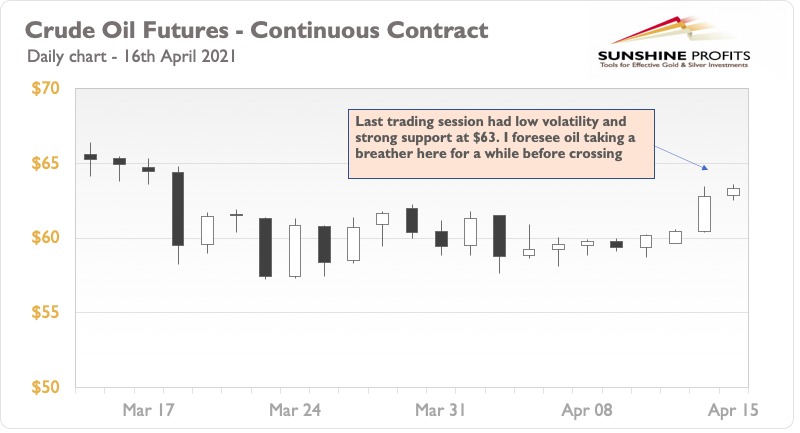

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Pandemic related demand dampeners are getting steam again and will be hard to ignore. Will this make for a bumpy ride ahead for crude?

On Friday (Apr. 16), the head of the World Health Organization (WHO) said – “Globally, the number of new cases per week has nearly doubled over the past two months. This is approaching the highest rate of infection that we have seen so far during the pandemic.” While the number of infections in itself doesn’t impact oil demand, the resulting lockdowns and “Stay at Home” orders do.

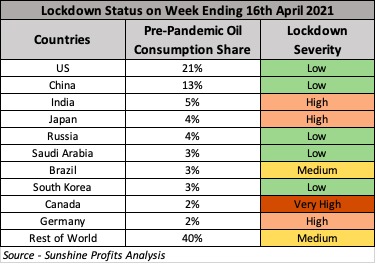

Hence, every week, I will share an update on the lockdown status for top oil consuming countries. As seen in the table above, the top oil consuming countries like India, Japan, Canada and Germany have “High-Severity” lockdowns limiting mobility and business operations. Brazil, on the other hand, has limited restrictions despite of high number of cases. Fortunately, the top two consumers, the U.S. and China, have low impacts of lockdowns and are in a phase of rapid economic recovery.

I foresee a tumultuous journey for oil ahead. There is the likelihood of some pullback next week, as demand recovery remains in uncertain territory. However, my position remains the same – just that the smooth sailing anticipated earlier may not happen.

Oil is experiencing upward momentum though, and rightly so. Some of the demand improvement optimism comes from the following:

- A sharp drop in U.S. Petroleum Inventories because of record crude draws.

- India having “all-time high” gasoline consumption in Mar 202.

- An upbeat view on global oil demand by the International Energy Agency (IEA).

- Strong summer driving season in the U.S. with miles driven over interstate highways only 2% below the same week (ending April 4th) in 2019.

- China’s refinery output up by 19.7% in Mar 2021 compared to last year.

The above factors pack a lot of ammunition to keep momentum going for this week. Next week can see a breather coupled with a re-evaluation of the market prices. My investment position is in sync with the behavior of key driving factors and market sentiments. In the coming week it’ll be interesting to watch the interplay of the opposing factors.

To summarize, the ongoing upward momentum will continue with intermittent pauses and hiccups. Short term bullish behavior is more certain while in the medium term, there are chances of oil prices going in circles.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Hold long positions with entry at $59-61, with $54.81 as a stop-loss and $65.50 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist