Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified on a risk/reward point of view.

- RBOB Gasoline No new position justified on a risk/reward point of view.

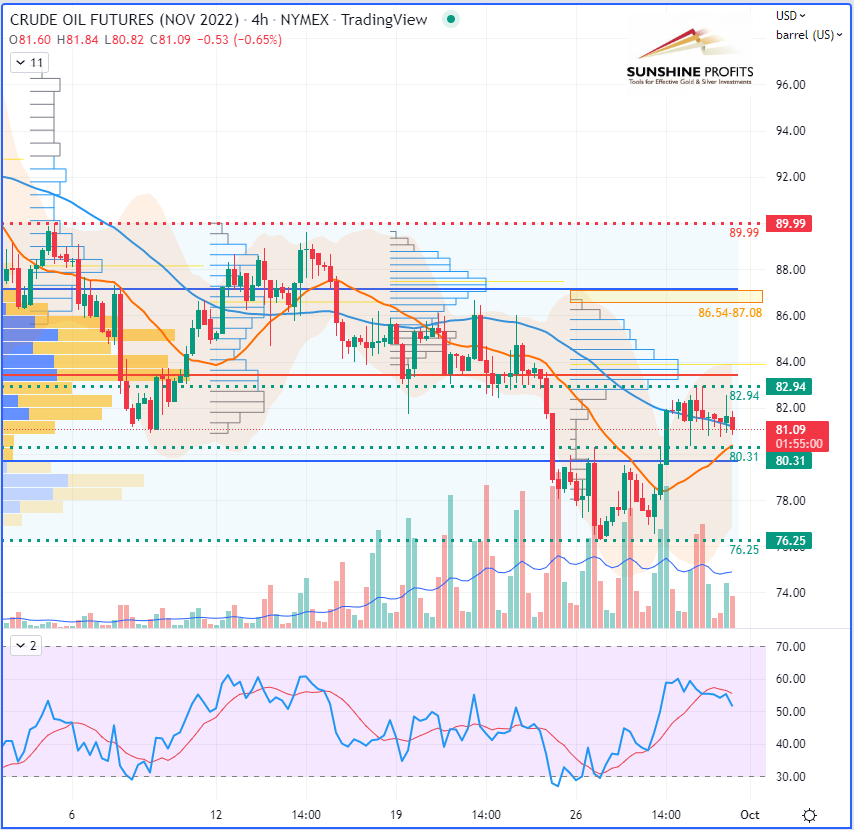

- WTI Crude Oil [CLX2022] Short around the 86.54-87.08 area (yellow band) with stop at 89.99 and targets at 82.94, 80.31 & 76.25.

- Brent Crude Oil No new position justified on a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

For some guidance on risk management in a more dynamic dimension while managing multiple contracts, I invite you to read an article I wrote on how to spread risk for a trade.

WTI Crude Oil (CLX22) Futures (November contract, daily chart)

WTI Crude Oil (CLX22) Futures (November contract, 4H chart)

That’s all, folks, for today. Have a nice weekend!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist