Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

- Henry Hub Natural Gas No new position justified on a risk/reward point of view.

- RBOB Gasoline No new position justified on a risk/reward point of view.

- WTI Crude Oil No new position justified on a risk/reward point of view.

- Brent Crude Oil No new position justified on a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

What are the (macro-)economic, geopolitical, and technical factors driving oil prices this week?

After progressing in their July-August range between $85 and $100, and despite Saudi-leaded OPEC+ output cut, black gold has walked down the stairs to re-explore the lower floor.

Macroeconomics

On the macroeconomic view, the greenback explored a new roof as the DXY marched just above $110 at the beginning of the week – still regularly progressing within its yearly regression channel with a Pearson’s R (correlation coefficient) of 97 %.

U.S. Dollar Currency Index (DXY), daily chart

Fundamental Analysis

On Monday, Saudi-leaded OPEC+ members agreed to a small production cut of 100,000 barrels per day from October onwards to bolster prices. The key to this decision is also the possible return of Iran to the market if the economic sanctions are lifted. Indeed, Iran could add up to 1 million bpd to the market even though President Joe Biden told Israeli Prime Minister Yair Lapid during their meeting a week ago that an Iranian nuclear deal was out of the question in the short-term.

It seems that the risk of losing Russian energy supplies is no longer enough to support prices, as traders are focused on demand. In addition, poor Chinese trade figures have recently been published, with a sharp slowdown in export growth, to 7.1% year on year in August (compared to 18% in July). On oil more specifically, Chinese crude imports are down 4.7% since the start of the year compared to the same period in 2021, and imports of refined products have shrunk by 15.9%. Added to this is the new wave of health restrictions, which now affect several hundred million Chinese, to stem a new wave of COVID-19 cases with very strict policies.

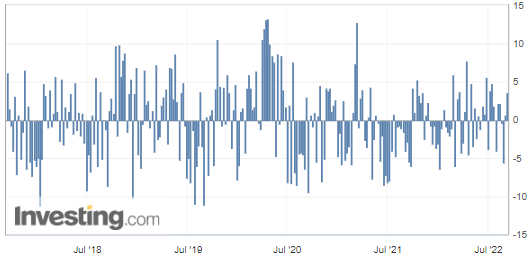

U.S. API Weekly Crude Oil Stock

On Wednesday, the American Petroleum Institute (API) released the weekly change in crude oil stock. During the week ended September 4, oil inventory levels were build to an excess of 3.645M barrels, while analysts were anticipating a very light decline.

(Source: Investing.com)

Geopolitics

Russian President Vladimir Putin uses oil and gas as an economic weapon, but the market, rather than worrying about its effect on supply, has turned its attention to the effect on weakening demand at high energy prices. Moreover, on Wednesday, the Russian head of state warned that Russia would no longer deliver oil or gas to countries that would cap the prices of hydrocarbons exported by Moscow since the G7-group and the European Union have prepared projects ranging in this direction.

“Russia will respond to price caps on Russian oil by shipping more oil to Asia,” Russian Energy Minister Nikolai Shulginov said on Tuesday morning at the Eastern Economic Forum in Vladivostok.

“Russia and partners are considering setting up their own insurer to facilitate oil trade.”

“Nothing has been decided on Nord Stream 1 gas pipeline resumption.”

These comments expressed by Nikolai Shulginov came just a few days after members of the G7-group agreed last Friday to impose a price cap on Russian oil in a bid to hit Moscow's ability to finance the war in Ukraine.

Technical Analysis

On the daily chart, WTI crude oil (October contract) has just broken below its 10-week support and is moving towards the lower band of the regression channel (which was set with two standard deviations from the mean regression line).

WTI Crude Oil (CLV22) Futures (October contract, daily chart)

RBOB Gasoline (RBV22) Futures (October contract, daily chart)

Brent Crude Oil (BRNV22) Futures (October contract, daily chart) – Contract for Difference (CFD) UKOIL

That’s all, folks, for today. Stay tuned for our next oil trading alert!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist