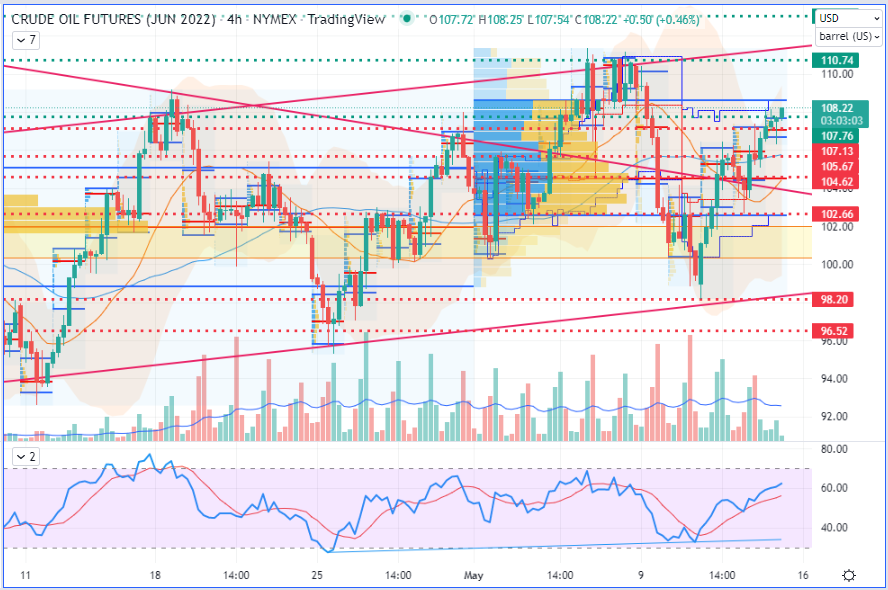

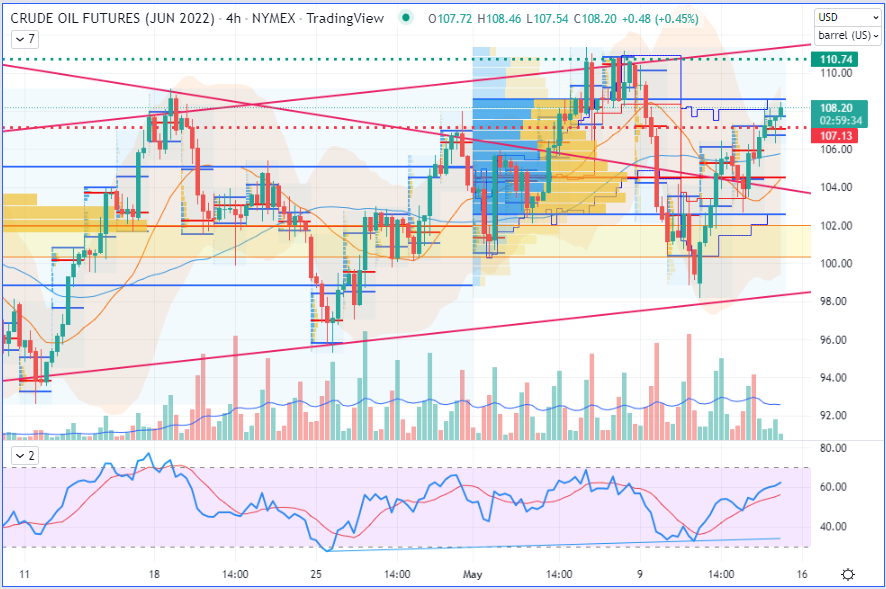

Trade status update: entry triggered – stop lifted on Wednesday just below 98.20 – stop lifted just below $102.66 on Thursday, turning it into a stop-win (above breakeven) – stop lifted just below $107.13 as the market hit our first target – as market has just broke out yesterday’s high ($108.13), I decided to drag it up again to the next level, located just below $107.13 – keeping it tight – for the rest of the position.

See on below charts all my stop increments (both on daily and 4H charts):

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

WTI Crude Oil (CLM22) Futures (June contract, 4H chart)

As usual, here are cleaner views of them with just the dragged stop and the next (2nd) target:

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

WTI Crude Oil (CLM22) Futures (June contract, 4H chart)

Read more: Article about one of my risk management methods.

That’s all, folks, for today. Have a nice weekend!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist