Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, the black gold moved lower once again after the EIA weekly report showed unexpected build in crude oil and gasoline inventories. Thanks to these bearish numbers, light crude lost 2.77% and closed the day below $47. How did this drop affect the very short-term picture of the commodity?

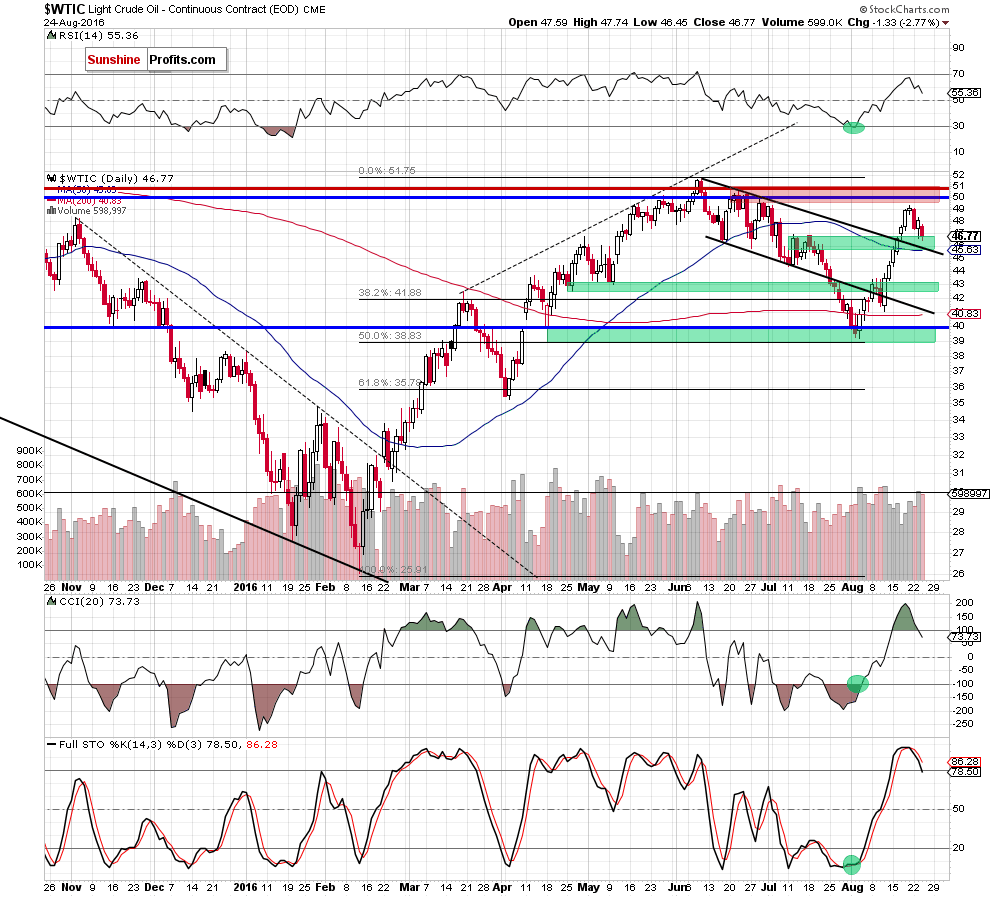

Yesterday, the U.S. Energy Information Administration report showed that crude inventories increased by 2.5 million barrels last week, missing analysts’ expectations. Additionally, gasoline stocks also rose, while distillates supplies dropped less-than-expected, which disappointed market participants and pushed the price of the commodity lower. As a result, light crude slipped under $47 once again. What’s next? Let’s take a look at the chart below and find out (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that crude oil declined yesterday and approached the green support zone once again. What does it mean for the commodity? We think that the best answer to this question will be the quote from yesterday’s alert:

(…) Crude oil moved below $47 level (…), which is the upper part of our support area, so the question is if the decline is already over. It could be, but in our view, it’s really too early to say so. It was only the upper part of the support that was reached – not the lowest point, so the implications are only somewhat bullish (…)

The reversals in crude oil are important, especially when accompanied by high volume, but only after a sizable decline. The reversals in February and August, for instance were both followed by much higher prices, but the reversal in the second half of May that was seen after only a small move lower, wasn’t – it marked the moment when a short-term horizontal trend has begun and nothing more. We can say the same about the early-June reversal. Consequently, it may not be the case that a sharp rally will follow, but that instead we will see some sideways movement for some time (back and forth trading between $45 and $52). If we see major bullish or bearish confirmations, we’ll keep you informed.

Taking all the above into account, we can summarize today’s Oil Trading Alert in the same way as we did yesterday:

Summing up, the decline in crude oil may be over, but it doesn’t have to be and it appears that instead of seeing a sharp rally from here, we could see at least several days of sideways trading. The next trading opportunity could be close, but it could also be the case that we’ll have to wait for a better risk to reward ratio for at least several additional days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts