Trading position (short-term; our opinion): Short positions (with a stop-loss order at $53.22 and initial price target at $46) are justified from the risk/reward perspective.

On Thursday, crude oil lost 2.30% as a stronger U.S. dollar made the commodity less attractive for buyers holding other currencies. In this environment, light crude slipped under the Jun high, invalidating earlier breakout. What does it mean for black gold?

Let’s jump into the charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

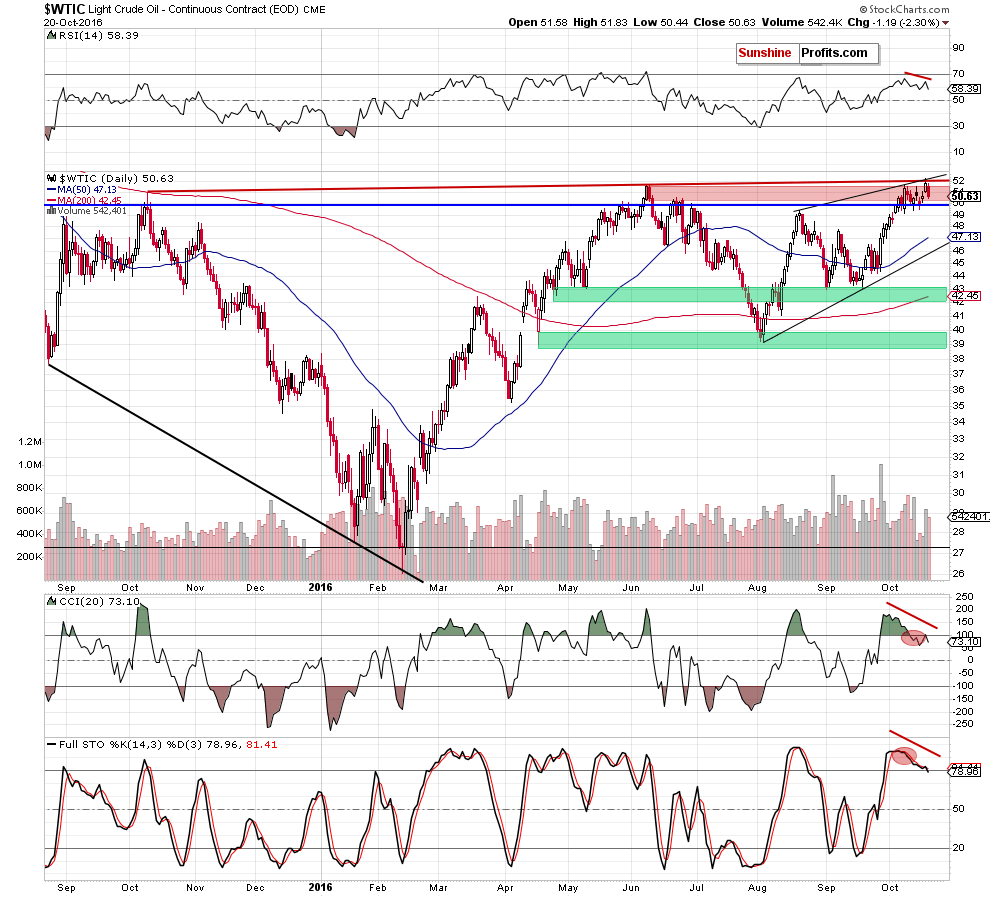

The first thing that catches the eye on the above chart is a breakout above the Jun high and a fresh 2016 high of $52.22. But is this event as bullish as it seems at the first sight? In our opinion, it‘s not. Why?

Firstly, although crude oil broke above the previous high and climbed above the red resistance line (based on the Oct 2015 and Jun 2016 highs), this improvement was very temporary and light crude reversed very quickly, invalidating earlier small (barely visible from the daily perspective) breakout.

Secondly, with yesterday’s downswing, the commodity also invalidated a tiny breakout above the black resistance line based on the Aug and Oct 10 highs, which is an upper border of the black rising wedge (another negative sign).

Thirdly, the size of volume that accompanied yesterday’s increase wasn’t huge (compared to what we saw at the end of Sep and on Oct 13), which raises doubts about oil bulls’ strength.

Fourthly, there are clearly visible negative divergences between the RSI, CCI, Stochastic Oscillator and the price of the commodity, which doesn’t bode well for further rally. At this point, it is also worth noting that although the CCI and Stochastic Oscillator invalidated earlier sell signals, it seems to us that they generate them once again in the very near future (maybe even later today).

Looking at the daily chart, we see that although crude oil hit a fresh 2016 high, oil bulls didn’t manage to hold gained levels (not to mention further improvement), which resulted in a comeback below the Jun high. In this way, the commodity invalidated earlier breakout, which is a negative sign that suggests further deterioration (especially when we factor in the fact that the CCI and Stochastic Oscillator generated sell signals once again) and a test of our yesterday’s first downside targets:

(…) we believe that crude oil will extend losses (...) and (...) if we see further declines, the intial downside target would be the barrier of $50 and recent lows (around $49.15-$49.47).

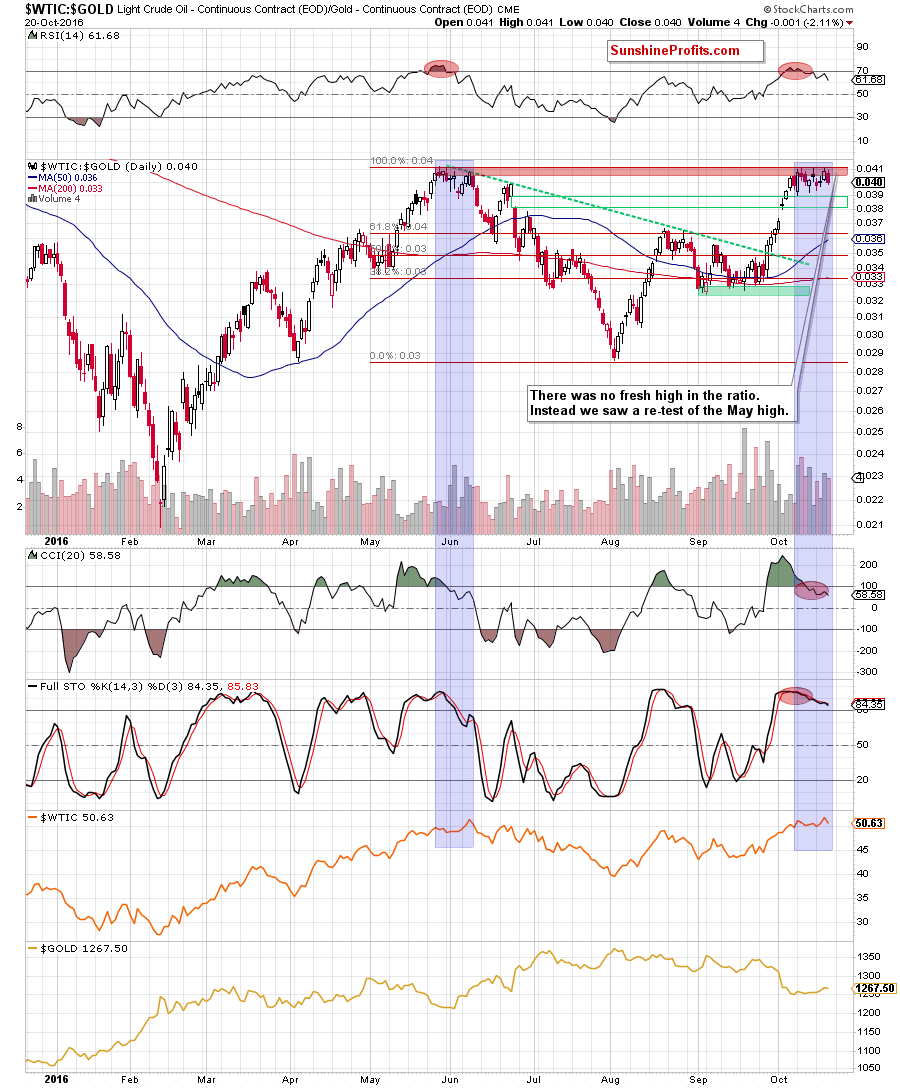

Finishing our today’s alert, please keep in mind what we wrote about the current situation in the oil-to-gold ratio:

(...) although crude oil hit a fresh 2016 high, we didn’t see a similar price action in the case of the ratio. Instead, we saw a re-test of the May high, which means that we have a negative divegence between the commodity and the ratio.

What does it mean for crude oil’s future moves? As you see on the chart, we had a similar situation in May and Jun. Back then the ratio didn’t manage to hit a fresh high in line with crude oil, which translated into declines in both cases – crude oil and tthe ratio. Additionally, sell signals generated by the indicators remain in place, suggesting further deterioration in the ratio and lower prices of light crude as a strong negative correlation remains in place.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil moved lower and invalidated earlier breakout above the Jun high. This negative event in combination with sell signals generated by the indicators and the current situation in the oil-to-gold ratio suggests further deterioration and a test of the barrier of $50 in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $53.22 and initial downside target at $46) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts