Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil moved sharply higher after the EIA report showed a larger-than-expected drop in crude oil and gasoline inventories. Thanks to these bullish numbers, light crude gained 4.66% and climbed above two important resistance lines. Is it enough to trigger a rally to $50?

Although the U.S. Energy Information Administration reported that distillate inventories increased by 3.382 million barrels, the report also showed that crude oil inventories declined by 14.51 million barrels and gasoline inventories dropped by 4.211 million barrels in the week ended September 2, beating analysts’ forecasts. On top of that, supplies at Cushing, Oklahoma decreased by 434,000 barrels. Thanks to these bullish numbers the price of crude oil came back above $47. Will we see a test of the barrier of $50 in the coming week?

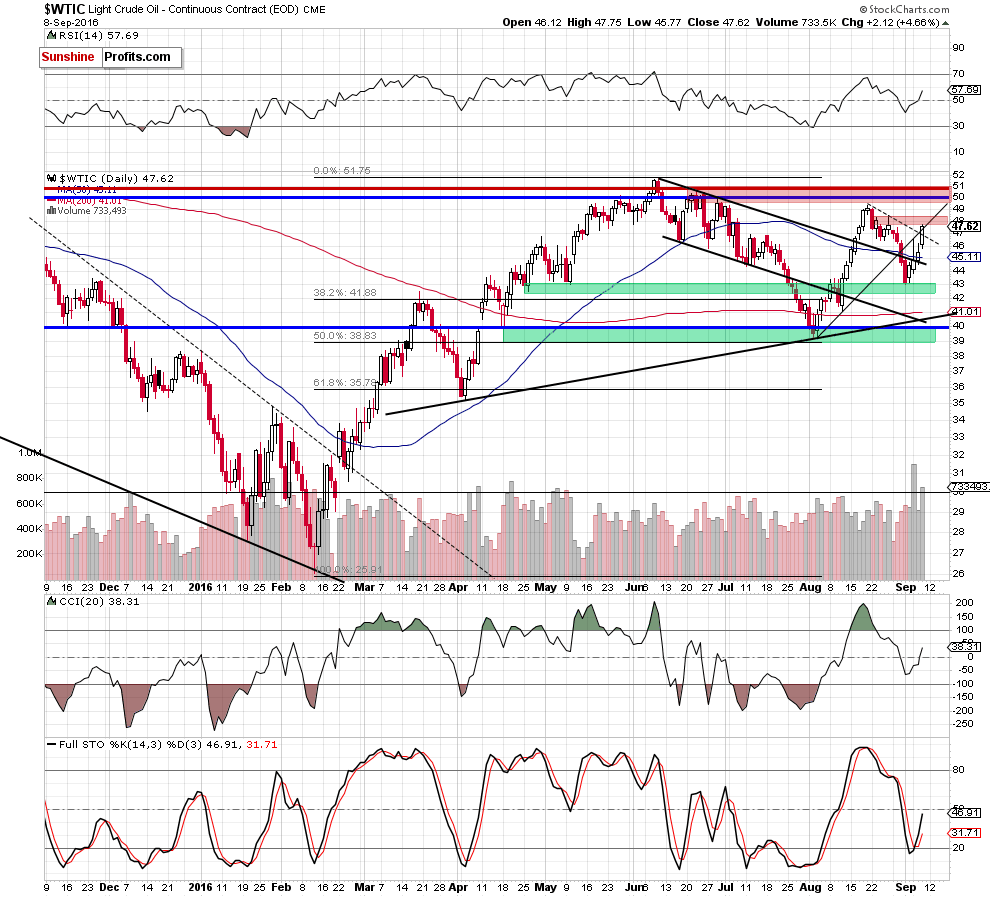

Let’s take a look at the chart below and find out (charts courtesy of http://stockcharts.com).

The first thing that catches the eye on the daily chart is a breakout above the black dashed resistance line based on the previous highs. With yesterday’s increase, crude oil also invalidated the breakdown below the black rising line based on the Aug lows, which in combination with the size of volume that accompanied Thursday’s session and buy signal generated by the Stochastic Oscillator suggests further improvement and a test of the Aug high and the red resistance zone (slightly above it) in the coming week.

Nevertheless, we should keep in mind that light crude also approached the first resistance zone based on the Aug 23 and Aug 26 highs (in terms of intraday highs and daily closings), which may encourage oil bears to act and result in a test of the strength of the black dashed line based on the previous highs (which serves now as the nearest support) in the coming day(s).

Summing up, yesterday, crude oil shot up and invalidated earlier breakdown under the support/resistance line based on the Aug lows. Additionally, the size of volume and buy signal suggest further improvement, however, before we see such price action, light crude will likely verify yesterday’s breakout above the resistance line based on previous highs.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts