Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Those entering the market now can do so by holding long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Have you seen the news? “Oil Price Climbs to 6-week High” and “Oil Price Falls Due to India Demand Worries” on the same day? If you wonder why – read on.

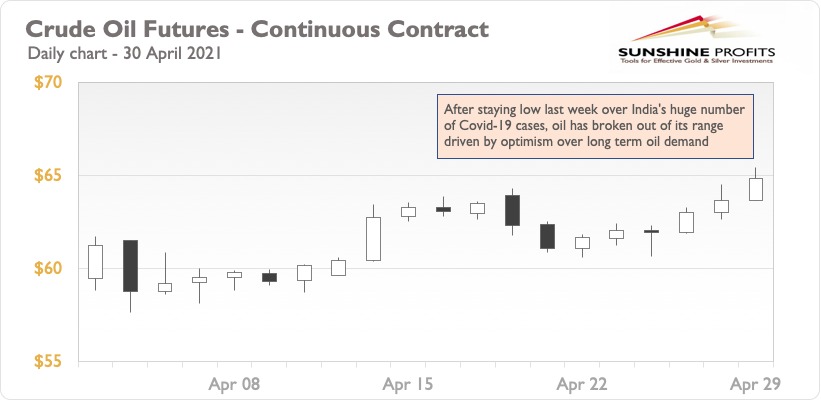

Oil rallied and reached a high of $65.47 yesterday (Apr. 29) before falling to sub-63.5 levels as per the latest numbers. As expected in my last alert, there were multiple signals indicating a breakout of oil from rangebound behaviour but not in a straight-line manner. Concerns over Asian oil demand are not diminishing – on the contrary, they led to push-pull behaviour.

Furthermore, Japan is reeling from the climbing cases as the virus spreads. However, so far oil demand numbers are encouraging. According to the latest data from METI, oil demand in March 2021 was only 2.9% lower than in Mar 2020. So, we are already approaching pre-Covid levels, but it will be more certain once April numbers are out.

Another positive indicator of increasing demand has also emerged in the US. EIA has released data of increased air travel leading to an increase in US jet fuel consumption. Currently approaching around 1.5 million passengers per day, the number is still away from the pre-Covid levels of 2.5 million passengers per day. But this year alone, the number has doubled from 0.75 million in Jan 2021 to the current 1.5 million indicating a strong comeback for the US economy.

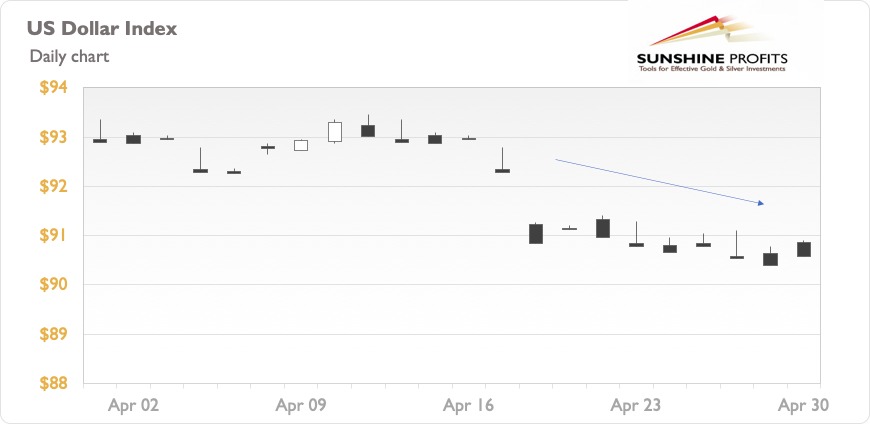

I also predicted a continuous trend of a falling dollar, which has been actualizing, as can be seen in the below chart. As the index lowers towards the psychological $90 support, crude gets strengthened and inches upwards. More importantly, though, expected inflation in the coming months could serve as a catalyst needed for the highly anticipated big rally of the black gold.

Oil above $70 cannot be ruled out and is very much in play. For this week, I’d rather wait on the sidelines than take a position, though. Those who entered at around $60 had a chance of profit booking – the price target of $65.5 was just a hairline width away from the price high of $65.47.

To summarize, we are witnessing a strong bullish market followed by a medium bearish pullback. Driven by highly optimistic reports from policy makers and influencers, oil will continue to climb with some dancing around. Moreover, with inflation just around the corner, the $70 level cannot be ruled out.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Those entering market now can do so by holding long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist