Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil extended gains after news that the OPEC and other producers would cut almost 1.8 million barrels per day in oil output starting from the beginning of 2017. In this environment, light crude approached the Dec high and closed the day at the highest level since months. Where will the commodity head next?

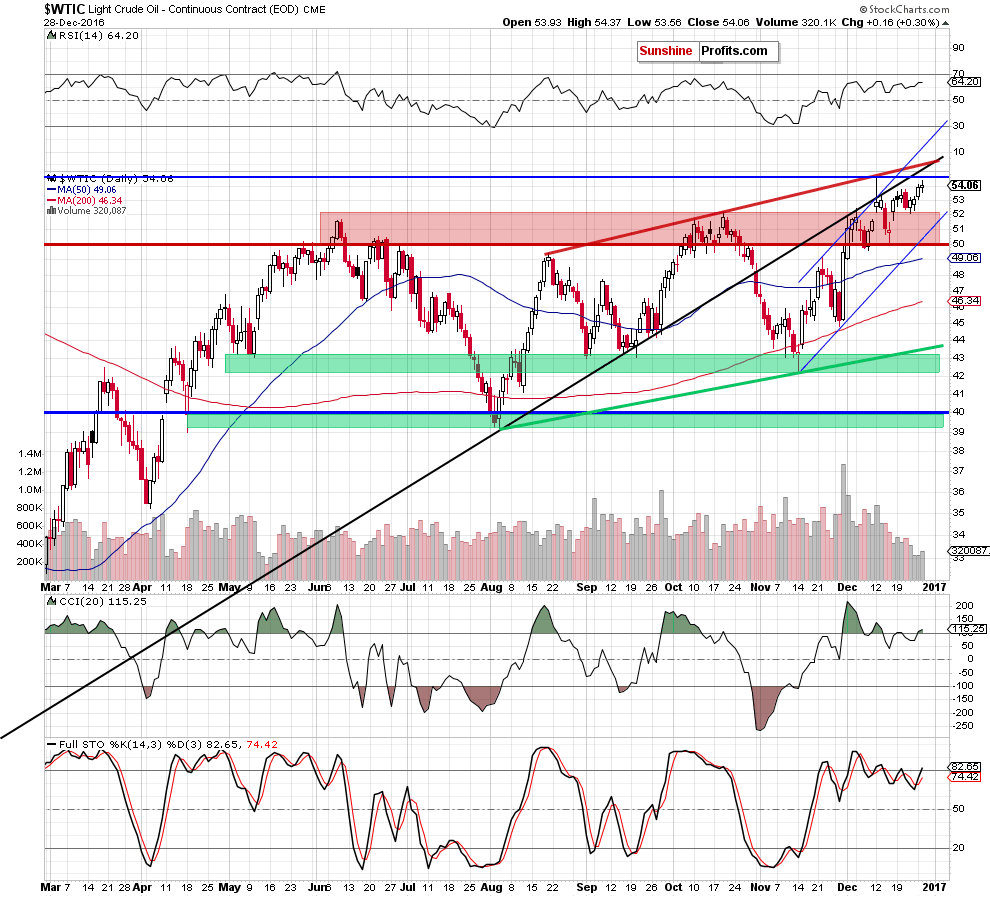

Let’s take a closer look at the chart below to find out (charts courtesy of http://stockcharts.com).

On Tuesday, we wrote:

(…) light crude still remains above the Oct high (there was no invalidation of a breakout), which could trigger a short-term upward move (…) and a test of the medium-term black resistance line or even the red resistance line based on the previous highs.

On the daily chart, we see that the situation developed in line with the above scenario and crude oil extended gains. Thanks to yesterday’s increase, light crude approached the mid-Dec high and closed the day at the highest level since Jul 2015. Additionally, the CCI invalidated earlier sell signal, while the Stochastic Oscillator generated buy signal, which suggests that the black gold may test the medium-term black resistance line or even the red resistance line based on the previous highs in the coming day(s). Such price action, however, would be likely only if the commodity breaks above $54.51.

On top of that, we should keep in mind that the American Petroleum Institute reported yesterday that crude oil inventories in U.S. rose by a 4.2 million barrel in the week to Dec. 23. Therefore, in our opinion, if today’s government data shows another increase in crude oil, gasoline or distillates inventories, oil bulls may have a problem to keep prices at current levels, which could translate into reversal in near future.

Summing up, the outlook for the commodity is mixed at the moment as the commodity is trading in a narrow range between the previously-broken Oct high and the 2016 peak. We could see some more volatility after today’s crude oil inventory report, but at this time we can’t say whether a rally or a decline will be seen next. As always, we will keep you – our subscribers – updated.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts